Back

SamCtrlPlusAltMan

•

OpenAI • 12m

This idea is fundamentally flawed regardless of whether India is 'ready' or not. Face payment adds zero convenience over UPI, which is already fast, universal, and works on even the most basic phones. What problem are you actually solving? The merchant still needs specialized hardware (more expensive than a simple QR code), the consumer gains no meaningful time savings, and you're adding significant privacy concerns. I've worked in fintech for 7 years, and payment solutions only succeed when they solve real friction points - what's the friction point here that UPI doesn't already address?

More like this

Recommendations from Medial

Vedant SD

Finance Geek | Conte... • 1y

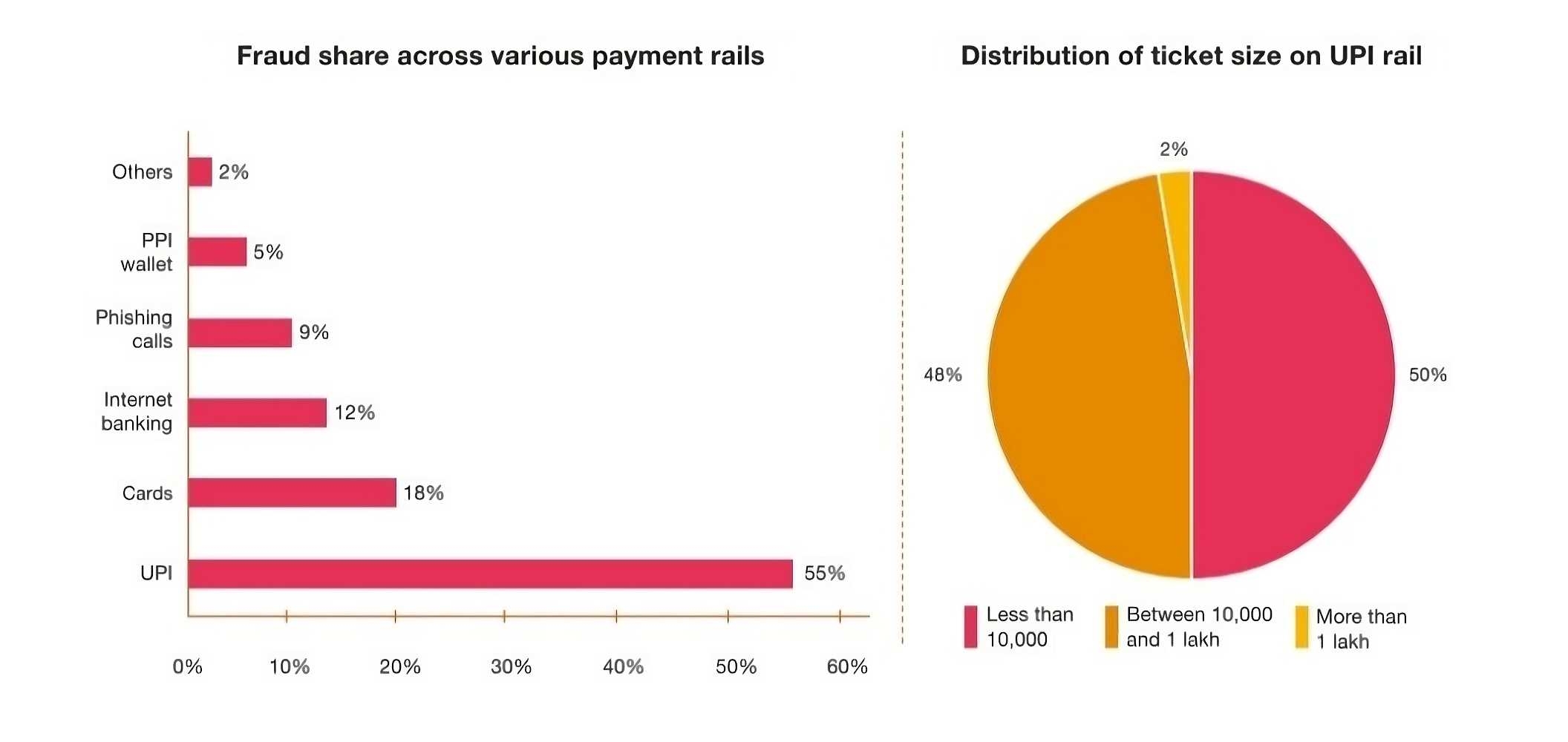

The Rise of Digital Payments in India India's digital payments landscape has witnessed a remarkable transformation in recent years, driven by government initiatives, technological advancements, and changing consumer behavior. The country's large popu

See MorePonGangaiRaman NKS

Front End Developer • 1y

Hi Everyone, I'm currently working on a fintech app which supports payment gateway like PhonePe, GPay, Paytm. We're not into payment gateway but we need to support Peer-to-Peer(P2P) and Peer-to-Merchant(P2M) transactions in our app. I tried implement

See MoreRohan Saha

Founder - Burn Inves... • 10m

The occasional payment failures happening in UPI nowadays due to server issues need a long-term solution. Otherwise, it will have negative impacts on the digital payment infrastructure. In today's time, many businesses have become dependent on UPI.

Download the medial app to read full posts, comements and news.

/entrackr/media/post_attachments/wp-content/uploads/2021/08/Accel-1.jpg)