Back

Anonymous 1

Hey I am on Medial • 11m

**Investment Pitch: Building India’s Premier Alternative Investment Firm** **Vision** To establish **India’s leading investment firm**, built to **outperform Blackstone** by strategically acquiring and managing high-value assets across **Private Equity, Real Estate, and Alternative Investments**. Our approach is designed for **maximum capital efficiency, risk mitigation, and global scalability**. **Business Model** We generate long-term **compounded cash flow** through: - **Private Equity** – Acquiring and restructuring high-potential private companies. - **Real Estate & Infrastructure** – Investing in prime commercial and industrial assets. - **Strategic Trading** – Leveraging capital markets for liquidity optimization. - **Alternative Investments** – Diversifying into high-growth sectors and emerging opportunities. In this journey I just do not want your money. I want you. Check your DM. And allow me to share my business plan.

More like this

Recommendations from Medial

Vivek Joshi

Director & CEO @ Exc... • 8m

Unlock the secrets of alternative investments in our latest video, "Alternative Investments Fundamentals - All You Need to Know!" Discover the essential concepts that differentiate alternatives from traditional investments. Dive into real estate, hed

See MoreAryan Kapur

Director at PEMD Ltd... • 1y

I run a private equity firm in London with my dad, PEMD Ltd. part of the PLMD Group, plmd group manages over £23M worth of properties/assets and now we want to make our name in private equity, perhaps having capital, we prefer to work with investors

See MoreAyush Dash

Become a millionaire... • 9m

India’s AI Healthcare Revolution: How Doctors, Hospitals, MedTech, and Pharma Are Leading the future of digital Helth. 1. AI Revolution in Healthcare: India is leveraging artificial intelligence (AI) to transform healthcare delivery. AI-powered tool

See MoreChintu Adwani

Helping Start Ups an... • 8m

In the unlisted world, transparency often ends after the funding round. We want to change that — by helping startups communicate better and investors stay informed. From structured updates to founder support, we’re on a mission to build long-term t

See MoreTarun Suthar

•

The Institute of Chartered Accountants of India • 1y

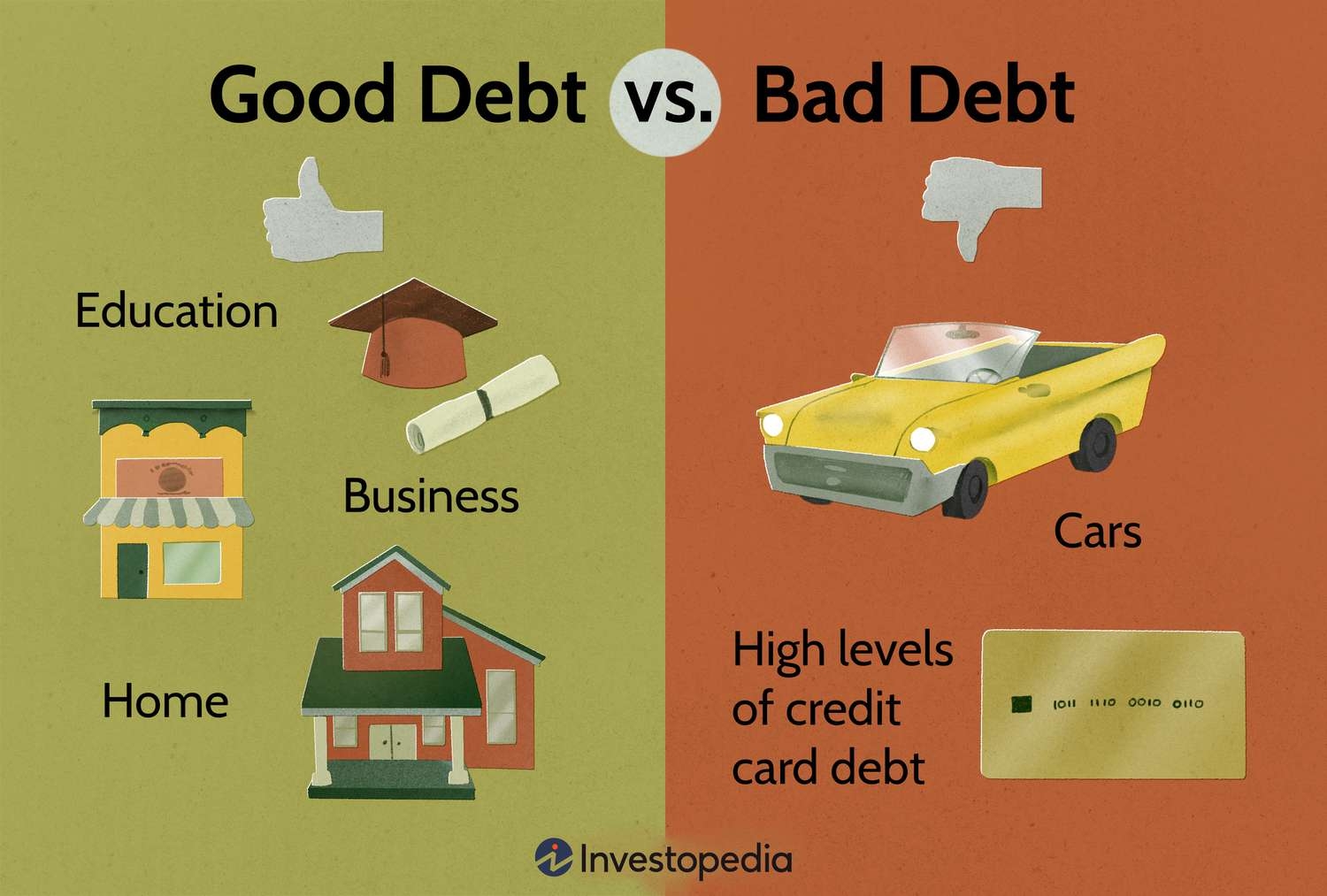

Have you read the book "Rich Dad, Poor Dad" written by "Robert Kiyosaki" . he is a genius. He admitted to having more than $1.2 billion in debt 🤯. you might have watched his yt Shorts claiming that. He views this debt as a strategic move and a par

See More

Download the medial app to read full posts, comements and news.

/entrackr/media/post_attachments/wp-content/uploads/2021/08/Accel-1.jpg)