Back

Vikas Acharya

Building Reviv | Ent... • 12m

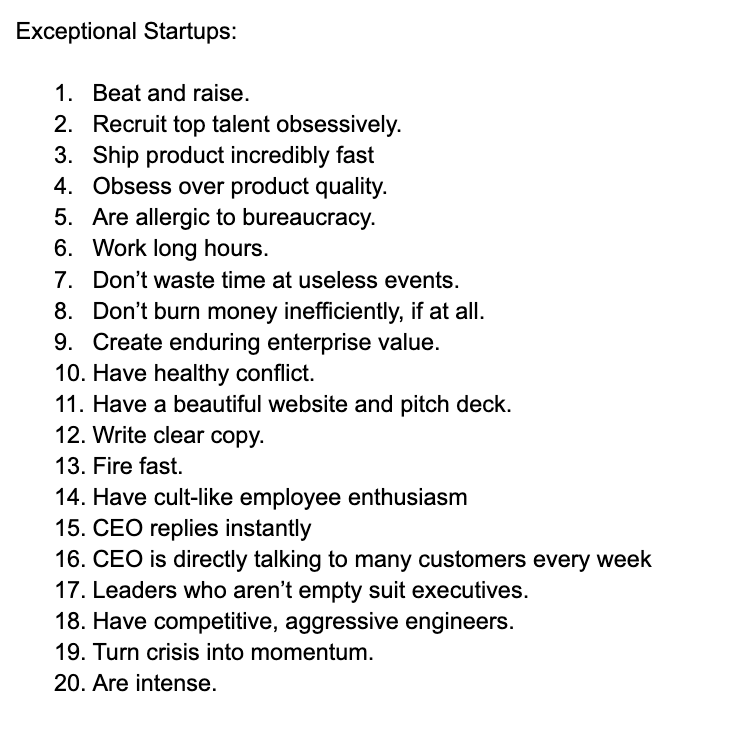

𝗧𝗵𝗲 𝗦𝗲𝗰𝗿𝗲𝘁 𝗪𝗼𝗿𝗹𝗱 𝗼𝗳 𝗚𝗵𝗼𝘀𝘁 𝗦𝘁𝗮𝗿𝘁𝘂𝗽𝘀 How Operating in Stealth Mode Can Lead to Remarkable Success ? 𝙄𝙣𝙩𝙧𝙤𝙙𝙪𝙘𝙩𝙞𝙤𝙣 In an ecosystem dominated by flashy launches and viral buzz, some companies choose to operate entirely under the radar. These “ghost startups” forgo the public spotlight, instead focusing on product development, exclusive networking, and quiet, sustainable growth. In this article, we explore what ghost startups are, why founders might opt for stealth mode, and how real-life examples have turned secrecy into success. 𝙒𝙝𝙖𝙩 𝘼𝙧𝙚 𝙂𝙝𝙤𝙨𝙩 𝙎𝙩𝙖𝙧𝙩𝙪𝙥𝙨? Ghost startups are companies that deliberately avoid broad public attention. Instead of hosting high-profile launches or extensive marketing campaigns, they work quietly on perfecting their products and forging discreet partnerships. The reasons vary—from protecting sensitive intellectual property to avoiding competitive pressure in emerging markets. 𝙒𝙝𝙮 𝙂𝙤 𝙂𝙝𝙤𝙨𝙩? Protecting Intellectual Property: By staying under the radar, startups can prevent competitors from catching wind of innovative ideas too soon. Focusing on Product: Without the distraction of public hype, founders can iterate and refine their offerings based on direct feedback from a small, engaged user base. Avoiding External Pressures: A silent approach often means fewer media expectations and less investor pressure during the vulnerable early stages. 𝙎𝙩𝙧𝙖𝙩𝙚𝙜𝙞𝙚𝙨 𝙀𝙢𝙥𝙡𝙤𝙮𝙚𝙙 𝙗𝙮 𝙂𝙝𝙤𝙨𝙩 𝙎𝙩𝙖𝙧𝙩𝙪𝙥𝙨 Stealth Product Development: Many ghost startups roll out beta versions to a select audience, using invite-only programs or private trials to gather genuine insights while keeping details confidential. Exclusive Networking: Founders often rely on invitation-only events, secret online groups, or one-on-one meetings to build relationships with potential customers and partners. Controlled Funding: Instead of pursuing large, attention-grabbing funding rounds, these startups may opt for smaller, strategic investments—allowing them to grow on their own terms. Ghost startups prove that sometimes operating in the shadows is a strategic advantage. By focusing on solid product development, protecting proprietary ideas, and leveraging exclusive networks, these founders build businesses that often speak for themselves once the time is right.

