Back

siddhant dalvi

Advocate • 11m

If within 3 days the owner fails to do the compliance or give an undertaking as required under Section 191BA (2) of the MMC Act, 1888 Le commissioner:

More like this

Recommendations from Medial

CA Kakul Gupta

Chartered Accountant... • 1y

The Central Board of Direct Taxes (CBDT) has specified that no tax deduction at source (TDS) under Section 194Q of the Income Tax Act, 1961, will be required for purchases made from units of International Financial Services Centres (IFSC), provided b

See MoreRaju Biswal

🧠 Building Laryaa a... • 2m

Why AI Should Never See What It Doesn’t Need? Most AI systems fail not because they’re unintelligent, but because they see too much. In regulated, real-world environments, visibility is a liability. If an AI needs full screens, raw data, or unres

See More

Sai Vishnu

Income Tax & GST Con... • 11m

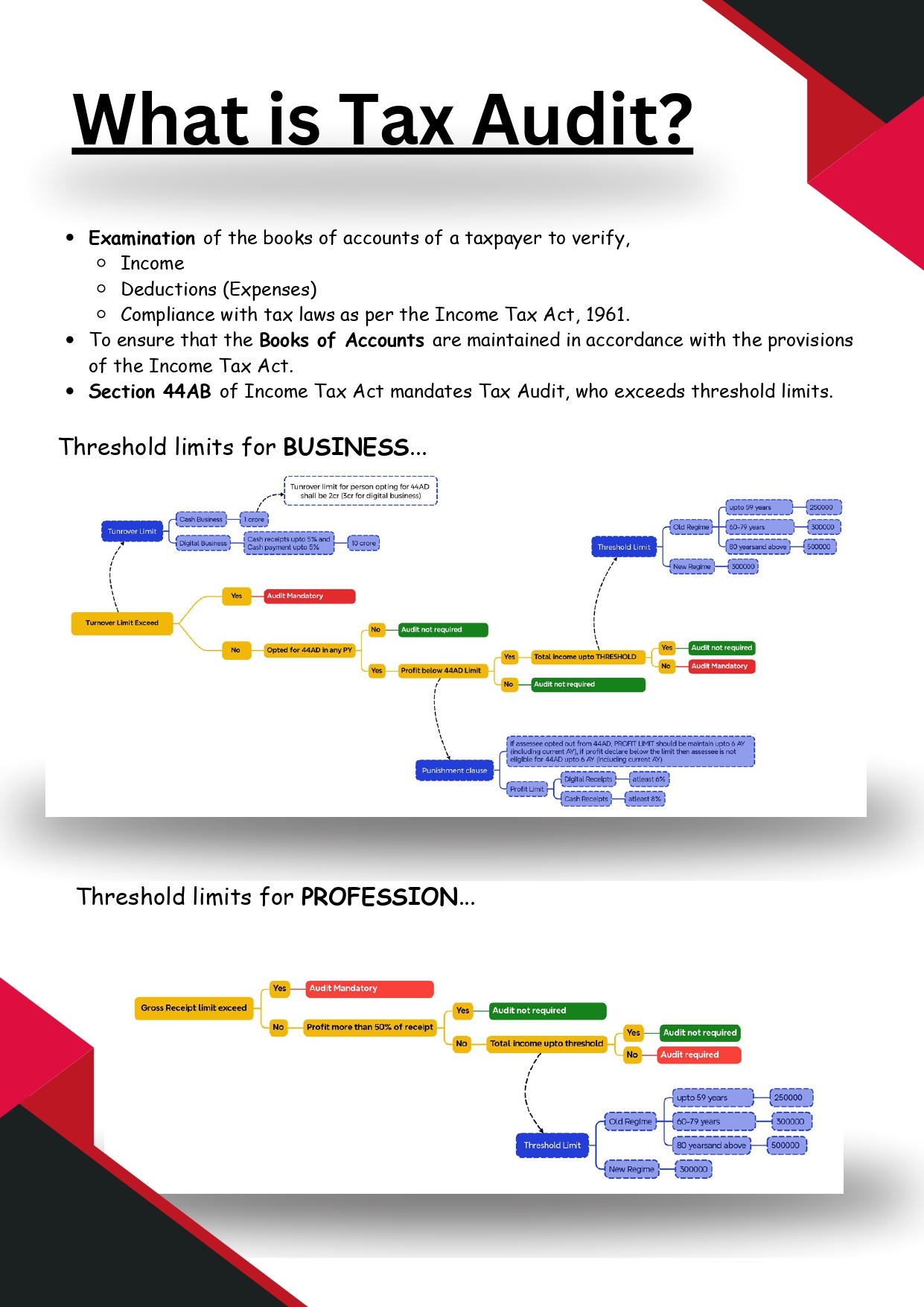

🚀 Everything You Need to Know About TAX AUDIT in Just 5 Minutes! 📊💡 🔎 What is a Tax Audit? A tax audit is a detailed examination of a taxpayer’s books of accounts to verify: ✅ Income & Deductions ✅ Compliance with the Income Tax Act, 1961 ✅ Prop

See More

Tarun Patel

Cybersecurity Analys... • 9m

Job Title: Chat BPO Operations Manager (Level 2) Responsibilities: Team Supervision: Manage and monitor chat agents (performance, discipline, productivity) Ensure SLA compliance (response time, quality) Client Communication: Act as the point of c

See MoreAASHIRWAD DEVELOPER GROUP

The business should ... • 1y

Attention GST taxpayers: November 30, 2024 is last day to claim pending input tax credit by filing GSTR 3B November 30, 2024, is the last date to claim any pending input tax credit (ITC) or amend any errors or omissions in compliance with the Goods

See More

CA Chandan Shahi

Startups | Tax | Acc... • 12m

Why should a startup opt for a Private Limited Company only? 1. Easy Fundraising from Investors Investors & VCs prefer Pvt Ltd because they can get equity (shares) in exchange for investment. Proprietorships and LLPs cannot issue shares, making fun

See MoreDownload the medial app to read full posts, comements and news.

/entrackr/media/post_attachments/wp-content/uploads/2021/08/Accel-1.jpg)