Back

Vagle

Hakuna matata • 1y

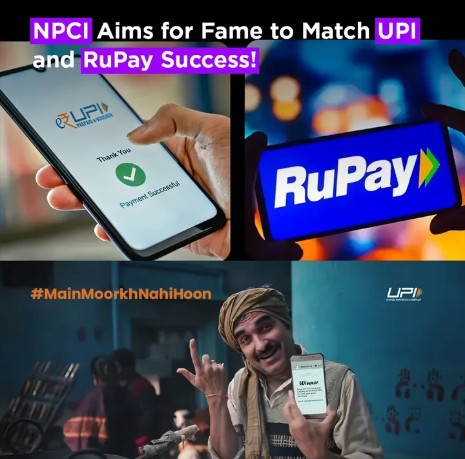

digital payments kaisa ho.....UPI jaisa ho.....

More like this

Recommendations from Medial

Vedant SD

Finance Geek | Conte... • 1y

The Rise of Digital Payments in India India's digital payments landscape has witnessed a remarkable transformation in recent years, driven by government initiatives, technological advancements, and changing consumer behavior. The country's large popu

See Moregray man

I'm just a normal gu... • 10m

The Reserve Bank of India (RBI) has announced that it will soon revise the transaction limits for Unified Payments Interface (UPI) payments made to merchants, also known as person-to-merchant (P2M) transactions. This move is aimed at enhancing the ef

See More

Mr khan

Smart. Sustainable. ... • 1y

UPI Statistics for December 2024: Total Transactions: December 2024 mein, UPI ne over 10 billion transactions process kiye, jo pehle ke months ke comparison mein kaafi zyada tha. Transaction Value: UPI transactions ki total value ₹15 lakh crore (app

See MoreDownload the medial app to read full posts, comements and news.

/entrackr/media/post_attachments/wp-content/uploads/2021/08/Accel-1.jpg)