Back

More like this

Recommendations from Medial

Rohan Saha

Founder - Burn Inves... • 6m

Zomato PE ratio has reached around 994 in the Indian market I mean can you even imagine? The company valuation still does not look worth buying yet people are investing in it what I keep thinking is how badly is this one stock affecting the Nifty? A

See MoreRohan Saha

Founder - Burn Inves... • 1y

Ajj kal bohot log kuch experts ye boll rahe he ki indian market overvalued ho geya he.... Lakin indian market ka PE ratio avi 5 years ke average ke ass pass hi ghum raha he.... Or bank nifty ka PE to 5 years average se bohot nicea hai... Indian mar

See MoreVIJAY PANJWANI

Learning is a key to... • 2m

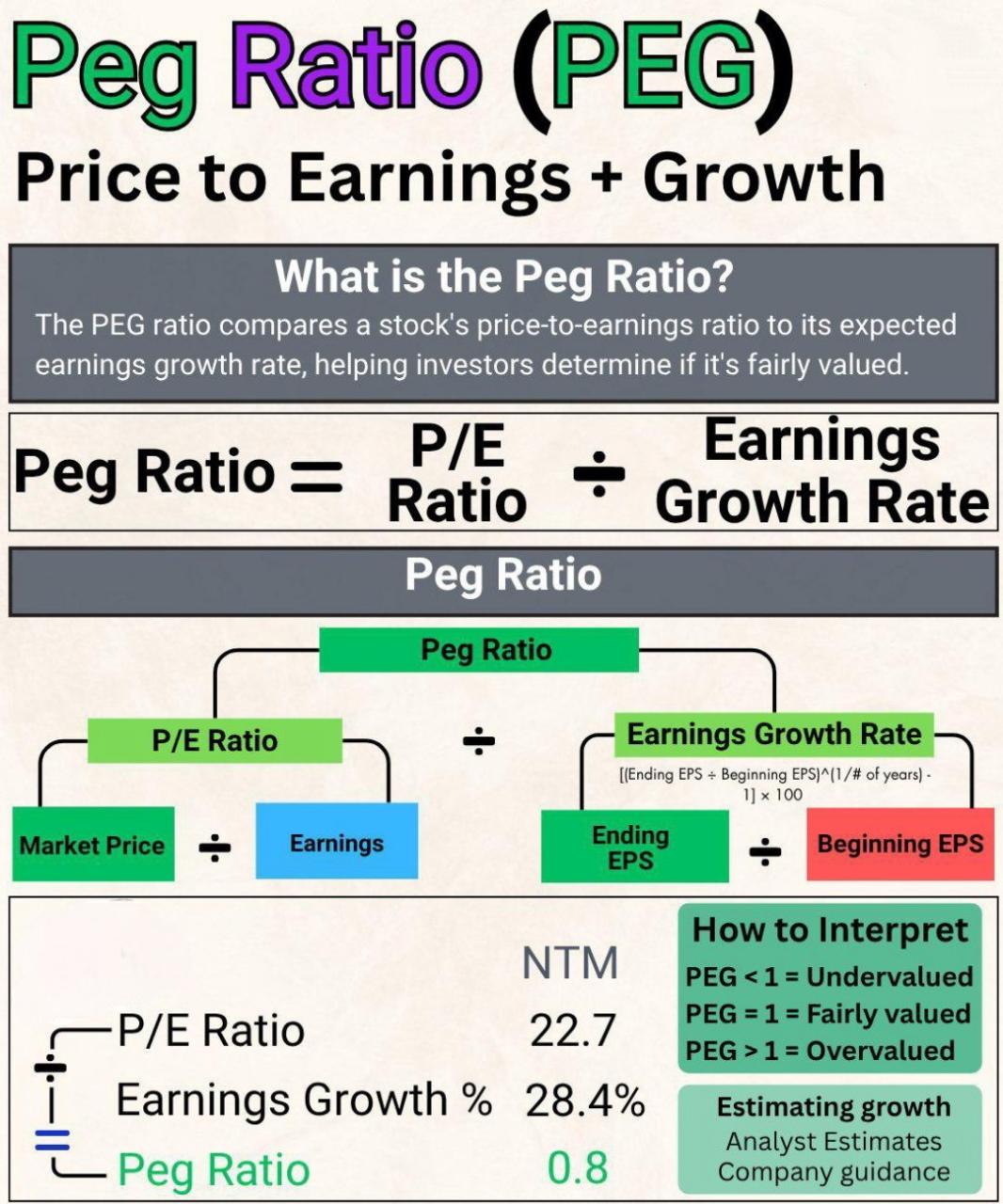

PEG Ratio Explained in 30 Seconds! Want to know if a stock is undervalued or overvalued? Use the PEG Ratio one of the smartest tools used by pro investors! 🧮 Formula: PEG = P/E Ratio ÷ Earnings Growth Rate ✅ PEG < 1 = Undervalued ⚖️ PEG = 1 = Fai

