Back

Sayan Ghosh

•

OG Capital • 12m

Co-Build a VC Fund in Public: Day 15 (ROI does not lie - we need more women in this ecosystem) 1 in 20 Partners in Venture Capital Funds are Women! This number is abysmal! And I am equally to blame. How can an industry function with only 5% representation of women at the top level? Compare this to women CXOs in Indian corporations, which still hover closer to 40%. In fact, less than 20% of all investment team members across funds in India are women. Is this why women-led companies typically receive less than half the funding compared to their male counterparts? Most funds, that claim to have 20-25% women in their teams, place the majority of these women in non-investment roles. This does not benefit the ecosystem. We are in this crisis despite the fact that women deliver 2.5x better returns than their male counterparts. We all know the probable reasons behind this disparity, but the real question is: What can we, as investors, do to solve this? Below is how Ortella Global Capital - OG Capital, India's only fund that co-builds companies, is addressing this issue: - Diverse perspectives drive better investments. We actively hire and promote women. Since women drive 70-80% of consumer purchasing decisions, their lived experience offers a critical advantage in evaluating products. In fact, by the end of 2025, we aim to have at least 40% women in our investment team. - Ambition isn’t just about hockey-stick growth. Founders who combine big visions with grounded realism often de-risk opportunities. We train our teams to ask: “Could this ‘conservative’ pitch actually reflect the rigor we are undervaluing?” - Confidence grows when dialogue flows. We encourage the founders we meet to respectfully challenge feedback by saying, “Help me understand your perspective—here’s mine.” - We test anonymized pitch decks (hiding names and genders) during early reviews to track patterns and assess whether certain founders are disproportionately questioned on technical depth. Our data helps us identify gaps, which we then address internally. First, we need to fix ourselves before we can bring about change in the ecosystem. What more can we do? At OG Capital we believe a diverse team is an untapped goldmine. We are actively seeking and excited to back such startups, not just as an exception, but because the numbers have proved that they are an undervalued powerhouse of innovation We continue to invest and co-build companies at Ortella Global Capital - OG Capital, India's only fund that co-builds companies with Gaurav Verma and Rajvardhan Mohite #ortella #ortellaglobal #ortellaglobalcapital #ogcapital #cobuilding

Replies (4)

More like this

Recommendations from Medial

Rajvardhan Mohite

Investor | 2X Founde... • 1y

I am excited to announce that I have started a new position as Co-founder and Head of Enterprise Investments at Ortella Global Capital - OG Capital, India's only fund that co-builds companies. I am looking forward to investing in and co-building with

See More

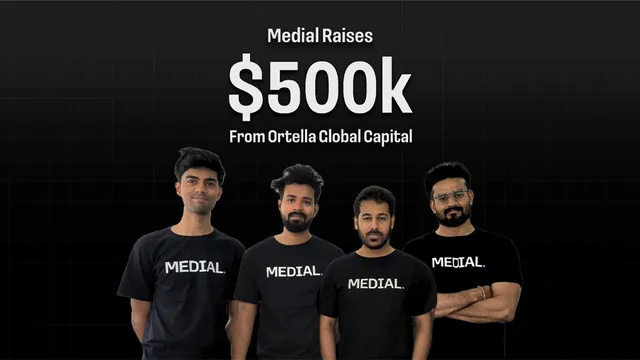

financialnews

Founder And CEO Of F... • 1y

Let's Congratulations 🎉 Medial raises $500K in pre-Series A led by OG Capital . . . Medial Secures $500K in Pre-Series A Funding, Led by Ortella Global Capital Professional social media platform Medial has successfully raised $500K in a funding ro

See MoreGaurav Verma

Head - Revenue Marke... • 1y

I am excited to announce that I have started a new position as Co-founder and Head of Consumer Investments at Ortella Global Capital - OG Capital, India's only fund that co-builds companies. I am looking forward to investing in India’s growing cons

See MoreSayan Ghosh

Hey I am on Medial • 1y

Join us! The hardest part in building a startup is building the right team - not just building a team but building the right team. For us, the right team members possess three key elements: a. Passion: Genuine enthusiasm for what we are building b

See More

Sayan Ghosh

Hey I am on Medial • 1y

I am happy to unveil today that I have started a new position as Co-Founder at Ortella Global Capital - OG Capital, India's only fund that co-builds companies! In 2012, I failed to raise my first Venture Capital Fund. Back then, ‘startup’ was barel

