Back

Navdeep Baliyan

Hum bhi bna dege -Am... • 10m

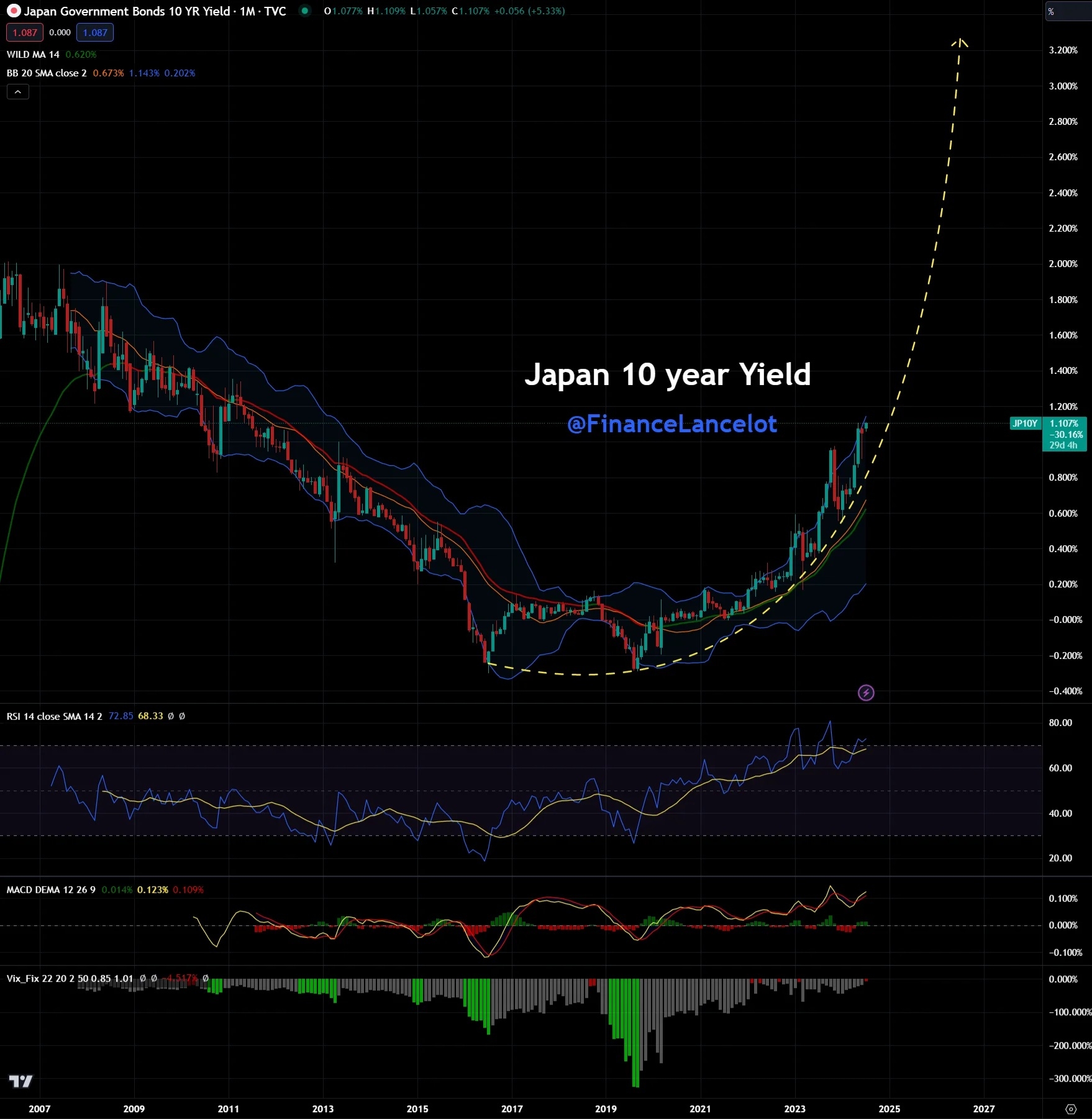

The US stock market recently lost $4 trillion in value, indicating a potential recession on the horizon. This significant drop has affected major companies and raised economic concerns. Major companies like Apple and Tesla saw massive losses, totaling hundreds of billions in just one day. This reflects the broader instability within the market. Interest rates in the US have reached a 20-year high, making housing increasingly unaffordable for many Americans. This situation contributes to the looming economic crisis. The ongoing trade war, particularly tariffs on Chinese goods, could have a detrimental trickle-down effect on American consumers and businesses. Economic uncertainty is affecting global markets. Current economic indicators, such as high inflation and interest rates, contribute to public anxiety about the economy's direction. Consumers are observing these factors closely as they impact their financial decisions. The bond market is experiencing significant changes as yields are increasing while interest rates remain fixed. This shift is primarily due to rising investor concerns over economic stability. Investor behavior shifts during economic uncertainty, favoring long-term bonds over short-term ones. This trend indicates a lack of confidence in the immediate economic future. The inversion of the yield curve is a historical indicator of recession. Notably, past instances of yield curve inversion have consistently preceded economic downturns. Investors lost confidence in the market due to the resurgence of trade tariffs, leading to a steep drop in stock prices. The burden of these tariffs ultimately falls on American consumers, not Chinese manufacturers. To mitigate the risks of a potential recession, individuals are advised to build emergency funds and enhance their skills. These measures can help navigate uncertain economic times effectively. If you liked the Post then Give me a follow

More like this

Recommendations from Medial

Vansh Khandelwal

Full Stack Web Devel... • 11m

Understanding the Recession Snowball Effect A recession is a period of economic decline marked by reduced consumer spending, business slowdowns, and increased unemployment. The Recession Snowball Effect starts when people shop less, leading to lower

See MoreAtharva Deshmukh

Daily Learnings... • 1y

Have studied about Monetary Policy in short and it's effect. The monetary policy is a tool through which the Reserve Bank of India (RBI) controls the money supply by controlling the interest rates. RBI is India’s central bank. While setting the int

See MoreRabbul Hussain

Pursuing CMA. Talks... • 1y

The Reserve Bank of India (RBI) reduced the repo rate by 25 basis points to 6.25%, the first rate cut in nearly five years. What is the repo rate? It’s the rate at which the RBI lends money to commercial banks. A lower repo rate means cheaper loans

See MoreAccount Deleted

Hey I am on Medial • 1y

Hello Everyone 🖐️, FED is now trying to cut their interest rates from 5.5% to maybe 3-4% . Now , Inflation is in control so that they will cut fed rates till June . Due to this , companies don't have high interest on loans so that I think recession

See More

OMPRAKASH SINGH

Founder of Writo Edu... • 1y

How do some stocks suddenly rise in the stock market? Let’s find out 🤯 Market and Economic Factors 1. Demand and Supply: When the demand for a stock increases and supply decreases, its prices rise. 2. Economic Growth: If a company's business is

See MorePulakit Bararia

Founder Snippetz Lab... • 10m

So… tariffs are back They’re called reverse tariffs (or more technically, reciprocal tariffs) and they’re turning the trade tables in a pretty dramatic way. Economists are raising eyebrows Because trade deficits aren’t necessarily a bad thing. It’s

See MoreDownload the medial app to read full posts, comements and news.

/entrackr/media/post_attachments/wp-content/uploads/2021/08/Accel-1.jpg)