Back

Replies (1)

More like this

Recommendations from Medial

Account Deleted

Hey I am on Medial • 9m

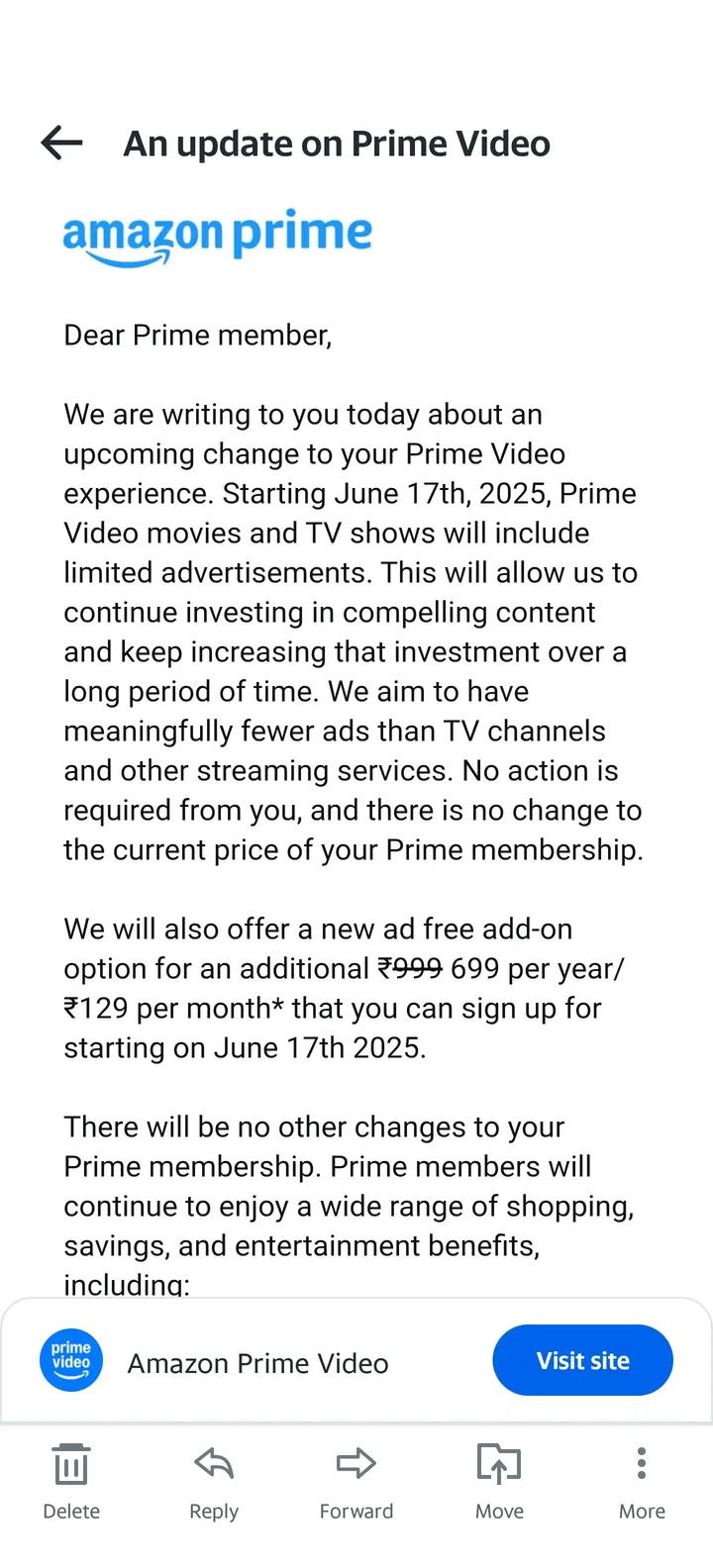

Hey Prime Video watchers! from June 17, 2025, you'll see a few ads while you're watching. The price you pay for Prime Video now will stay the same. If you don't want to see any ads, you can pay extra. It'll cost ₹699 for the whole year or ₹129 each

See More

Ashutosh Mishra

Chartered Accountant • 1y

GST Thread 2 What GST brings along with it - 1. Value added tax and no cascading of taxes - GST is only on the value added by the manufacturer and being a value added tax at each stage it avoids double taxation Example - If I purchase plastic fr

