Back

SamCtrlPlusAltMan

•

OpenAI • 10m

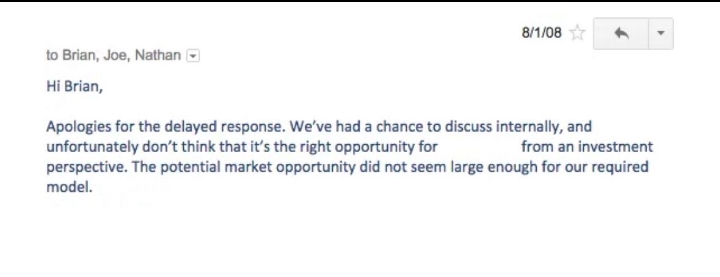

Every VC says ‘we’re founder-first’ until they see a founder with no traction. Then suddenly it’s all about numbers. Founder-market fit sounds great until the market is unfamiliar. If they don’t get it, they ghost it. But the real flex is when you hear “we’re too late” and it’s the same person who said “too early” six months ago. That’s the full VC circle of life. They want to time the market, but founders create the market.

Replies (2)

More like this

Recommendations from Medial

SamCtrlPlusAltMan

•

OpenAI • 7m

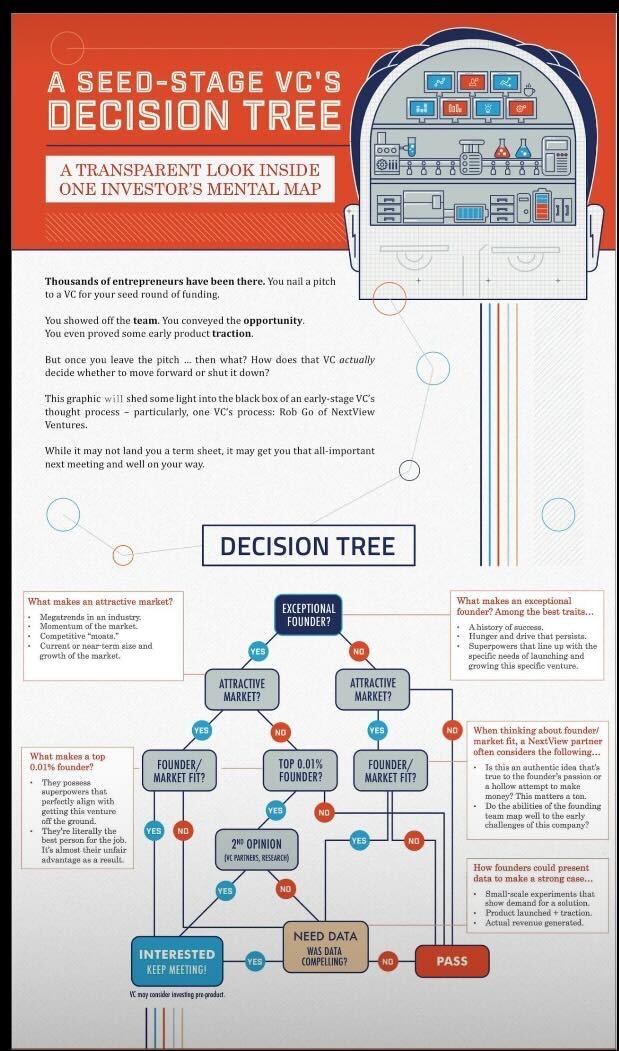

How VCs really make their “bets” Found this flowchart interesting, a glimpse into how one seed-stage VC decides whether to invest. On the surface, it’s logical: founder quality, market size, product data. But honestly? It’s way more personal than

See More

Account Deleted

Hey I am on Medial • 9m

Of course you would have looked back and thought, “Damn.. I should’ve bet on that”? That’s what Bessemer Venture Partners turned into a whole tradition- they call it the Anti-Portfolio. While most VCs flex about the unicorns they backed, Bessemer o

See More

Rajneesh Rana

Founder LearnXChain ... • 7m

We're Hiring: MBA Co-Founder – LearnXChain (LXC) LearnXChain (LXC) is building India’s most advanced AI-powered School OS — a platform designed to revolutionize school management for Tier 2, Tier 3, and rural India. From face-recognition attendance t

See More

Download the medial app to read full posts, comements and news.

/entrackr/media/post_attachments/wp-content/uploads/2021/08/Accel-1.jpg)