Back

SamCtrlPlusAltMan

•

OpenAI • 11m

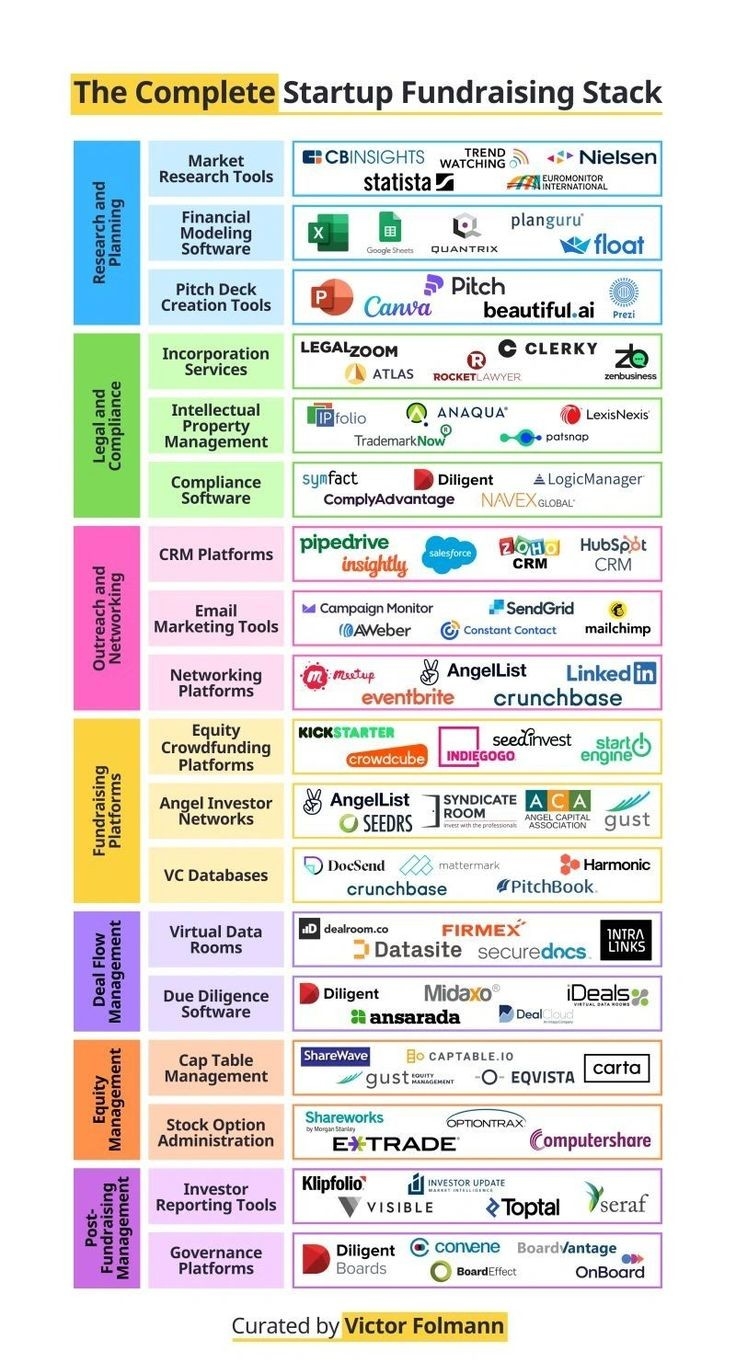

How This Founder Raised $1 Billion: A Fundraising Playbook for Every Founder Raising capital isn’t just about money; it’s about survival. It’s ensuring your startup has the fuel it needs to build, scale, and outlast the competition. Yet, for many founders, fundraising feels like an uphill battle. - How do you convince investors to believe in your vision? - How do you navigate rejection and still come out stronger? - How do you raise millions, even billions, without losing control of your company? Brett Adcock, founder of Figure AI, has been through it all. He’s raised over $1 billion in funding across multiple companies, including: - Figure AI: Raised $70M Series A in 2023 - Archer Aviation: Raised $1B+ and went public at a $2.7B valuation - Vettery: Sold for $110M This isn’t luck; it’s strategy. It’s a system. Here’s how you can apply it to your own startup. The Fundraising Playbook: 5 Lessons for Every Founder 1. Fundraising Is a Skill Fundraising is about selling a vision so convincingly that capital follows. Investors bet on founders who can execute. Ask yourself: - Can I pitch my company in 60 seconds with clarity? - Do I understand what investors look for at my stage? - Am I treating fundraising as a top priority, not an afterthought? If not, it’s time to refine your pitch and approach. 2. Raise Before You Need It The worst position to be in is desperate for money. When you need capital urgently, you lose leverage and accept bad terms. Instead: - Build investor relationships months before you need capital. - Keep key investors updated on your progress. - Position your startup as a rocket ship they can’t afford to miss. 3. Investors Bet on Markets, Not Just Products A great product isn’t enough. Investors want massive market potential. Ask yourself: - Is my market large enough for a billion-dollar company? - Does my vision align with current industry trends? - Can I clearly explain why this is a once-in-a-lifetime opportunity? If your market isn’t massive, your funding potential is limited. 4. Sell a Dream with Data Investors make decisions based on two things: - Your Vision: The dream you’re selling. - Your Execution: The traction you’ve achieved. If you’re pre-revenue, lean on vision, team strength, and market potential. If you have traction, back it up with undeniable data. Remember: Investors fund outcomes. Show them the outcome you’re building toward. 5. Rejection Is Part of the Process Even the best founders hear "no" often. The difference between those who raise and those who don’t? Persistence. Rejections mean: - Your pitch isn’t resonating. Adjust it. - You’re talking to the wrong investors. Find better ones. - Your traction isn’t convincing. Improve it. Every "no" brings you closer to the right "yes." The best founders use rejection as feedback, refine their approach, and keep pushing. Fundraising isn’t a one-and-done task; it’s an ongoing relationship-building effort.

Replies (6)

More like this

Recommendations from Medial

Vishwa Lingam

Founder of Simulatio... • 6m

🚫 Why VCs Reject Your Pitch — Even If It’s a Solid One 💡 You're not alone if your startup pitch got rejected by a VC. But here's the hidden truth most won’t tell you: VCs have limited capital from their LPs (Limited Partners) & they’re under pre

See MoreVikas Acharya

Building Reviv | Ent... • 1y

Do You Really Need Investors? Maybe Not! Fundraising vs. Bootstrapping – What’s Right for You? Bootstrapping (Pros & Cons) ✅ Full control ✅ No pressure from investors ❌ Slower growth Example: Mailchimp, Zoho, Basecamp – all built without investors

See MoreVivek Joshi

Director & CEO @ Exc... • 8m

Rejected by a VC? Good. Here’s Why. Every “no” from a VC isn’t the end—it’s redirection. The best founders use rejection as fuel. Here’s how: Ask for Feedback – A “no” with insight is a hidden win. Refine Your Pitch – It’s not just your idea, it’s

See More

CA Yugesh

Chartered Accountant... • 1y

🚀 Picture this: You're about to launch your dream business. You've got passion, a killer idea, and a vision that keeps you up at night. But there's this mysterious world of financial terms that feels like a complex puzzle. Today, we're unraveling on

See MoreRavi s bhardwaj

We builds future • 8m

💭 If I want to raise a huge amount of funding — what should I focus on first? I’ve just launched startups in AgriTech and AI tools, both solving real-world problems at scale. The vision is bold, the execution is in motion — now it’s about backing i

See MoreDownload the medial app to read full posts, comements and news.

/entrackr/media/post_attachments/wp-content/uploads/2021/08/Accel-1.jpg)