Back

Rohan Saha

Founder - Burn Inves... • 1y

The Indian market has been declining since September 2024. Even the best investors or traders have seen their net worth decrease by at least 20%. The Indian market currently needs a good push, and only earnings can provide that push. All tariffs and other factors have already been factored in, but what is not happening is growth in earnings.

More like this

Recommendations from Medial

Rohan Saha

Founder - Burn Inves... • 6m

Right now these sudden ups and downs in the market are pretty normal since it’s still confused by tariffs and weak earnings If Indian companies had posted strong results there would have been some hope for the market to hold its ground but at this po

See MoreRohan Saha

Founder - Burn Inves... • 5m

investors and traders are currently very upbeat about the possibility of a GST cut which is why concerns around tariffs have started to ease however if the GST cut falls short of expectations for any reason the market could face a minor correction of

See MoreRohan Saha

Founder - Burn Inves... • 1y

"The Indian stock market has been down since September 2024. This is the first time in the last 24 years that our market has been down for such a long period. The market can fall either with or without any reason. If the market falls without any reas

See MoreRohan Saha

Founder - Burn Inves... • 10m

From today's market behavior, it's clear that the Indian market is currently more focused on earnings rather than any global factors. A good rally or even a healthy sideways movement might occur, which could bring more confidence from a technical lev

See MoreRohan Saha

Founder - Burn Inves... • 1y

From September 27th until now, FIIs (Foreign Institutional Investors) have only been selling in the Indian market, and this trend is continuing. Looking at the current data, it also seems that Indian investors might be parking their money back into d

See MoreRohan Saha

Founder - Burn Inves... • 1y

Today, the Indian market was expected to fall. Until now, our government was focusing on CAPEX (capital expenditure), but now this responsibility has been given to private players, so it will be interesting to see. The USA has imposed tariffs on Chin

See Morefinancialnews

Founder And CEO Of F... • 1y

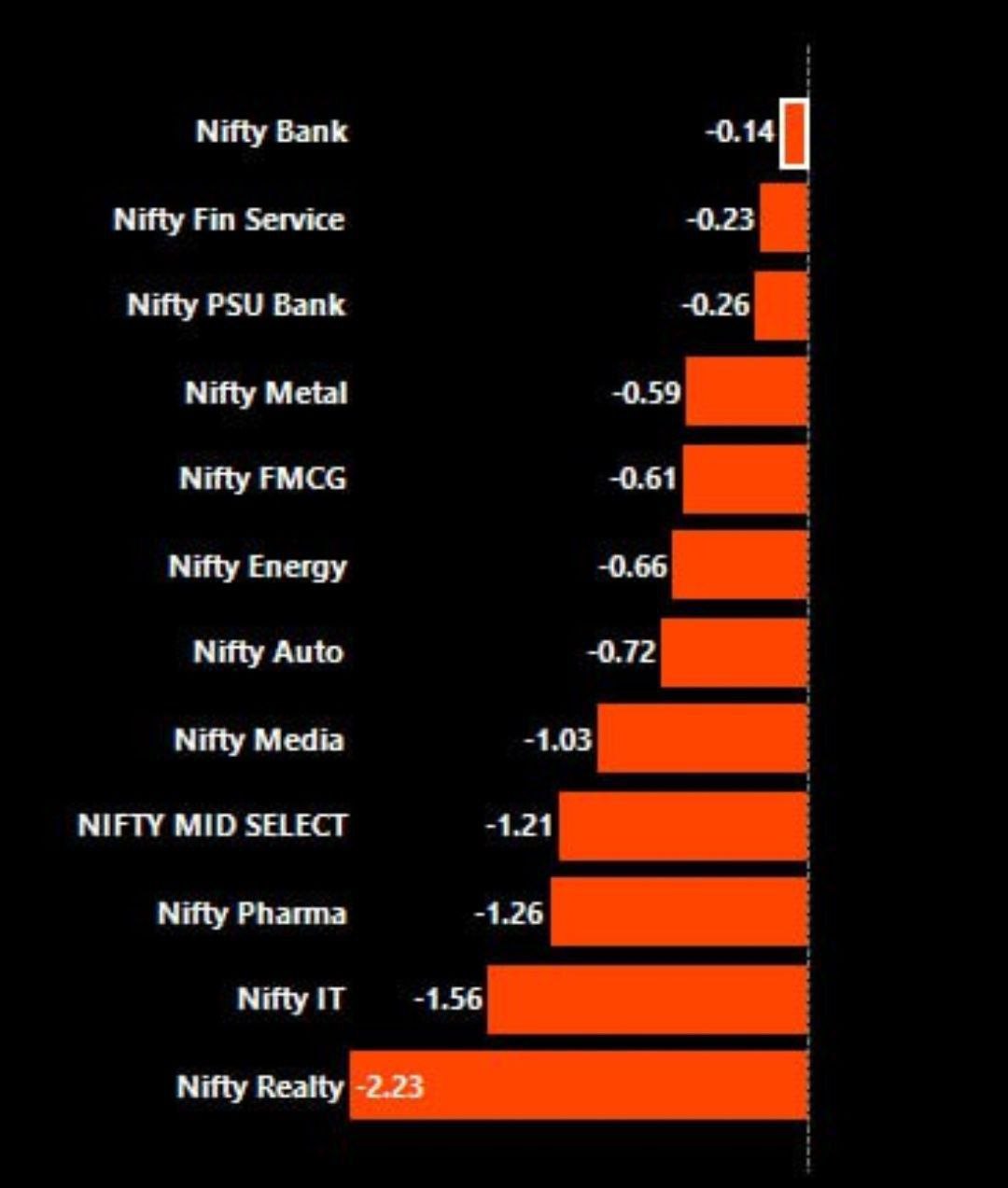

Stocks market today: Sensex, Nifty 50 crash 1% each; what is driving the market down? Explained with 5 factors 1. The Adani saga 2. Concerns over weak Q2 earnings 3. Escalating geopolitical tensions 4. Heavy foreign capital outflow 5. Technical

See MoreDownload the medial app to read full posts, comements and news.

/entrackr/media/post_attachments/wp-content/uploads/2021/08/Accel-1.jpg)