Back

Rohan Saha

Founder - Burn Inves... • 10m

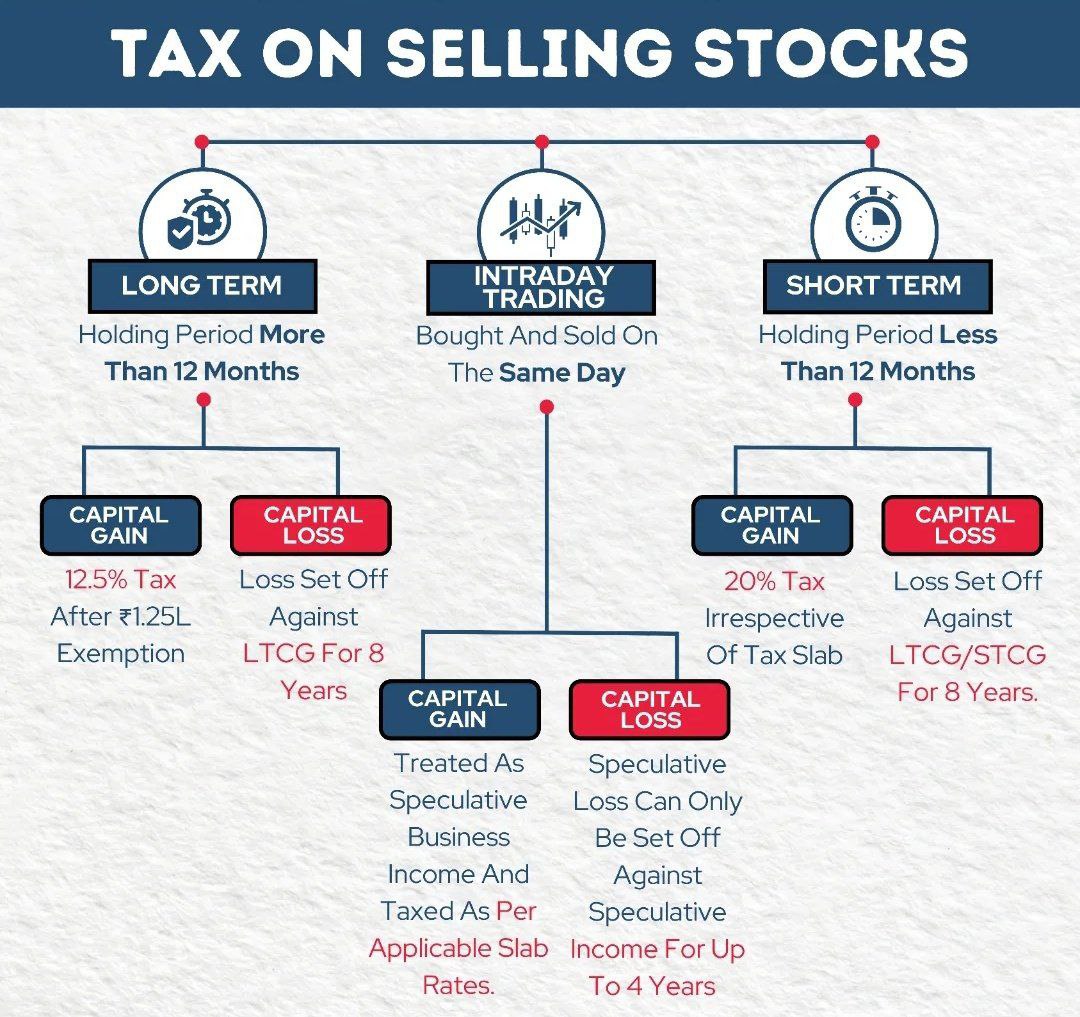

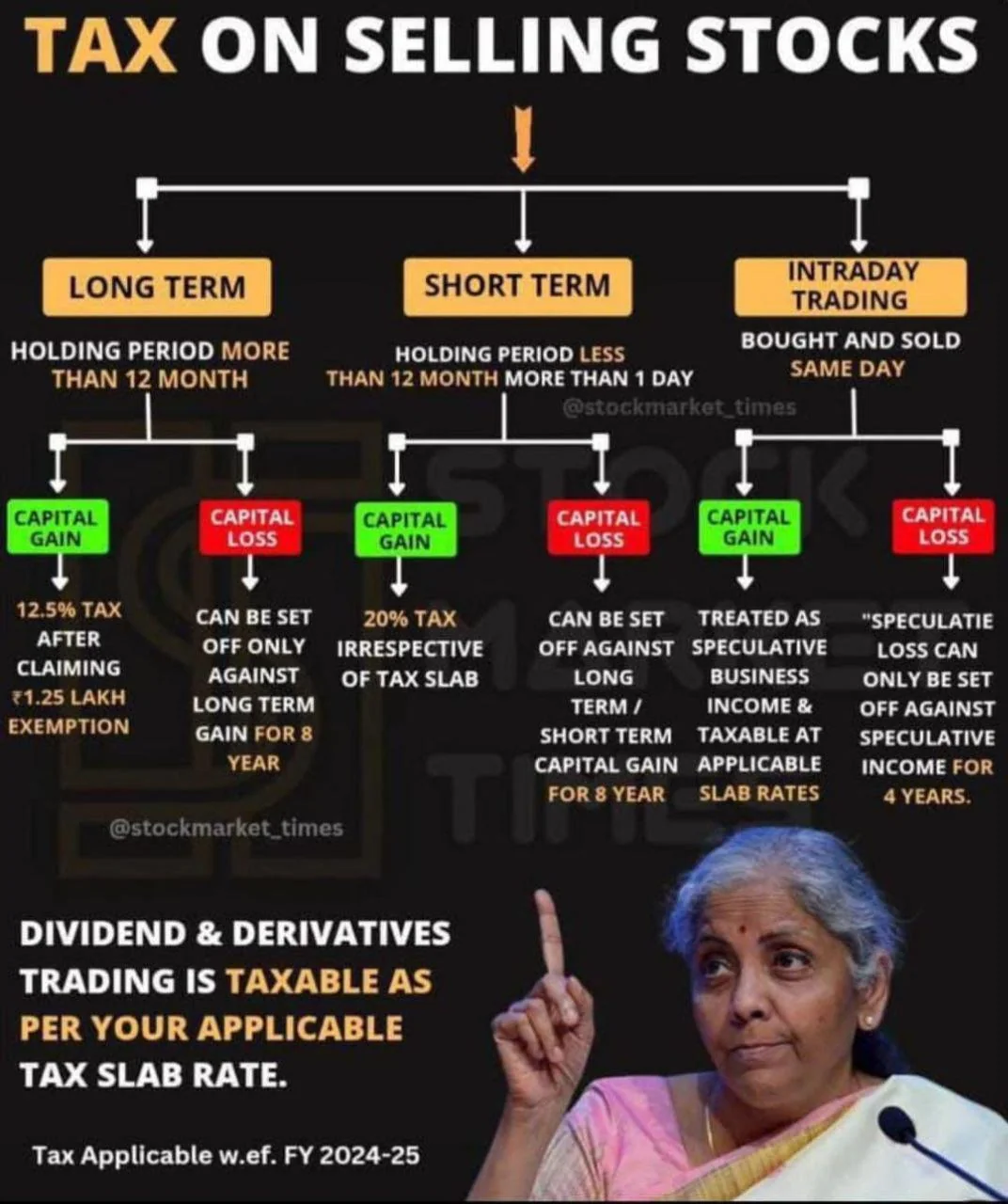

capital gain taxation

Reply

8

12

More like this

Recommendations from Medial

Shubham Jain

Partner @ Finshark A... • 1y

ITR Forms for Stock Market Income📈 A lot of people have been asking about which ITR form to use for stock market income. Here's a quick guide to clear up any confusion 👇 1. Salary + Capital Gains: ITR-2 2. Salary + Capital Gains + Intraday Tradi

See More1 Reply

3

10

financialnews

Founder And CEO Of F... • 1y

This Penny Stock "Standard Capital Markets' Share Surges Post Fundraising Completion; Penny Stock Still Under ₹2" "Standard Capital Markets Ltd Gains 4-5% in Early Trade on Thursday After Completing Fundraising; Stock Remains Under ₹2" Penny Stock

See More Reply

7

Download the medial app to read full posts, comements and news.

/entrackr/media/post_attachments/wp-content/uploads/2021/08/Accel-1.jpg)