Back

More like this

Recommendations from Medial

VIJAY PANJWANI

Learning is a key to... • 4m

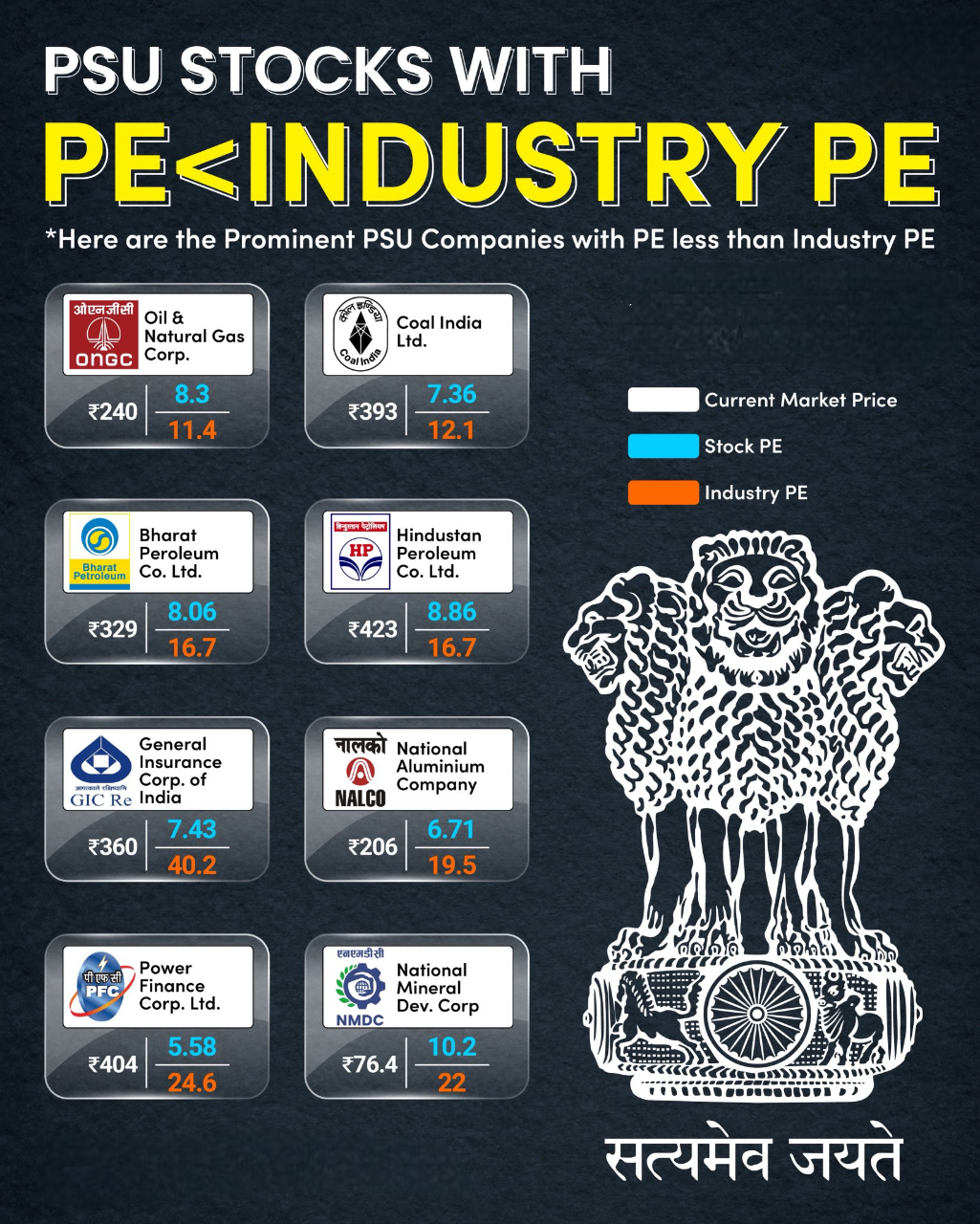

PSU Stocks with PE < Industry PE In the current market, valuation matters more than ever. One strong indicator is the Price-to-Earnings (PE) ratio. When a company’s PE is below the industry average, it can signal undervaluation and opportunity for i

See More

Rohan Saha

Founder - Burn Inves... • 1y

If the Indian market is rising, it doesn't mean that only Foreign Institutional Investors (FIIs) are buying. This time, it's being observed that even without FIIs, or even after heavy selling by FIIs, the Indian market has held onto its important sup

See MoreRohan Saha

Founder - Burn Inves... • 6m

The market seems to be facing strong selling pressure going into next week Interestingly it is mostly retail investors who are selling possibly even more aggressively than FIIs based on the latest FII and DII data the market usually does not drop thi

See More

Account Deleted

Hey I am on Medial • 1y

As we know Invesco revalued the Swiggy and Pinelabs valuation and As of now PineLabs $3.5 Billion and Swiggy at 12.1 Billion . But due to this cut in valuation, these firms can face these challenges in the future and both firms are backed by Peak XV

See More

Download the medial app to read full posts, comements and news.