Back

Shiva Prasad

•

Lognormal • 11m

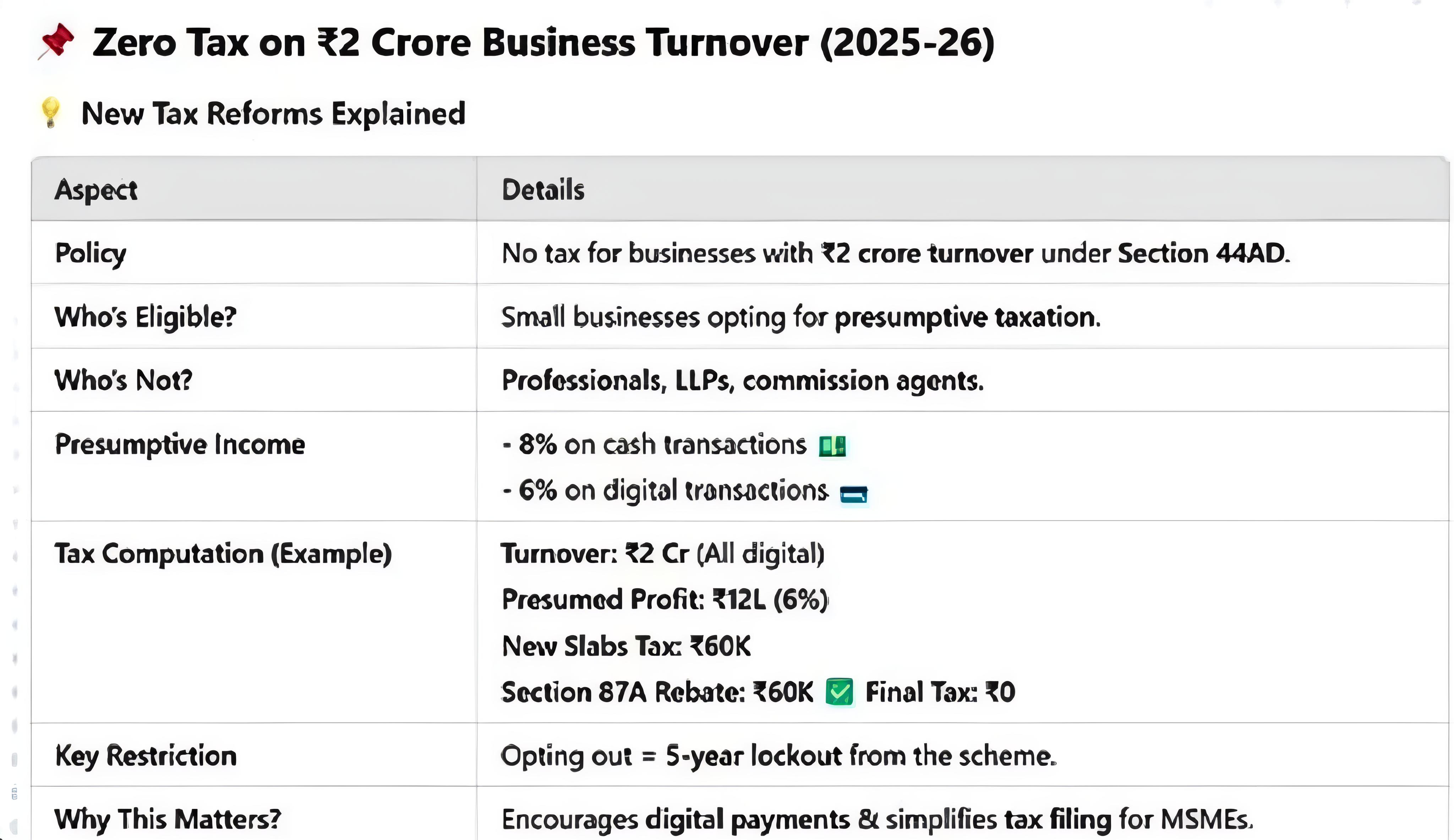

I don't think so, They need Business Registration sometimes GST too. You also need to have a current account on your business for heavy transactions. You can pay 0 income tax if your turnover is less than 2CR with proprietorship registration. No need for GST payment till your turnover is 40Lakhs

