Back

Anonymous 1

Hey I am on Medial • 11m

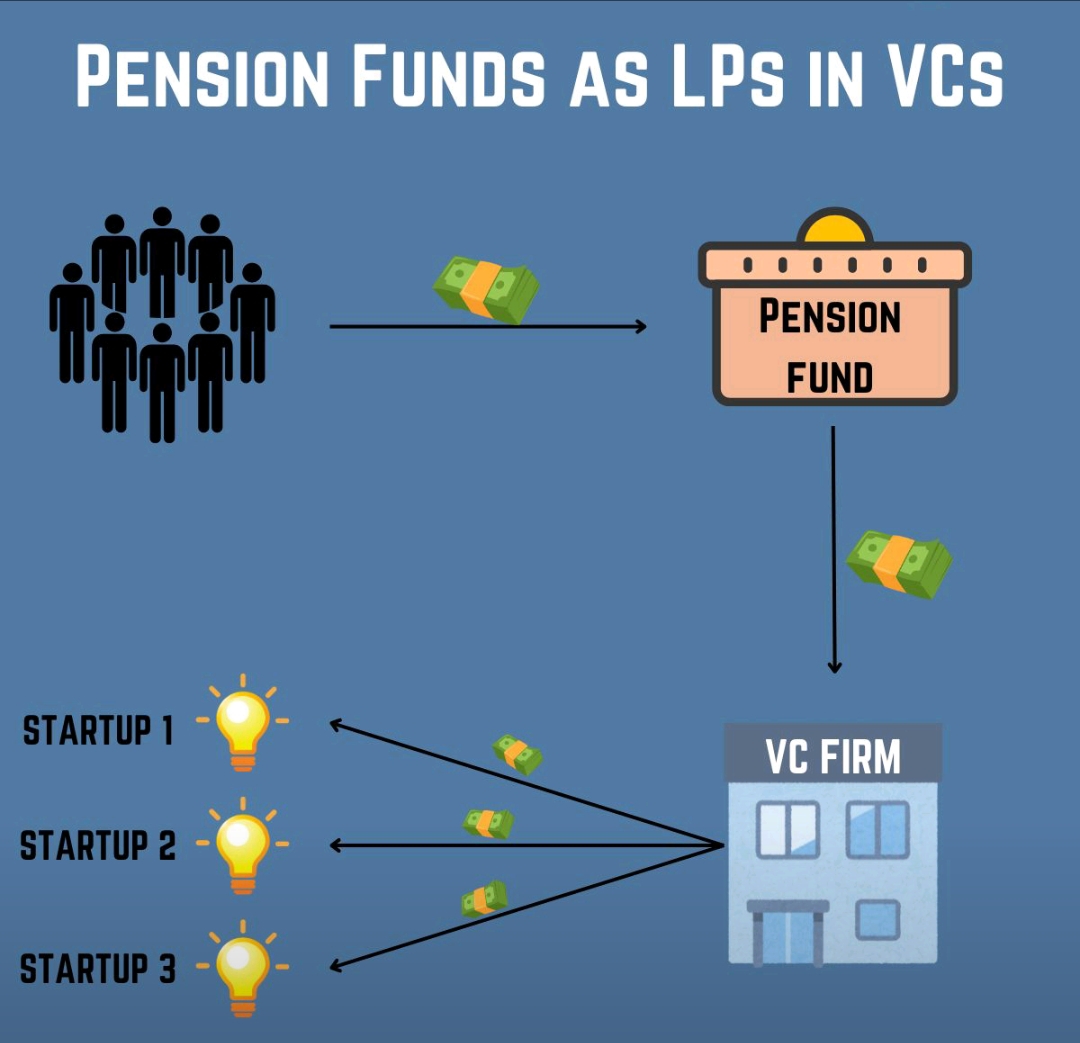

Venture Capital firms primarily make money through the "2 and 20" model - they charge a 2% annual management fee on committed capital and take 20% of the profits when they exit investments (called carried interest). Most people don't realize how lucrative this arrangement is. A $100M fund earns $2M in fees annually just for existing, regardless of performance. The real money is in the carried interest though. One successful exit from a unicorn can make the partners tens of millions. It's basically a license to print money if you can raise a fund.

