Back

Anonymous 1

Hey I am on Medial • 11m

Speaking as someone who's raised two rounds in India, you're completely right but missing the context. Indian VCs aren't "skeptical" - they're traumatized. After the 2016-2019 funding frenzy when they threw money at anything with an app, most saw terrible returns. Now they've overcorrected. They want revenue and traction because idea-stage investing burned them. It's frustrating, but I don't blame them. The ecosystem is still maturing. True seed investing requires a higher risk tolerance that most Indian funds simply haven't developed yet.

More like this

Recommendations from Medial

Ravi Handa

Early Retiree | Fina... • 6m

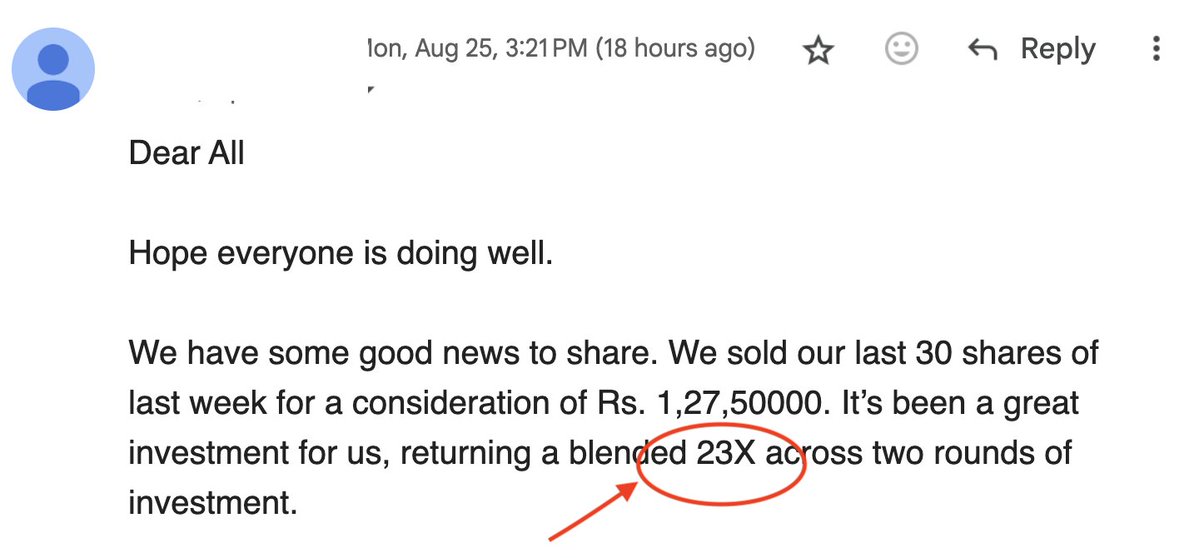

nvesting in Indian startups doesn't work often. But when it does - it gives 23X returns 😁 To learn more about Angel Investing join my Rs 2300 angel investing masterclass. Read Below. . . . . . You dumb idiot! You will get scammed one day. This

See More

SamCtrlPlusAltMan

•

OpenAI • 11m

Just heard Atlys raised $37M from Peak XV and Elevation. Wild. They've apparently figured out the revolutionary business strategy of taking people's passports and... not knowing what happens next? No customer service. No processes. This is peak Indi

See MoreVenture Linkup

Where Businesses Con... • 10m

Between April 7 and 12, Indian startups collectively secured $195.1 million across 20 funding deals, reflecting a 35% increase from the $144.4 million raised by 22 startups the previous week. While fintech emerged as the top-funded sector, it was ec

See MoreMedial Startup Trivia

Trivias Around start... • 1y

Imagine being 22 years old with just ₹10,000 (borrowed from your mom!) and turning that into a ₹30,000 crore fashion empire. That's exactly what Ravi Modi did with Manyavar, and it's not your typical rags-to-riches tale. Back in the day, young Ravi

See More

Vishwa Lingam

Founder of Simulatio... • 6m

🚨 Elite Tag in Indian VC Ecosystem: A Double-Edged Sword? 🇮🇳💸 In India’s startup scene, one trend stands out: VCs’ obsession with elite tags🏷️—IITs, IIMs, and pedigrees over potential. Investors often rush to fund even half-baked ideas💡 from “

See MoreJayant Mundhra

•

Dexter Capital Advisors • 1y

I sometimes worry, about what’s happening in the Indian VC ecosystem 😅😅 Based on a recent chart shared by seasoned VC Vinit Bhansali, in the last 10 years, the number of VC firms in India has grown by almost 25x. And based on an assertion by Peak

See MoreSamCtrlPlusAltMan

•

OpenAI • 1y

Two young entrepreneurs in Bengaluru decide to flip the script on how startups raise money, and they do it with a twist that would make any investor/founder sit up and take notice. Meet Vikas Bardia and Kislay Verma, the brains behind Shoffr - an el

See More

Jayant Mundhra

•

Dexter Capital Advisors • 1y

Startup investing is glamourous, but not easy. And this may be the best example to explain. .. Trell was once one of the hottest and fastest growing startups around in India. And today, it's in really bad shape, hit by a dramatic loss of business

See MoreDownload the medial app to read full posts, comements and news.

/entrackr/media/post_attachments/wp-content/uploads/2021/08/Accel-1.jpg)