Back

Gagan K M

Co-founder|| Enterpr... • 1y

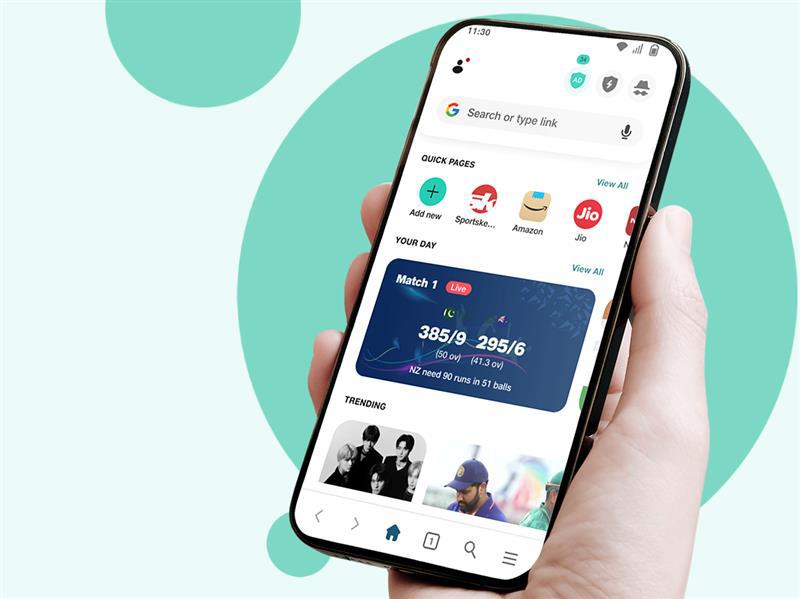

Reliance Jio has launched its own cryptocurrency, JioCoin, a blockchain-based digital currency designed to simplify digital transactions and promote financial inclusion in India. JioCoin aims to offer secure, transparent, and efficient transactions while challenging traditional banking systems. It promises faster processing, lower transaction fees, and wide accessibility to Jio's 450 million customers. JioCoin could potentially enhance financial inclusion for unbanked individuals in India. Industry reactions are mixed, with analysts recognizing JioCoin’s potential but raising concerns about regulatory issues. As the Indian government is reconsidering its stance on cryptocurrencies, JioCoin’s success will depend on regulatory collaboration. Initially, JioCoin will be used within Jio's ecosystem but may expand to e-commerce, retail, and government services. With Jio’s growing network, JioCoin could soon enable payments in physical retail outlets across India.

Replies (1)

More like this

Recommendations from Medial

Vedant SD

Finance Geek | Conte... • 1y

The Rise of Fintech in Bangalore: Trends and Opportunities * Trends: Mobile payments, digital lending, insurtech, blockchain, wealth management, regulatory sandbox. * Opportunities: Financial inclusion, increased access to credit, personalized fina

See MoreVedant SD

Finance Geek | Conte... • 1y

The Future of Fintech in India India's fintech sector has experienced rapid growth, driven by technological advancements, increasing smartphone penetration, and government initiatives. The country's large population and diverse demographics offer a s

See MoreVedant SD

Finance Geek | Conte... • 1y

The Rise of Digital Payments in India India's digital payments landscape has witnessed a remarkable transformation in recent years, driven by government initiatives, technological advancements, and changing consumer behavior. The country's large popu

See MoreVinayak Shivanagutti

🚀7M+ Post Impressio... • 1y

Case Study: PhonePe – India's UPI Leader Founded in 2015, PhonePe dominates India's digital payments landscape. Stats: Users: 350M+ registered Market Share: 40%+ of UPI transactions Business Model: Transactions, financial services, advertising. R

See More

Swapnil gupta

Founder startupsunio... • 8m

🙅 7 Key Reasons Why Groww Matters 1. Democratizing Investments: Groww simplifies investing for millennials and first-time investors, offering easy access to mutual funds, stocks, ETFs, and IPOs. This has empowered millions in Tier 2 and Tier 3 citi

See More

Mr khan

Smart. Sustainable. ... • 1y

UPI Statistics for December 2024: Total Transactions: December 2024 mein, UPI ne over 10 billion transactions process kiye, jo pehle ke months ke comparison mein kaafi zyada tha. Transaction Value: UPI transactions ki total value ₹15 lakh crore (app

See MoreParvej Rijwan

Founder Of Codebaaj.... • 8d

🇮🇳 Top 3 Companies in India (By Market Capitalization – 2026) Latest available data (January–February 2026) ke hisaab se India ki sabse badi companies market cap ke basis par yeh hain: --- 1️⃣ Reliance Industries Market Cap: ₹21.637 Trillion

See More

Download the medial app to read full posts, comements and news.

/entrackr/media/post_attachments/wp-content/uploads/2021/08/Accel-1.jpg)