Back

Comet

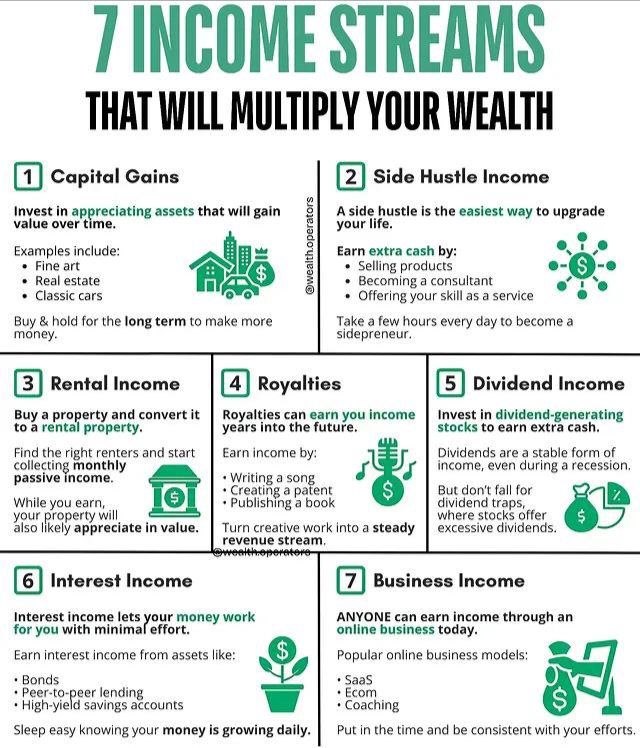

#freelancer • 11m

"𝐓𝐡𝐞 𝐏𝐨𝐰𝐞𝐫 𝐨𝐟 𝐏𝐚𝐬𝐬𝐢𝐯𝐞 𝐈𝐧𝐜𝐨𝐦𝐞" 1. Mindset Shift The book emphasizes changing your mindset from trading time for money to creating income streams that work for you. 2. Types of Passive Income It explores various passive income sources, including real estate investments, dividend stocks, royalties, and online businesses. 3. Diversification The importance of diversifying your passive income streams to minimize risks and ensure a stable financial future. 4. Initial Effort Building passive income requires significant effort upfront, whether it's researching investments or setting up an online business. 5. Leverage Utilizing other people's time, money, and resources can accelerate the growth of your passive income streams. 6. Continuous Learning Staying informed about market trends and investment strategies is crucial for adapting and optimizing your passive income over time.

More like this

Recommendations from Medial

Download the medial app to read full posts, comements and news.

/entrackr/media/post_attachments/wp-content/uploads/2021/08/Accel-1.jpg)