More like this

Recommendations from Medial

CA Jasmeet Singh

In God We Trust, The... • 11m

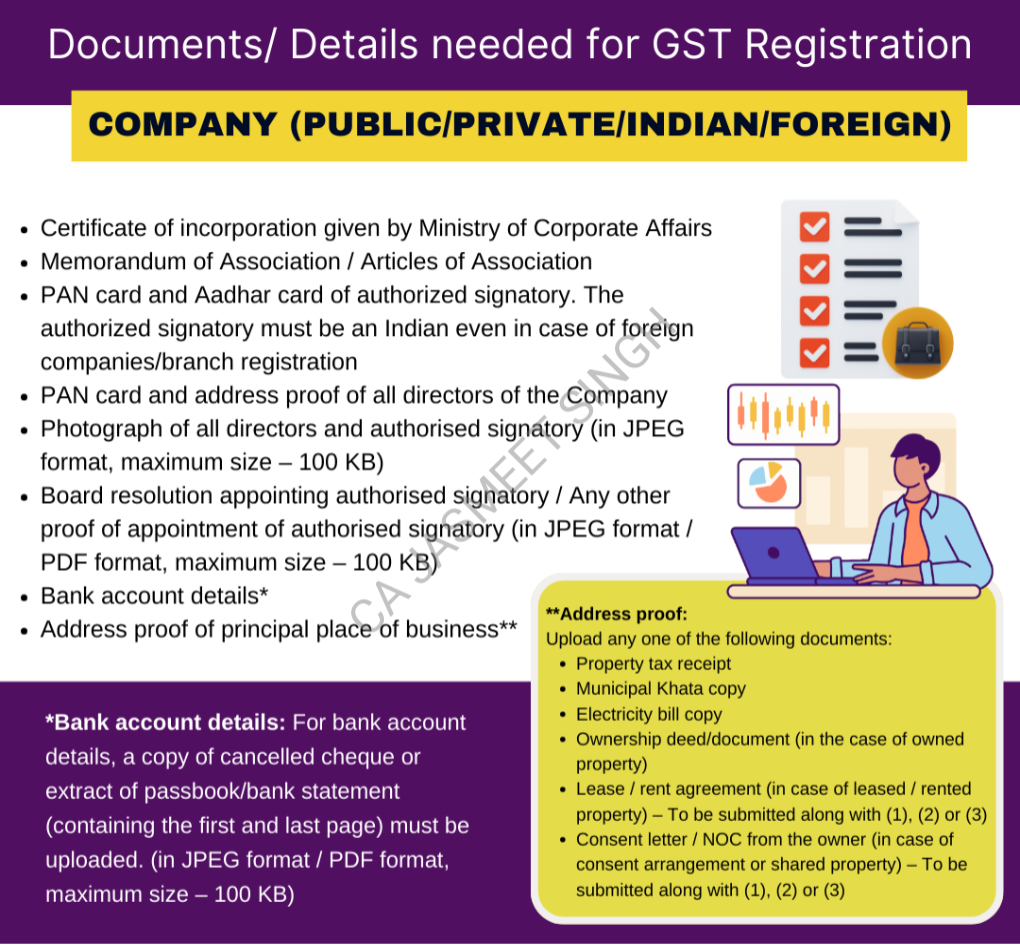

📢 GST Registration for Companies – Everything You Need to Know! 🚀 Starting a company? One of the first legal steps is getting GST registration! ✅ It not only gives your business a legal identity but also opens doors to seamless tax compliance, inp

See More

Shubham

Start small Dream Bi... • 1m

Need GST registration, company incorporation, or help in filing GST returns, corporate returns? Our team of chartered accountants & company secretaries handles it all—fast and hassle‑free. DM for more information. #GST #Incorporation #TaxReturns #S

See MoreRavi Kumar Mishra

Hum hai Aapke Busine... • 8m

ITR 23-24 24-25 25-26 Compution,Balancesheet with Ca Certified 1. GST Registration 2. GST return Filing 3. MSME Registration 4. Tds FILLING 5. Company, NGO & Partnership Reg. 6. Importer Exporter Code 7. ISO Non-Iaf/IAF Registration 8. Start up

