Back

More like this

Recommendations from Medial

Tarun Suthar

•

The Institute of Chartered Accountants of India • 10m

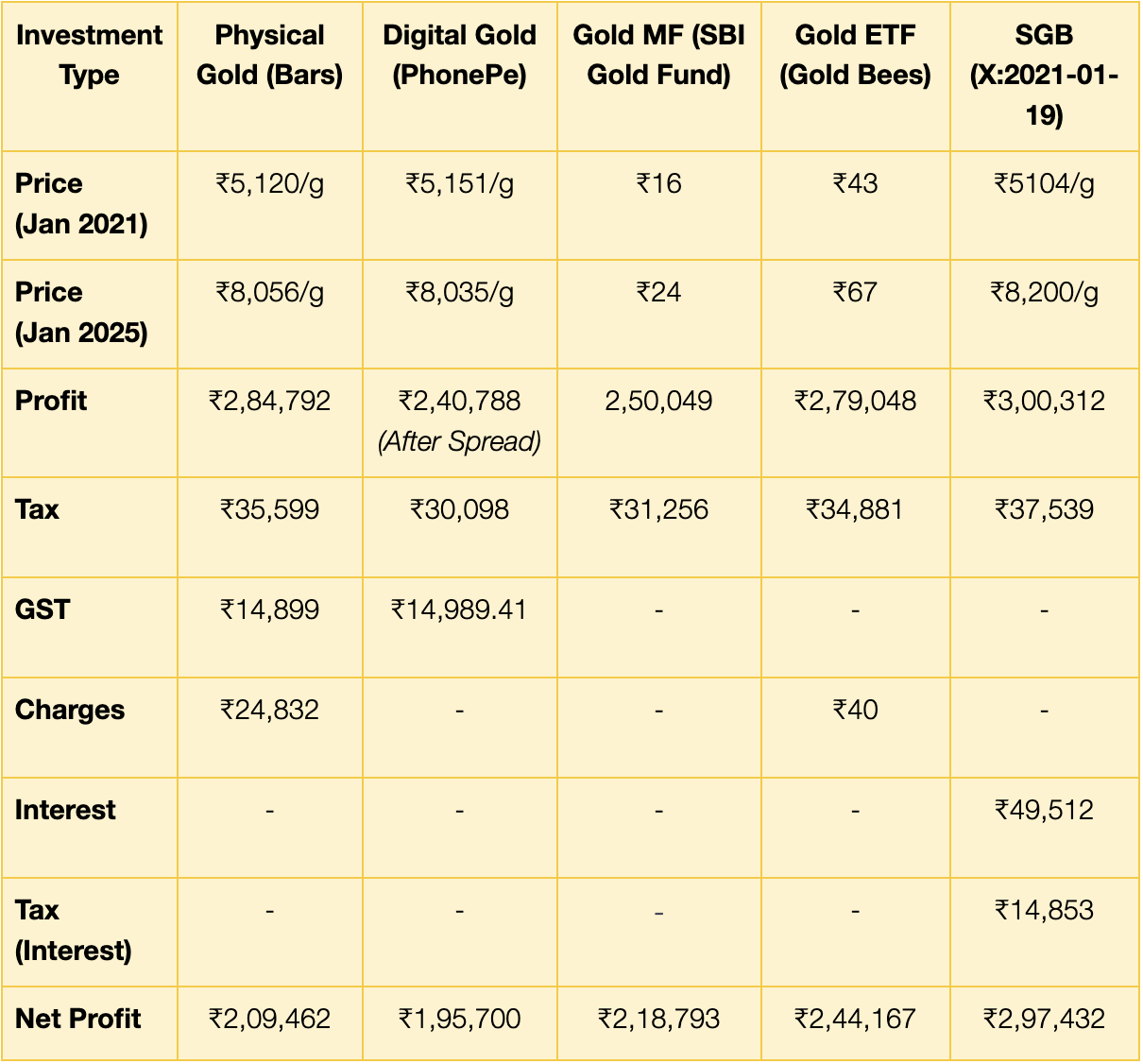

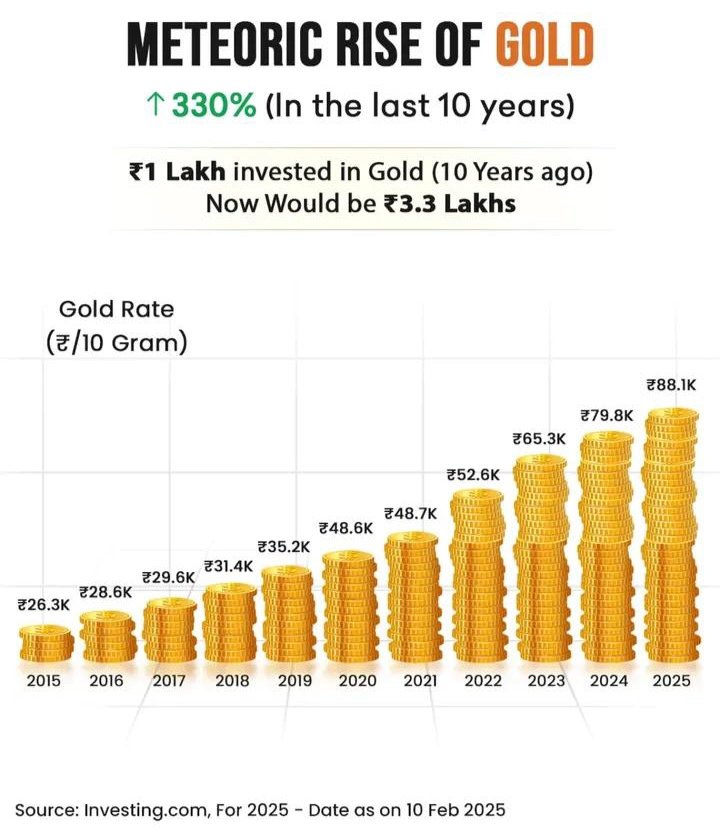

Different Ways to Invest in Gold 🪙 If you invest ₹5 Lakhs for a period of 5 years, what could your ROI look like across different gold investment options? There are commonly 5ways to invest in gold. 🪙 Physical Gold (Jewelry, Coins, Bars) 🪙 Digi

See More

Reply

1

3

1

Priyant Dhrangdhariya

Head of Finance @ Th... • 1y

India’s Gold Loan Market: A Glittering Opportunity The Sparkling Growth: Bajaj Finserv Ltd., a diversified NBFC, predicts India’s gold loan market—valued at $55.52 billion in 2022—will soar to $124.45 billion by 2029. A 12.22% annual growth fuels t

See More3 Replies

8

Download the medial app to read full posts, comements and news.

/entrackr/media/post_attachments/wp-content/uploads/2021/08/Accel-1.jpg)