Back

mg

mysterious guy • 11m

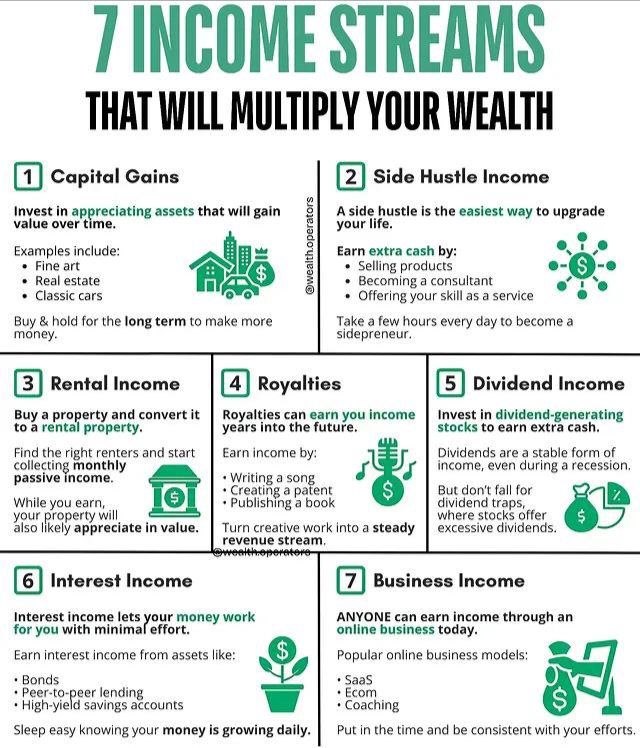

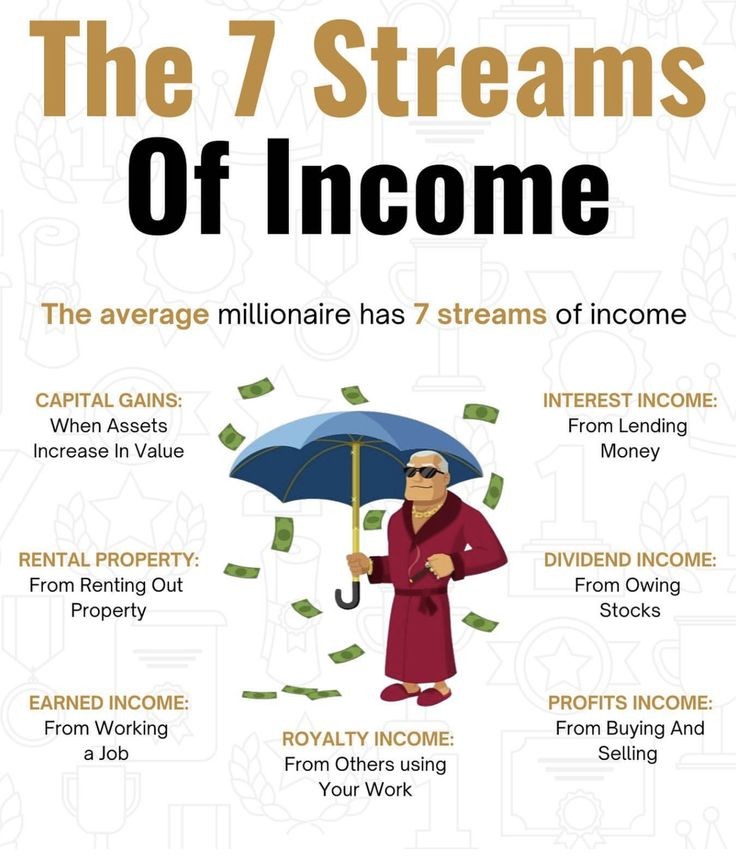

7 Income Streams that will multiple your wealth

Replies (1)