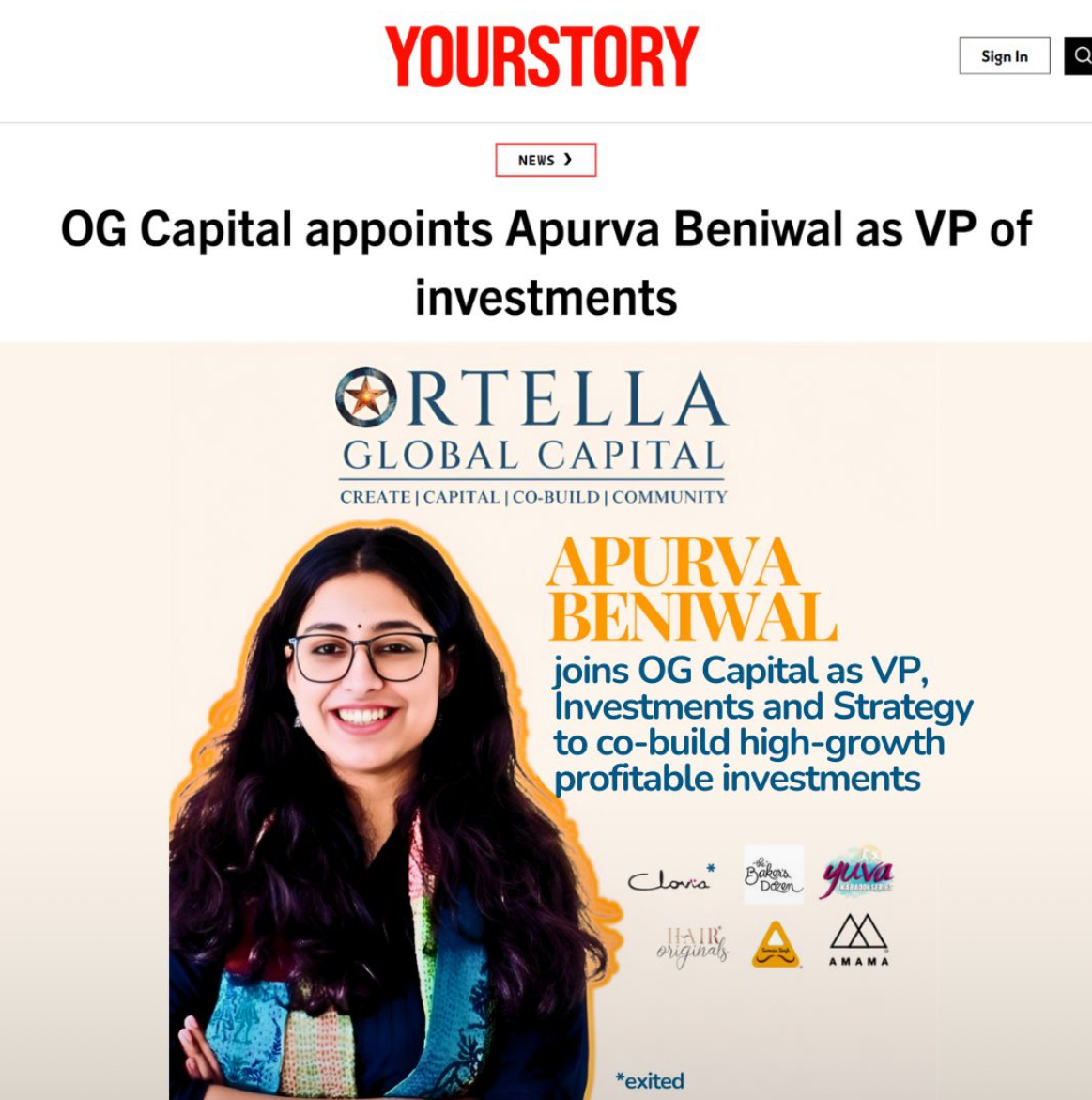

See MoreApurva Beniwal

Building the next bi... • 11m

Career Update: Some roles are taken, others are grown into quietly, over time. To me, this one feels like the latter. I have joined Ortella Global Capital - OG Capital, India's only fund that co-builds companies as VP – Investments & Strategy, Wit

See More

Download the medial app to read full posts, comements and news.

/entrackr/media/post_attachments/wp-content/uploads/2021/08/Accel-1.jpg)