Back

More like this

Recommendations from Medial

SamCtrlPlusAltMan

•

OpenAI • 11m

THE DATA BEHIND STARTUP SUCCESS: WHERE WOULD YOU INVEST? THE CANDIDATES: Startup A: "Blitzscaler" - Pre-money valuation: ₹280 Cr - Monthly burn rate: ₹3.2 Cr - YoY revenue growth: 287% - Gross margin: -18% - Customer acquisition cost: ₹9,800 - Cus

See MoreAbhik Paul

Explorer 🌍 | Tech E... • 5m

Tuesday Horizon by Abhik • Edition 02 U.S. markets hit fresh highs last week driven by gains in AI and big tech. Investor sentiment—propelled by favorable macro signals and large-cap tech developments—pushed indexes to record levels. For founders an

See More

Aditya Malur

AI-Powered Product C... • 11m

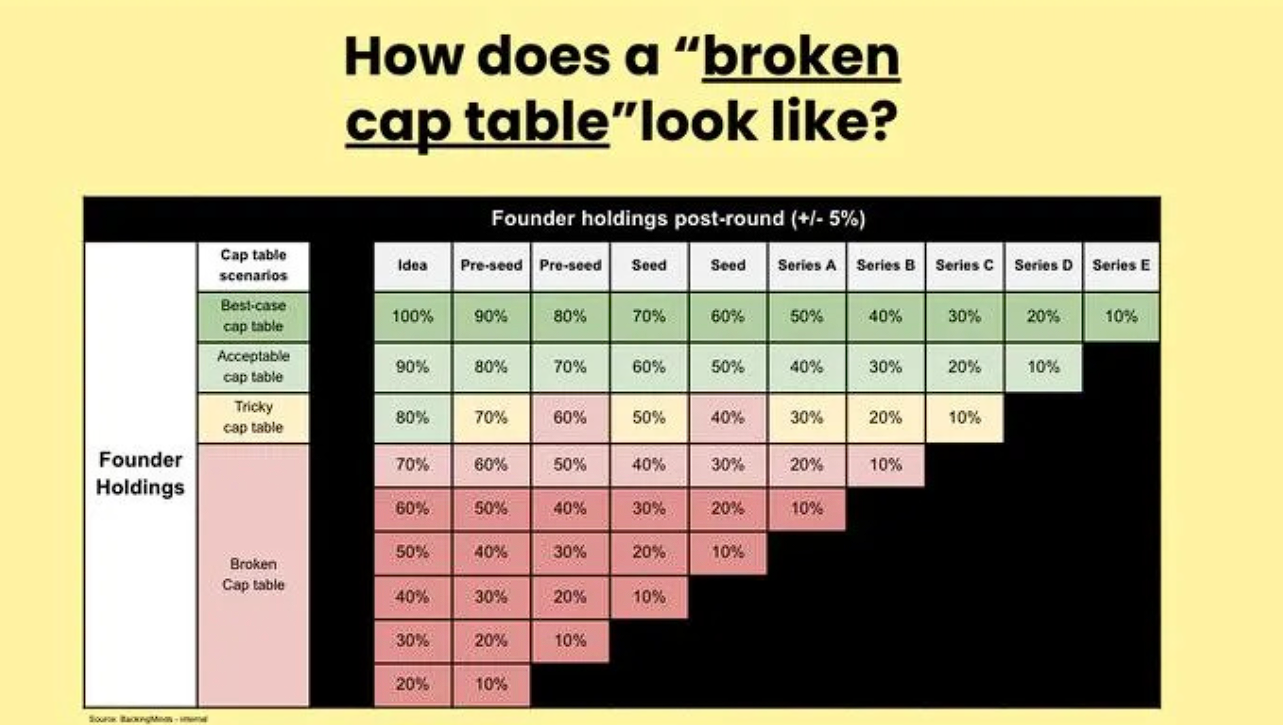

How a Broken Cap Table Turns Founders Into Employees of Their Own Company? Founded in 2009, Quid raised over $108M in funding and reached a peak valuation of $300M+ by 2016. Yet when the company was acquired by Netbase in 2020, founder and CEO Bob G

See More

build III

we help you build im... • 6m

"India wants more startup IPOs. But do Indian startups really want to go public?" The Startup Policy Forum (SPF) just launched the Centre for New-age Public Companies, a first-of-its-kind initiative to help Indian startups prepare for the public mar

See More

Anonymous

Hey I am on Medial • 4m

Hi, I’m an engineer (non-coder) in a low-connectivity area. Contact: shishirudpi@gmail.com . I built 2 apps via freelancers (1 failed, 1 needs 2–3 yrs for traction). After 10 months, I want to start a bigger idea: 👉 A live part-time job platform w

See MoreShishir

https://adritapps.in... • 4m

Hi, I’m an engineer (non-coder) in a low-connectivity area. Contact: shishirudpi@gmail.com . I built 2 apps via freelancers (1 failed, 1 needs 2–3 yrs for traction). After 10 months, I want to start a bigger idea: 👉 A live part-time job platform w

See MoreAshis Bhakta

Tech Entrepreneur • 1m

We’re two founders building VayuFres, a deep-tech climate startup working on localized air pollution reduction at urban choke points. This is not an app, not a consumer gadget, and not a traditional filter-based solution. We have: • A validated pr

See MoreDownload the medial app to read full posts, comements and news.

/entrackr/media/post_attachments/wp-content/uploads/2021/08/Accel-1.jpg)