More like this

Recommendations from Medial

Thakur Ambuj Singh

Entrepreneur & Creat... • 1y

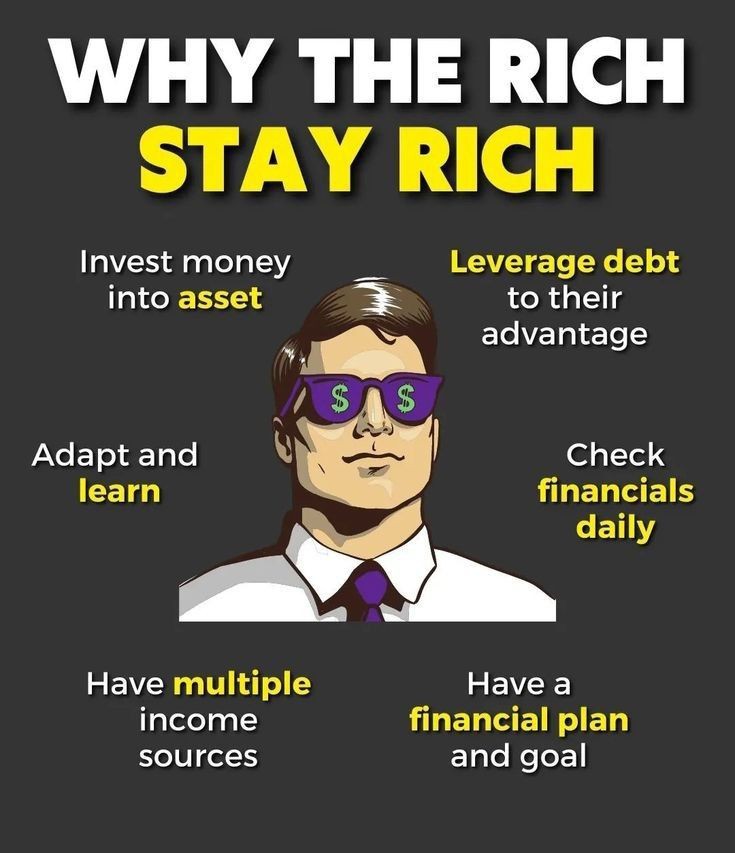

Why the Rich Stay Rich 💰 💼 Invest in assets, not just income. 📈 Leverage debt smartly. 📊 Review finances daily. 📚 Never stop learning and adapting. 💡 Diversify with multiple income streams. 🎯 Set clear financial goals and plans. Wealth isn't

