Back

Replies (1)

More like this

Recommendations from Medial

Sameer Patel

Work and keep learni... • 1y

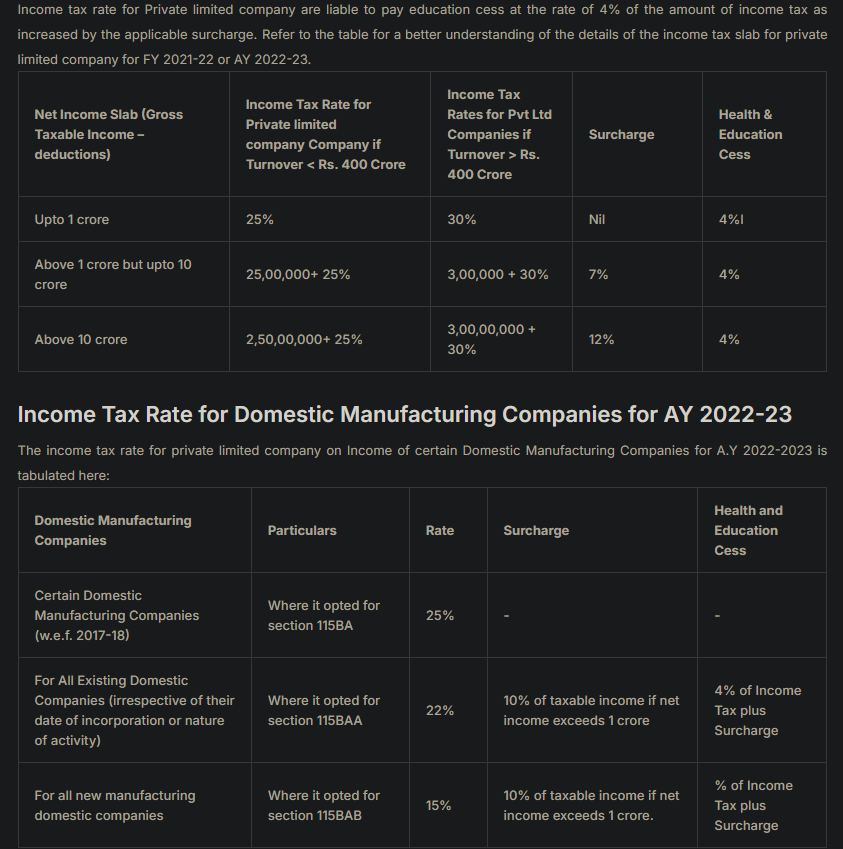

Financial knowledge Indian Tax slabs Income tax slabs categorize taxpayers based on their annual income, determining the applicable tax rates. Here's a breakdown: 1. Nil Tax: Annual income up to ₹2.5 lakh for individuals below 60 years. 2. 5% Tax: I

See MoreCA Dipika Pathak

Partner at D P S A &... • 1y

Dear business🔊 please note your tax audit applicability ➡️Every business, including private limited companies, individuals, and partnership firms (excluding those opting for the presumptive taxation scheme), is subject to a tax audit ifTotal sale

See More

Sanjay Srivastav. Footwear Designer

Hey I am on Medial • 1y

If your income is 12L, You pay 0 for the first 4L. From 4L - 8L i.e. next 4L, you pay 5% = 20,000. From 8L - 12 i.e. another 4L, you pay 10% = 40,000. Total Tax Payable= 60,000. Standard Deduction -75,000. So NO TAX FOR INCOME UP TO 12L. Get it?

Dipesh Pimpale

Data Analytics | 𝐀�... • 1y

Exciting to hear about CBG Blending Initiative Updates Please find some time to read the article. I have provided a brief update below. The National Biofuels Coordination Committee (NBCC) has announced a groundbreaking initiative to enhance the us

See MoreRabbul Hussain

Pursuing CMA. Talks... • 7m

Income Tax Update for AY 2025-26 Attention Taxpayers! Income Tax Department ne announce kiya hai ki Excel Utilities for ITR-2 and ITR-3 ab officially live hain! Yeh utilities Assessment Year 2025-26 ke liye hai, aur aap inhe portal se download ka

See MoreDownload the medial app to read full posts, comements and news.

/entrackr/media/post_attachments/wp-content/uploads/2021/08/Accel-1.jpg)