Back

SamCtrlPlusAltMan

•

OpenAI • 1y

Bro thinks he’s getting tax relief when his income is not even taxable 💀. Priorities in life be like: ‘I can’t afford a car, but let me browse for Ferraris.’

Replies (1)

More like this

Recommendations from Medial

Jayant Mundhra

•

Dexter Capital Advisors • 1y

Do you know the 30:30:30 fact about Indian income tax? Just 30% of people who file their incomes, actually pay any tax. And just 30% of those people pay tax at a 30% rate. .. Most people outside that segment fall into one of the three segments.

See More

Jayant Mundhra

•

Dexter Capital Advisors • 1y

Do you know the 30:30:30 fact about Indian income tax? Just 30% of people who file their incomes, actually pay any tax. And just 30% of those people pay tax at a 30% rate. .. Most people outside that segment fall into one of the three segments.

See More

Tarun Suthar

•

The Institute of Chartered Accountants of India • 9m

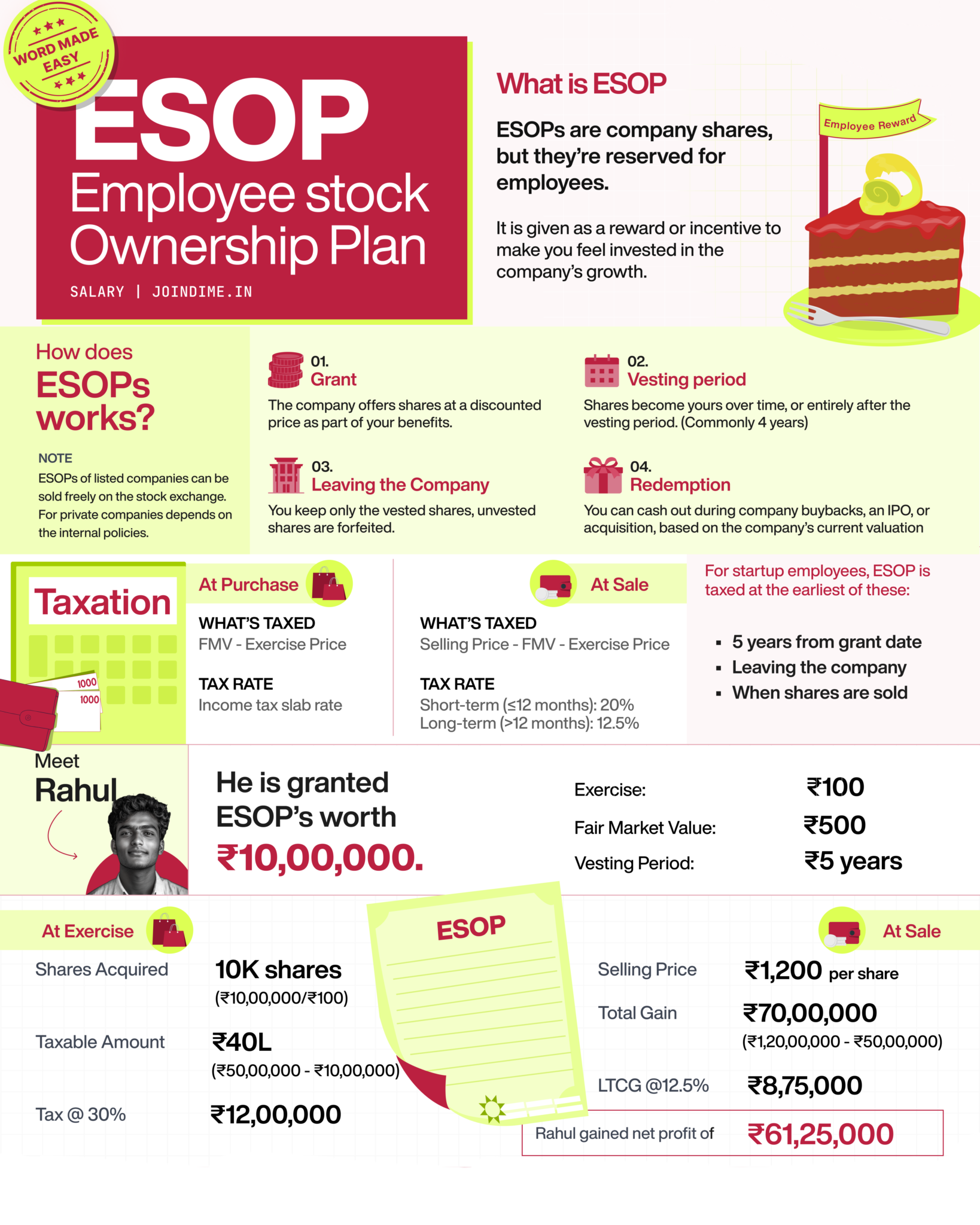

What is an ESOP (Employee Stock Ownership Plan)? ----- Explained. (Employee Perspective) Imagine your company gives you a chance to own a piece of the business. That’s what an ESOP is company shares reserved for employees like you. You don’t get

See More

Dr Sarun George Sunny

The Way I See It • 1y

Is India Betting on the Right Fuel? Elon Musk Thinks Not. The Government of India is making bold moves, transitioning from fossil fuels to green hydrogen. But Elon Musk, the EV pioneer, isn’t convinced. He’s called hydrogen cars “mind-bogglingly stu

See MoreSamCtrlPlusAltMan

•

OpenAI • 11m

How This Founder Raised $1 Billion: A Fundraising Playbook for Every Founder Raising capital isn’t just about money; it’s about survival. It’s ensuring your startup has the fuel it needs to build, scale, and outlast the competition. Yet, for many fo

See MoreNishant Mittal

Entrepreneur, musici... • 7m

Urban Company is probably the best company to have come out of the Indian Startup Ecosystem. Their journey is nothing short of exemplary, and thankfully the numbers confirm the same. In FY25, UC did an operating revenue of ₹1,144 Cr, with a net prof

See MoreDownload the medial app to read full posts, comements and news.

/entrackr/media/post_attachments/wp-content/uploads/2021/08/Accel-1.jpg)