See More

Rupesh Tiwari

In the Business of S... • 1y

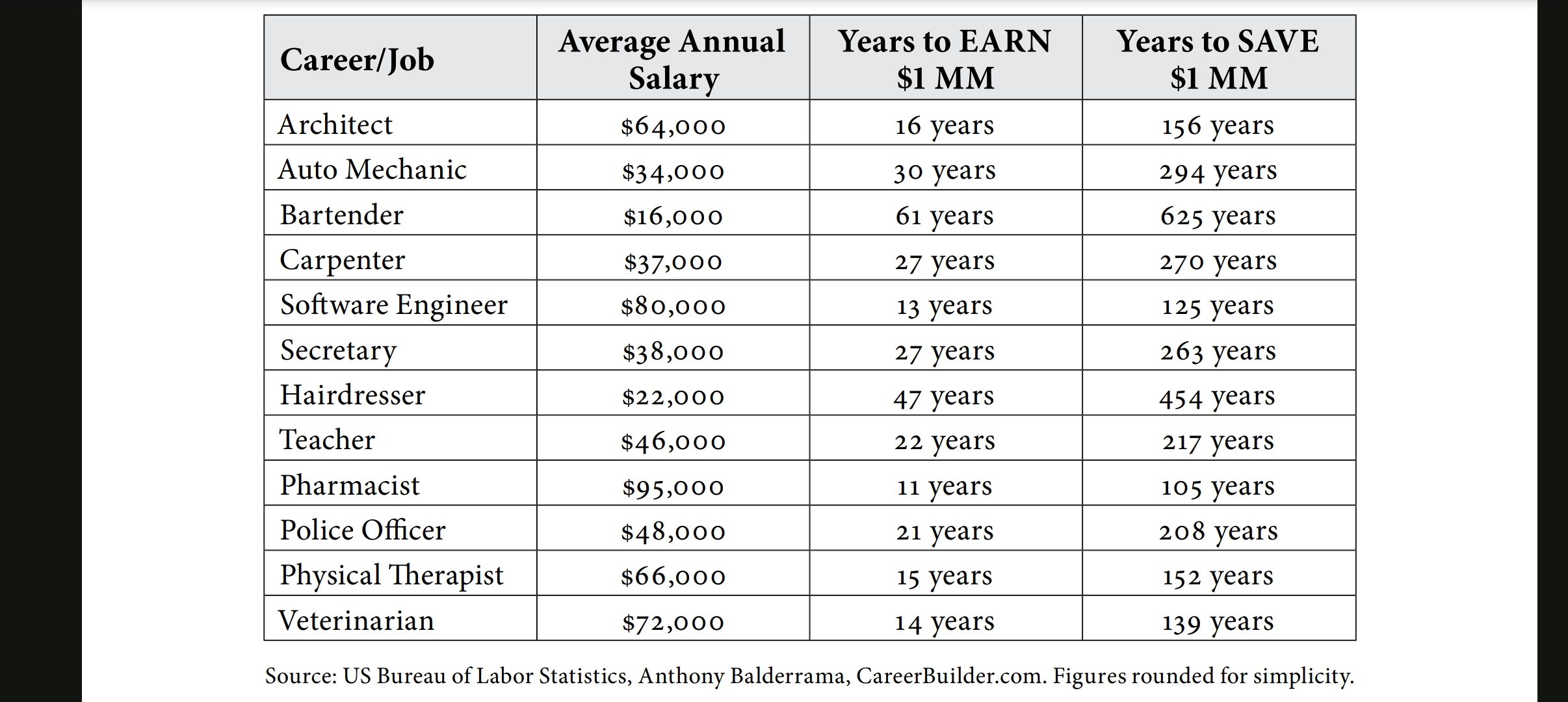

How to become Rich sooner? Getting rich requires a combination of smart financial habits, strategic investments, and patience. Here’s a structured approach to building wealth: 1. Increase Your Income Develop High-Income Skills – Learn skills that

See MoreThakur Ambuj Singh

Entrepreneur & Creat... • 1y

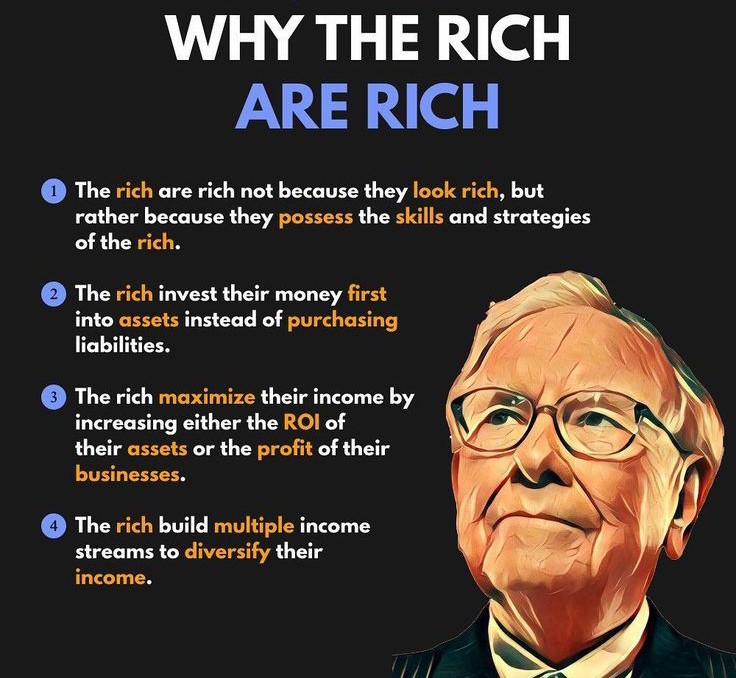

💼 Why the Rich are Rich 💼 It’s not just about looking wealthy it’s about the mindset and strategies that make a lasting difference. 💡 Here are some principles that set successful people apart 1️⃣ Skills & Strategies - True wealth comes from hav

See More

Suman solopreneur

Exploring peace of m... • 1y

(millionaire fastlane) Jobs constrain learning, offer modest income growth, and exchange time for money, all of which reduce wealth. Workers are subject to office politics, pay high taxes, and have no influence over their income. Since there are so f

See More

Suman solopreneur

Exploring peace of m... • 1y

Naval Ravikant on Freedom and Wealth: 1. Take More Risks: If you're sincere and keep trying, failure isn't a huge concern. 2. Own Equity: Ownership, not income, is the source of wealth. 3. Make Use of Leverage: Expand your work via code, media, or b

See MoreDownload the medial app to read full posts, comements and news.

/entrackr/media/post_attachments/wp-content/uploads/2021/08/Accel-1.jpg)