More like this

Recommendations from Medial

PRATHAM

Experimenting On lea... • 6m

Top three investments with zero to low risk in which you can earn 7 to 9% are: first, FDs; second, Liquid Mutual Funds; and third, Arbitrage Funds. Liquid Fund is a day fund which invests in super ultra short-term instruments like T-Bills in the mon

See MoreAdithya Pappala

Busy in creating typ... • 1y

#9TDAYVC- DAY10 🎯What is meant by Blind Pool? 🎯What is Draw Down? 🎯Capital Commitments: Capital Commitments under less than 1 Crore is not acceptable under AIF.Employees or Directors of the AIF should Invest a minimum of 25 lakhs. 20 Crores

See MoreHemanth Varma

''Money can't buy ha... • 1y

can mutual fund be a profitable investment? A mutual fund is a company that pools money from many investors and invests the money in securities such as stocks, bonds, and short-term debt. The combined holdings of the mutual fund are known as its po

See More

The next billionaire

Unfiltered and real ... • 1y

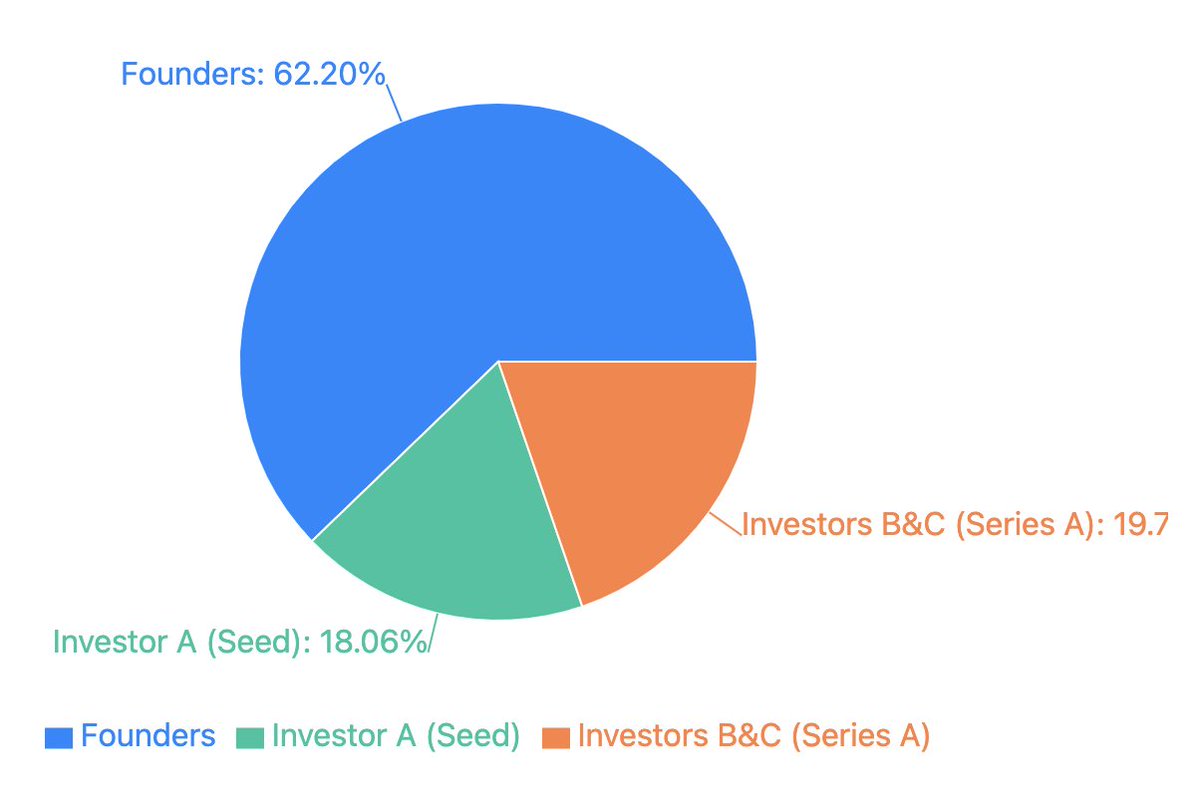

quick math on minimalist outcome: - raised $2M seed from peak (assuming 20 - 25% dilution) - raised $15M series a from peak + unilever ventures at a $76M val. - in talks to be acquired by HUL for $350M - founders to make $217M - seed investors get $6

See More

Download the medial app to read full posts, comements and news.

/entrackr/media/post_attachments/wp-content/uploads/2021/08/Accel-1.jpg)