See MoreCA Jasmeet Singh

In God We Trust, The... • 11m

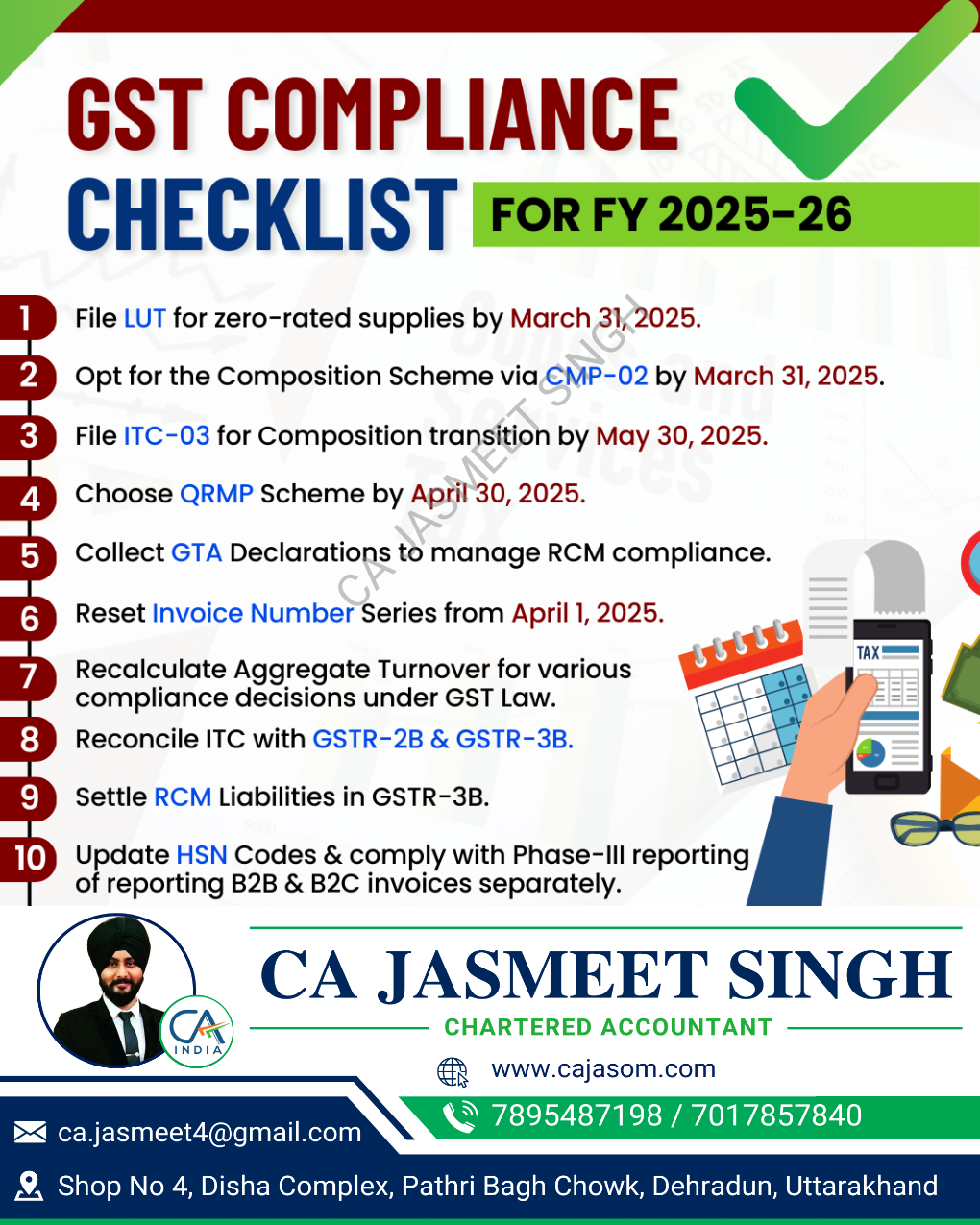

🚀 GST Compliance Checklist for the New Financial Year ✅ A new financial year means a fresh start for your GST compliance! 📆✅ Stay ahead of deadlines, avoid penalties, and ensure smooth tax filings with this essential checklist. 📊💼 🔹 Review GST

See More

Download the medial app to read full posts, comements and news.

/entrackr/media/post_attachments/wp-content/uploads/2021/08/Accel-1.jpg)