Replies (1)

More like this

Recommendations from Medial

Aniket Agarkhed

Hey I am on Medial • 1y

Sam Altman shares strategies for successful startup investing, emphasizing quality opportunities, informed decisions, and strong founder relationships. He highlights networking, supporting startups, and focusing on long-term growth while helping foun

See MoreChaman Kanth

Mechanical Engineer • 1y

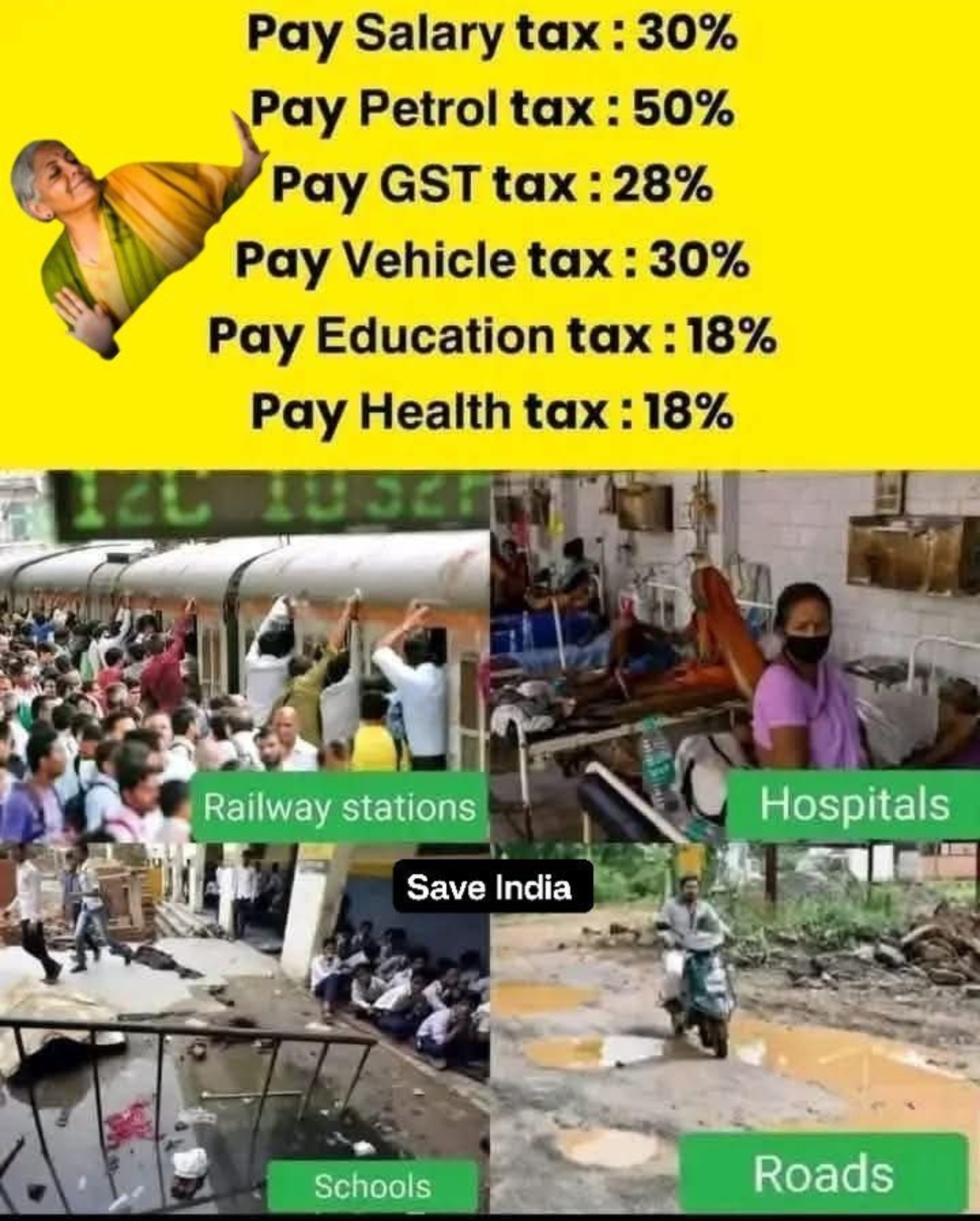

I was thinking lately about su 30 mki upgrades impact on india in recent DAC acceptance of necessity. They approved the New Radar Warning Receiver and ASPJ advanced self protection jammer pod will this make a difference in deep tech startups working

See More

Download the medial app to read full posts, comements and news.

/entrackr/media/post_attachments/wp-content/uploads/2021/08/Accel-1.jpg)