Back

More like this

Recommendations from Medial

Sameer Patel

Work and keep learni... • 1y

Financial knowledge Indian Tax slabs Income tax slabs categorize taxpayers based on their annual income, determining the applicable tax rates. Here's a breakdown: 1. Nil Tax: Annual income up to ₹2.5 lakh for individuals below 60 years. 2. 5% Tax: I

See MoreReyansh Rathod

Entrepreneur • 11m

Friends, have you ever thought that paying tax is our responsibility, but why does it seem like a deep trap? India's tax system is so complicated that the common man gets confused! On one hand, the changing rules of GST, on the other hand, the high r

See MoreTarun Suthar

•

The Institute of Chartered Accountants of India • 1y

You still have to pay taxes if your income is below 12Lakhs.💀 Let’s talk about a crucial detail in the recent Indian Union Budget that many people are overlooking. If you’re already aware, great! But if not, this is essential to know—otherwise, you

See More

Mehul Fanawala

•

The Clueless Company • 1y

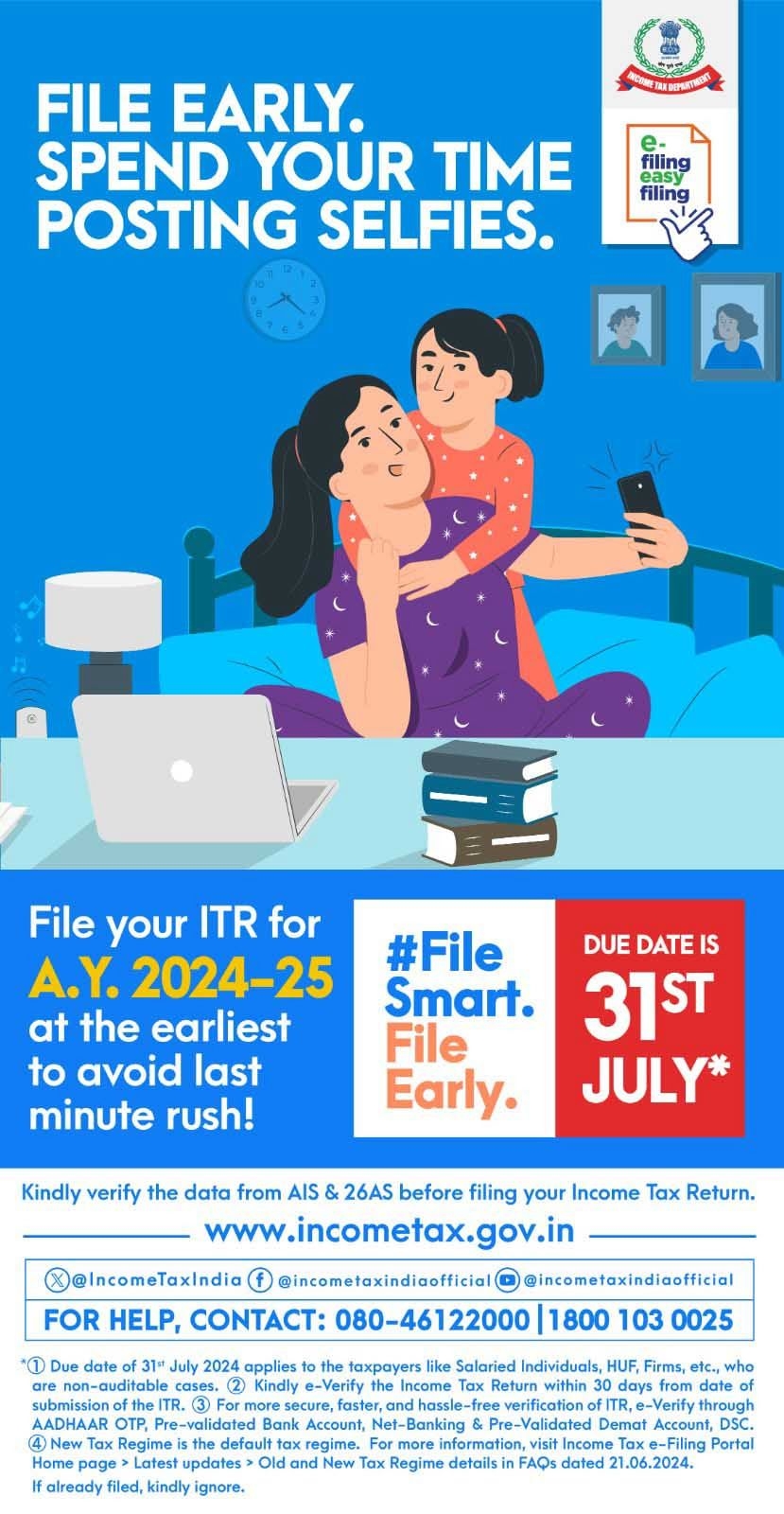

When the income tax return filing date is near, the income tax department goes into full marketing mode to remind taxpayers to file on time. Guess what? Even they have targets and quotas like our marketing and sales teams! 🎯 Imagine the tax offic

See More

financialnews

Founder And CEO Of F... • 1y

Budget 2025 expectations: Income tax relief buzz Speaking on the expected rationalisation of the income tax slab, Pankaj Mathpal, MD & CEO at Optima Money Managers, listed out the possible income tax slab for the new income tax regime, which may bri

See MoreDownload the medial app to read full posts, comements and news.

/entrackr/media/post_attachments/wp-content/uploads/2021/08/Accel-1.jpg)