See More

Aryan patil

Intern at YourStory ... • 1y

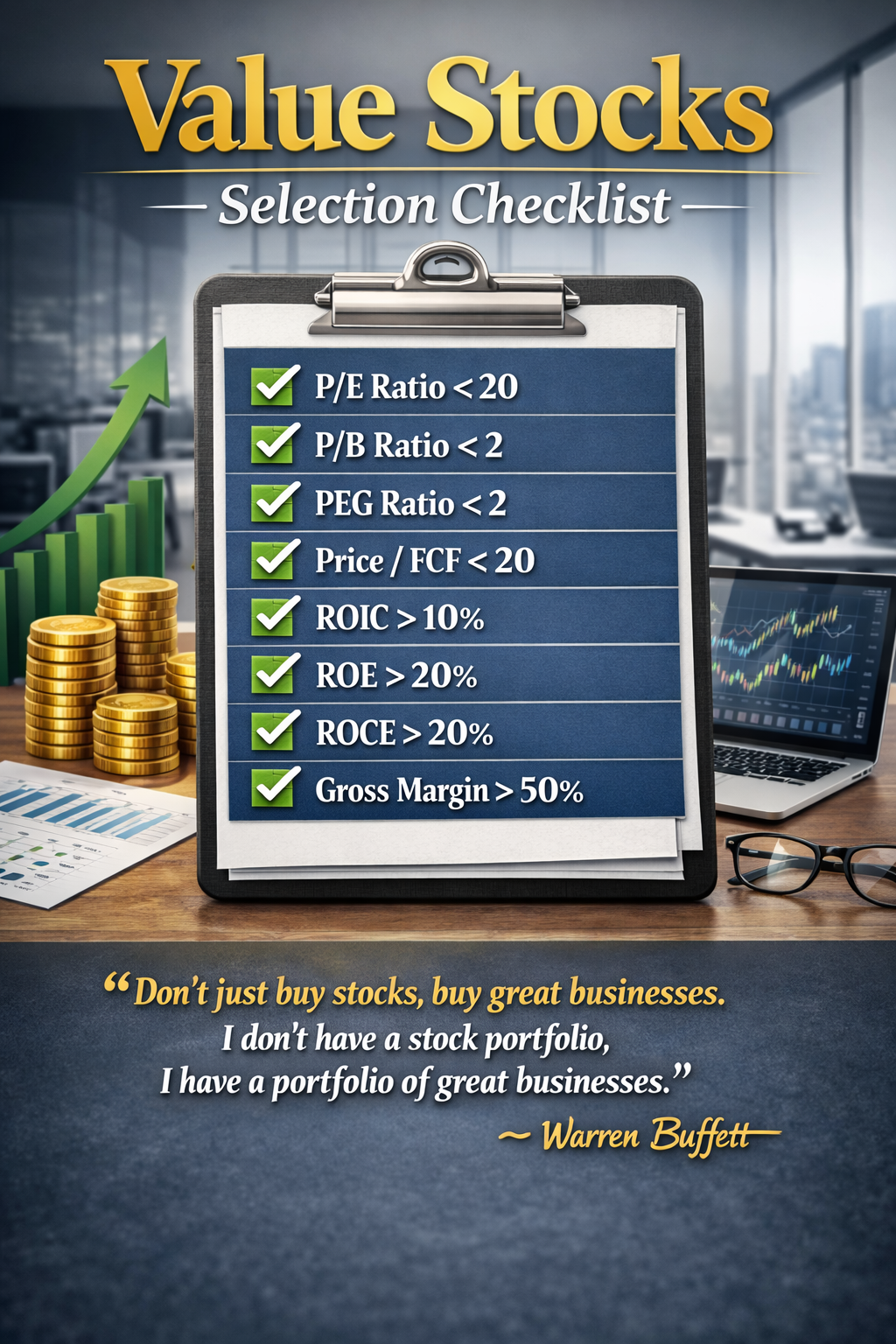

SEBI warned ⚠️ investors about Stock market bubble is about to burst anytime soon 📉 because The price-to-book (P/B) ratio of the Nifty Midcap 150 index is 4.26, and the Nifty Midcap 50 index has a P/B ratio of 3.64 This Means valuations of the Mid/s

See MoreHarshal Tiwari

Equity Research Anal... • 1m

👉Hindalco Industries Limited: 👉Only for Academic Research Current market price = 925 Target price = 1200 Stop loss = 876 Reward = 275 Risk = 49 Risk Reward ratio = 1:6 This is not a buy sell recommendation 👍 #HINDALCO #StockMarketIndia #Techni