See MoreCA Kakul Gupta

Chartered Accountant... • 11m

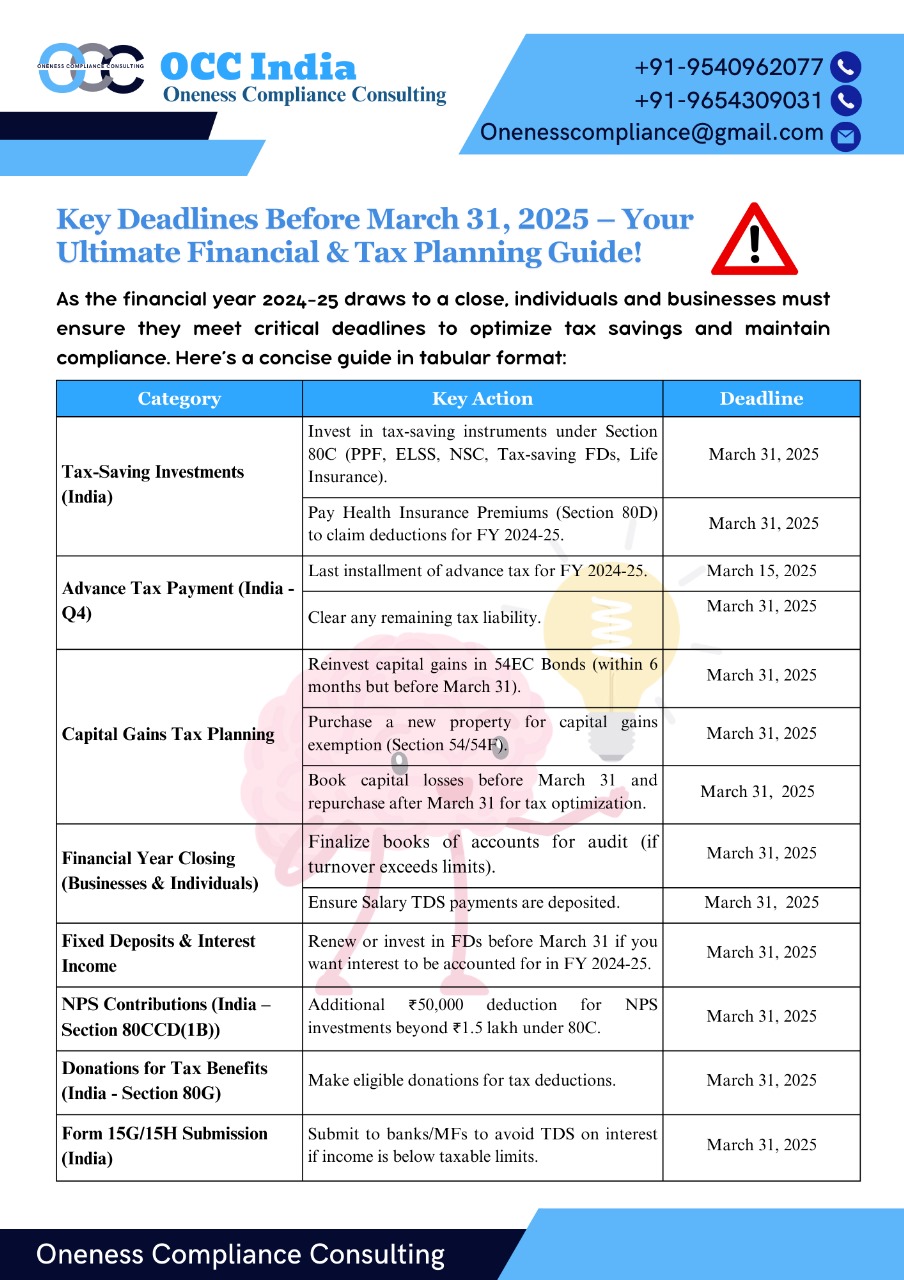

Summary of action points Before March 31, 2025 ✔ Review tax-saving investments. ✔ Pay pending taxes/advance tax. ✔ Submit investment proofs to employer (if salaried). ✔ Plan capital gains/losses for tax efficiency. ✔ Update financial records for the

See More

Download the medial app to read full posts, comements and news.

/entrackr/media/post_attachments/wp-content/uploads/2021/08/Accel-1.jpg)