Back

Replies (1)

More like this

Recommendations from Medial

theresa jeevan

Your Curly Haird mal... • 1y

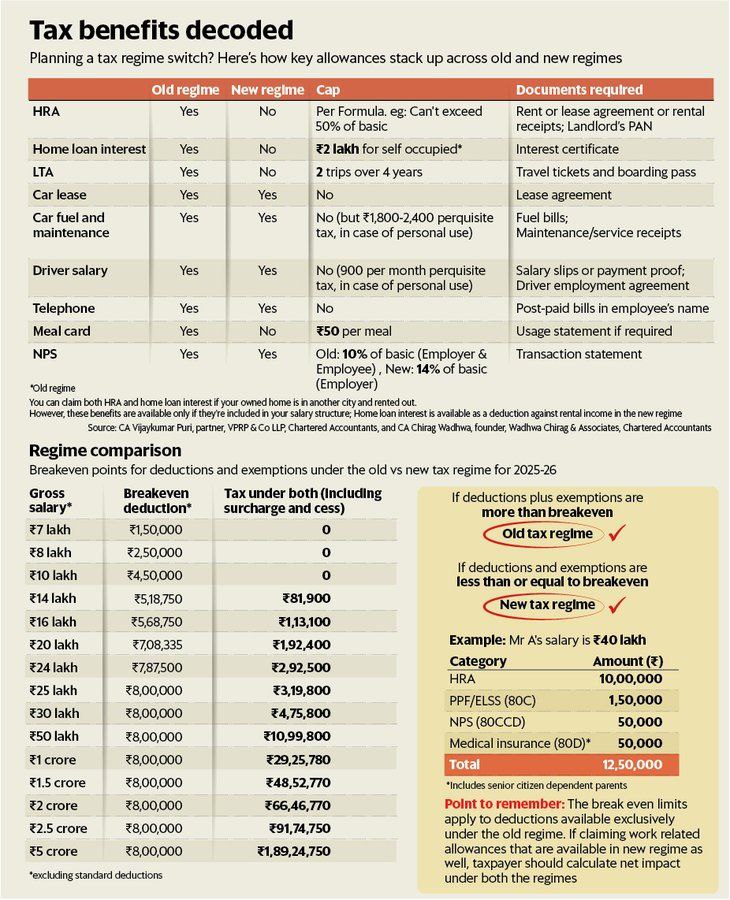

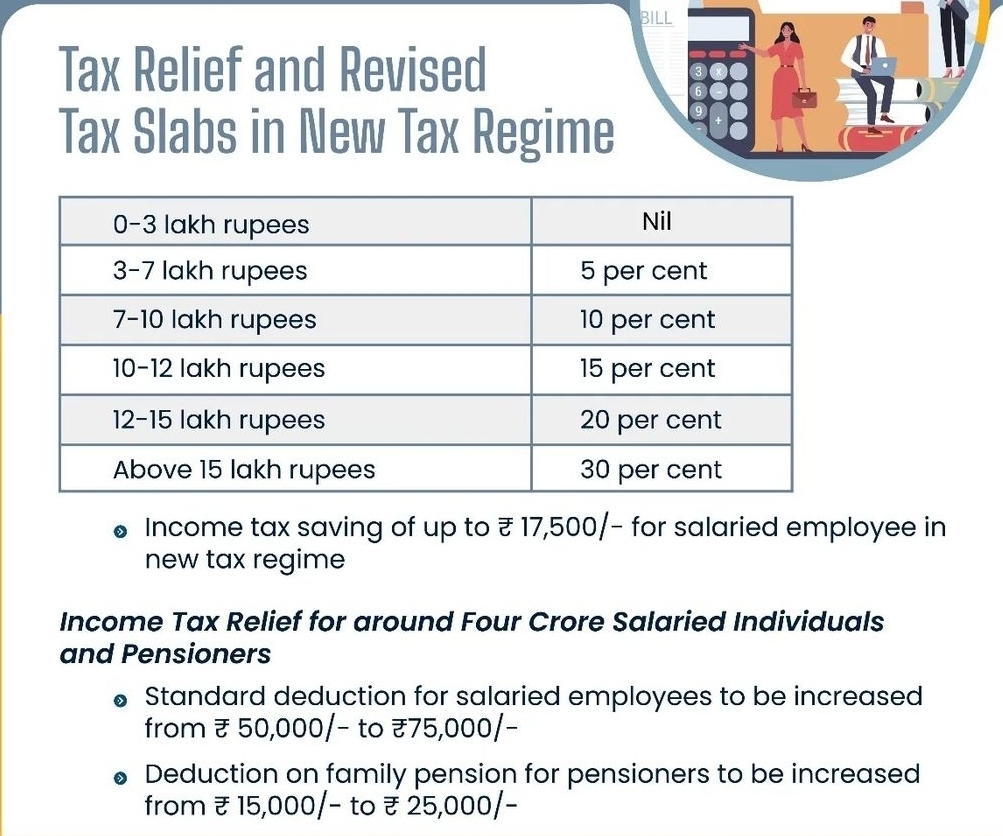

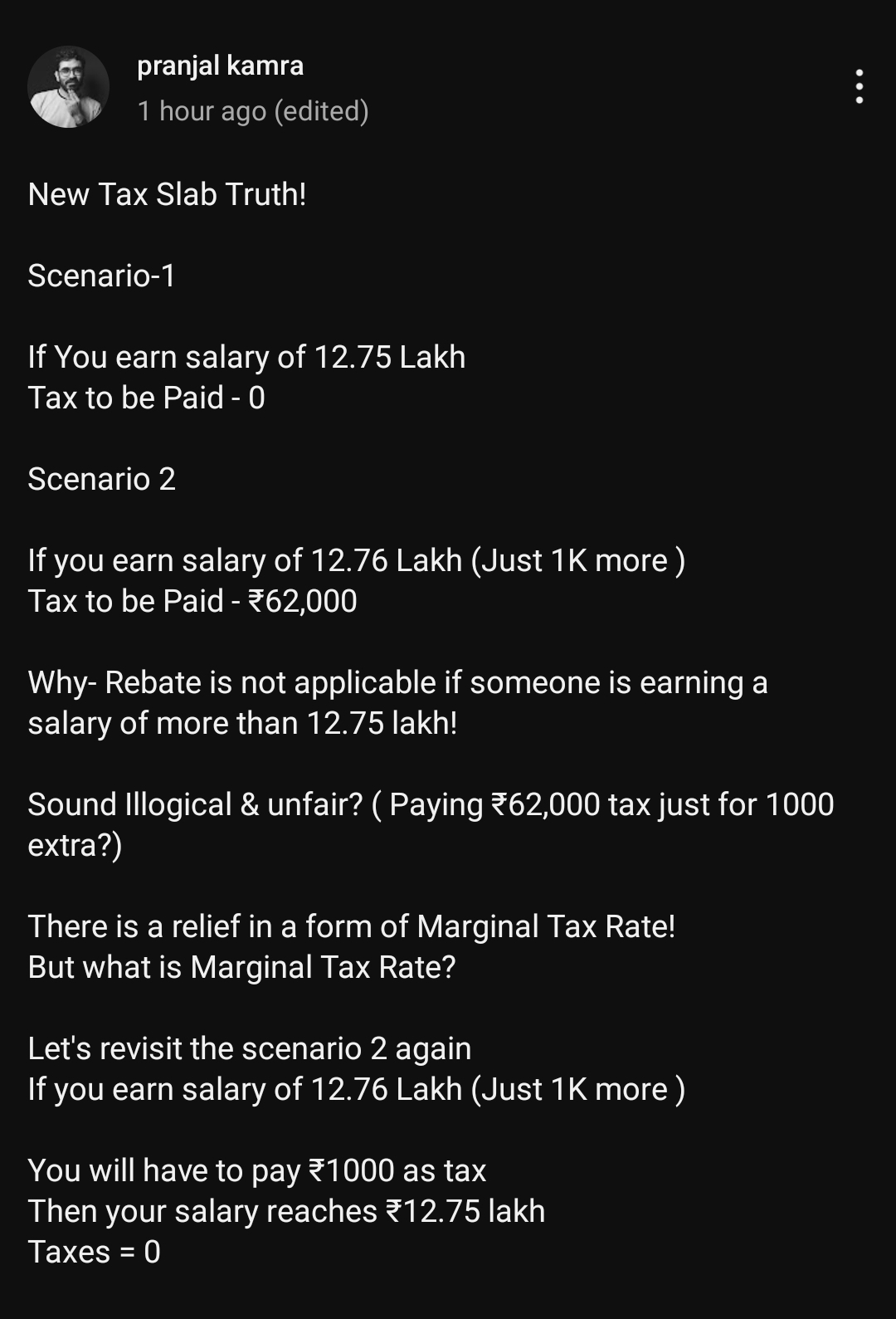

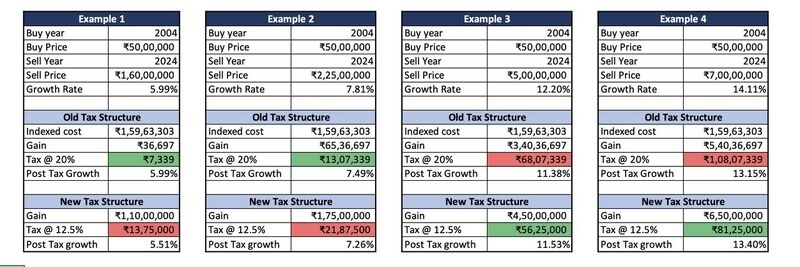

Deadpool’s Tax Tips—Let’s Make It Simple! 💸 Salary below ₹12.75L? Go with the new tax regime—less pain, less paperwork. Easy peasy. 🥳 💰 Salary above ₹12L? If your exemptions (HRA, 80C, 80D, home loan, etc.) are more than ₹5L, old tax regime coul

See More

14 Replies

9

20

Download the medial app to read full posts, comements and news.

/entrackr/media/post_attachments/wp-content/uploads/2021/08/Accel-1.jpg)