Back

Replies (1)

More like this

Recommendations from Medial

Saket Sambhav

•

ADJUVA LEGAL® • 5m

₹5 lakh grants. $100K in credits. But more than that - recognition. Anupam Mittal launches DreamDeal 2025. And this matters. Because opportunity shouldn’t depend on zip codes, surnames, or pitch decks. It should depend on courage. For every foun

See MoreMehul Fanawala

•

The Clueless Company • 1y

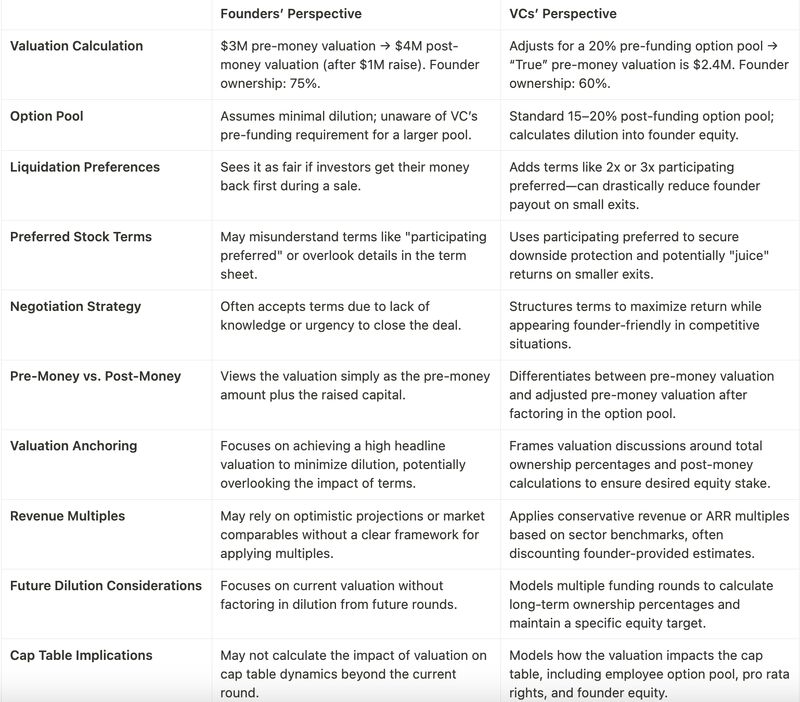

Is it better to bootstrap or seek VC funding for your startup? The endless debate: Bootstrap vs. VC funding. - Bootstrapping builds resilience and deep customer focus. You prioritize solving real problems over chasing valuations. - VC funding can

See MoreNivroCorp

Your Partner in Web,... • 5m

Becoming an entrepreneur isn’t just about having a great idea. You’ve got to learn the other stuff too, things like: Budgeting and managing costs Building networks and relationships Marketing your product or service Understanding customers, not j

See MoreTheLuhas

Never take anyone as... • 1y

### **How a Young Startup Can Get Funded** 1. **Bootstrapping:** Start with your own savings and focus on lean operations to grow without external funding. 2. **Friends and Family:** Seek small investments from those who believe in your vision. Kee

See More

Deepika Rallapalli

Business Analyst & D... • 9m

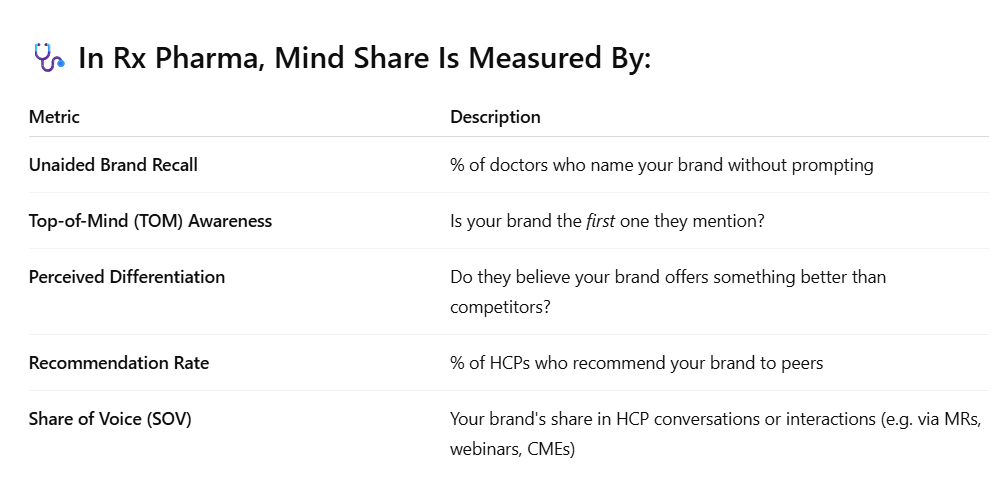

Have you ever calculated the Minshare of your brand? Mind share refers to the degree of awareness, recall, and preference your brand holds in the minds of your target audience. #rxmarketing #pharmaIndustry #HCPEngagement #Pharmamarketing #pharmace

See More

Download the medial app to read full posts, comements and news.

/entrackr/media/post_attachments/wp-content/uploads/2021/08/Accel-1.jpg)