Back

Piyush Lohia

Early Stage VC • 11m

Fundraising is not a formula that fits all. As a VC who makes returns on their portcos raising future rounds. Fundraising is the last piece I want my founders to be optimizing for. Fundraising is not a milestone but a requirement. Investments don’t make your company successful, you do. Run your business efficiently, know your customer and sell as much as you can. If you and your business are good, investments will follow.

Replies (1)

More like this

Recommendations from Medial

Vivek Joshi

Director & CEO @ Exc... • 9m

Unlock the secrets to effective VC fundraising with our latest video, "Mastering VC Fundraising: A Smarter Strategy!" Dive into a two-round funding approach that empowers startup founders to secure the capital they need while optimizing equity and gr

See MoreManu

Building altragnan • 9m

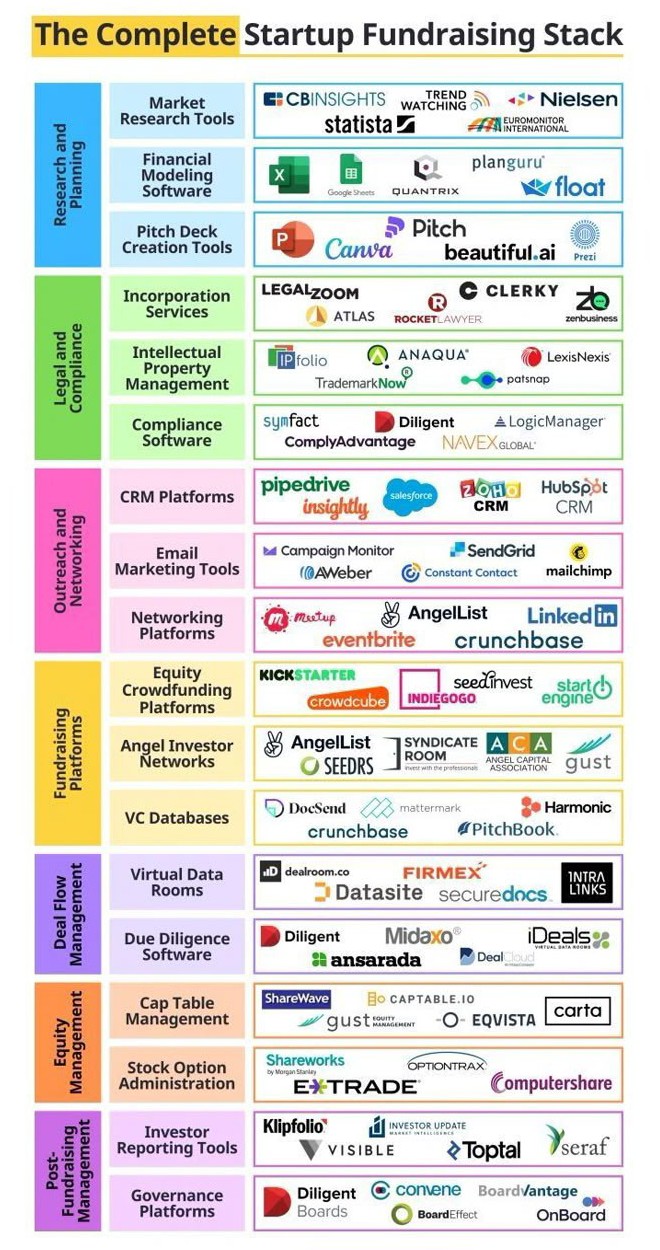

The Complete Startup Fundraising Stack is a handy guide for founders navigating the fundraising journey. It breaks down all the tools you might need—from researching your market and building a killer pitch deck, to managing investor relationships and

See More

Pradeep Yadav

•

Purple Unicorn • 1y

Hi everyone This side Pradeep . I am a startup enthusiast, working with a family office as Head of investments . I also support early and growth stage ventures to support them in their fundraising. i believe i Medial is an amazing new age platform

See MoreVivek Joshi

Director & CEO @ Exc... • 9m

Investment Mandates I. Sector-Agnostic Early-Stage Investments • Focused on providing the first institutional check to startups. • Early signs of traction and revenue are required. • Typical investment size: ₹1-8 crore in exchange for 8-18% equi

See More

Rushikesh Patil (RISHI)

Hey I am on Medial • 9m

Hey everyone! I’m currently building a high-potential startup in the Quick Commerce space, and I’m looking for a co-founder who has experience in fundraising, venture capital, and investor relations. ✅ What I'm Looking For: A partner who understand

See MoreDownload the medial app to read full posts, comements and news.