See More

Shubham Khandelwal

Software Engineer • 1y

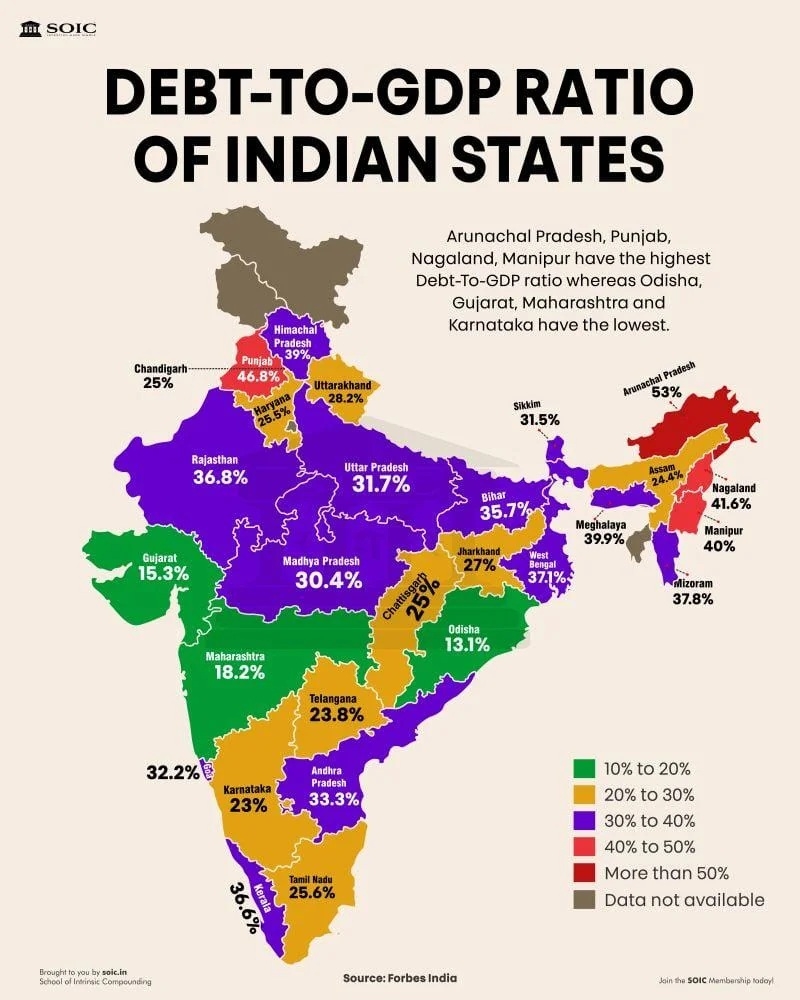

Debt to GDP Ratio of Indian States. Arunachal Pradesh, Punjab, Nagaland, Manipur have the Debt to GDP Ratio whereas Odisha, Gujarat, Maharashtra and Karnataka have the lowest Debt to GDP Ratio. Freebies in Poll Promises by Political Parties is the

See More

Download the medial app to read full posts, comements and news.

/entrackr/media/post_attachments/wp-content/uploads/2021/08/Accel-1.jpg)