Back

Aditya Arora

•

Faad Network • 10m

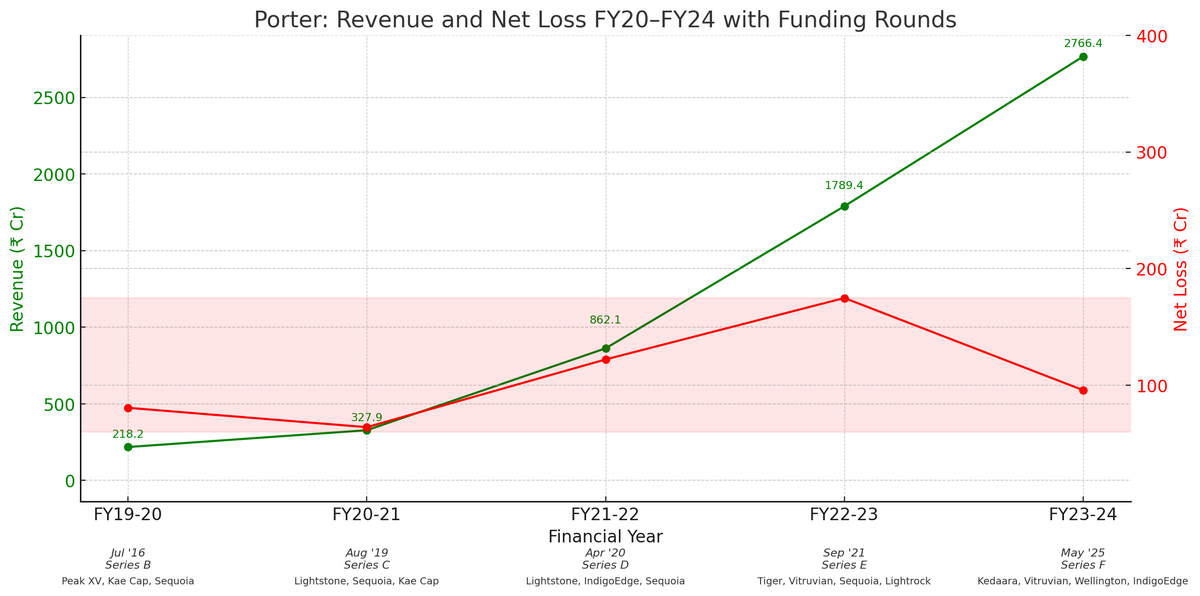

Went to IIT, Left JP Morgan and built an 8300 CR company. 1. After graduating from IIT Kharagpur, Pranav Goel began as an analyst at JP Morgan. Starting as a US equity research team member meant shifting his base from Gurugram to Mumbai. While booking a mini truck to change furniture, he faced a problem. 👇 2. He experienced that the entire system, from forwarders to intermediaries to customers, was broken even for intra-city logistics. He wanted to solve this via a tech-driven marketplace. In April 2014, he left his job at JP Morgan and started a company with two other IIT batchmates. In August 2014, Porter was born. 🚀 3. It started by connecting customers with light commercial vehicle owners instantly. However, the secret sauce was in their efficient business model. On the user side, It enabled users to book mini-trucks, 2-wheelers, and 3-wheelers just via an app, while for drivers, it gave them steady demand, GPS navigation and transparent pricing. ✅ 4. With smooth driver onboarding, incentives and a vernacular-friendly app, Porter grew to 1 lakh bookings in 18 months. As it expanded to Mumbai, Bengaluru and Chennai, it raised 35 CR in Series A from Sequoia Capital & Kae Capital in 2015. 💰 5. Porter's model was beautiful ➡️ Charge a 10-15% commission on every booking and increase wallet share by insurance, driver credit, and priority listings. Yet, it still saved 20% on costs for clients. Within three years, it scaled to 15 lakh deliveries, 10,000 driver partners and 200,000 clients in 5 cities of India. And the big moment came. 👇 6. In April 2018, Porter merged with Mahindra's owned logistics marketplace - Smartshift and raised ₹50 Cr in Series C by Mahindra Group. After the merger, they also launched Porter for Enterprise, catering to the B2B needs of clients like BigBasket, Urban Company, and Flipkart. It went live in 1600 pin codes across 10 cities in India. 🇮🇳 7. Porter was unstoppable now. By 2019, it scaled to 3 million deliveries and a revenue of 227 CR. While everybody focused on inter-city logistics, Pranav found another gap. He expanded to a category-defining same-day courier service with two-wheelers at hourly tempo rentals, and magic happened. 🪄 8. By April 2020, it raised ₹140 CR in Series D from Lightstone (now Lightrock) partners at a valuation of 774 CR. It had become a revolution now. By 2022, it doubled to over 1789 CR in revenue and raised a whooping 750 CR led by Tiger Global. As it became a half-unicorn, the big news came. 👇 9. On 16th May 2024, after a 2x revenue growth, Porter liquidated its option pool to secure investments at a 1 billion dollar valuation. After Krutim and Perfios, It became the third unicorn of 2024. 🦄 10. Today, Porter clocks revenue of ₹2,733 Cr, serves over 2.5 lakh drivers, and handles over 50 lakh deliveries monthly. ➡️Who would have thought that a boy from a middle-class family in Delhi and Gujarat studying in Kota would build an 8300 CR company? 🙏

Replies (1)

More like this

Recommendations from Medial

Maddula Charitha

Hey I am on Medial • 11m

**"Born in the storm, soaring to safety – Storm JP is not just an innovation, it's a testament to resilience and futuristic thinking. When challenges arise mid-air, Storm JP emerges as a guardian angel, seamlessly detaching and guiding passengers to

See More

Download the medial app to read full posts, comements and news.

/entrackr/media/post_attachments/wp-content/uploads/2021/08/Accel-1.jpg)