Back

CA Jasmeet Singh

In God We Trust, The... • 1y

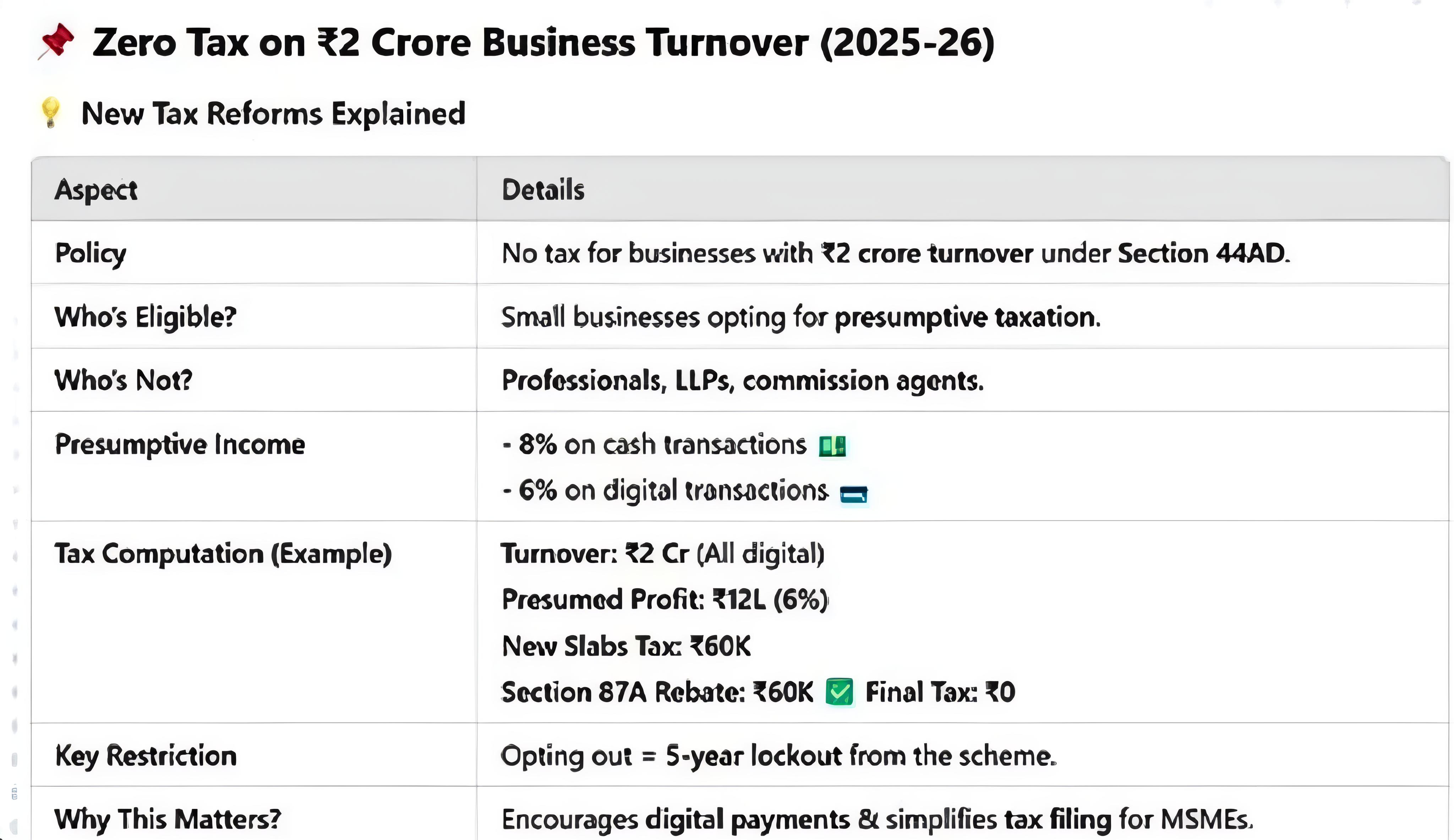

Hey Tarun, These New rates are applicable only for the Individual opting for New Regime. Also these thresholds do not give benefit to the Special Rate Income like STCG/LTCG. Last Year's Bombay High Court decision was officially override by the Bill proposal. In simple words " Your STCG/LTCG shall be taxable at special rates only and wont be given the benefit of Rebate u/s 87A. I hope it's clear bhai.

Replies (1)

More like this

Recommendations from Medial

Tarun Suthar

•

The Institute of Chartered Accountants of India • 1y

You still have to pay taxes if your income is below 12Lakhs.💀 Let’s talk about a crucial detail in the recent Indian Union Budget that many people are overlooking. If you’re already aware, great! But if not, this is essential to know—otherwise, you

See More

Download the medial app to read full posts, comements and news.

/entrackr/media/post_attachments/wp-content/uploads/2021/08/Accel-1.jpg)