Back

Vishu Bheda

•

Medial • 1y

Sequoia founder Don Valentine on the original mission of venture capital: In the 1990s, the internet boom made it look like anyone could make money by investing in startups. But many forgot what venture capital is really about: building strong, lasting companies. In the 1970s, early investors like Don Valentine and Arthur Rock focused on helping companies grow for years. They invested small amounts and stayed involved to guide these businesses. Compare that to 2000, when billions were thrown into random ideas, leading to a "get-rich-quick" mindset. The problem today is that many investors focus on quick gains, chasing trends like website traffic or market share. This hurts real innovators who want to create something meaningful. But there’s good news. Patient investors and hardworking founders, especially immigrant entrepreneurs, are building companies that last. For example, Cisco and Intel, supported by long-term thinking, are now worth nearly $900 billion combined. True venture capital is about helping businesses grow sustainably and creating value for everyone—founders, employees, and society. It’s not about quick money but lasting impact.

Replies (14)

More like this

Recommendations from Medial

Nikhil Raj Singh

Entrepreneur | Build... • 1y

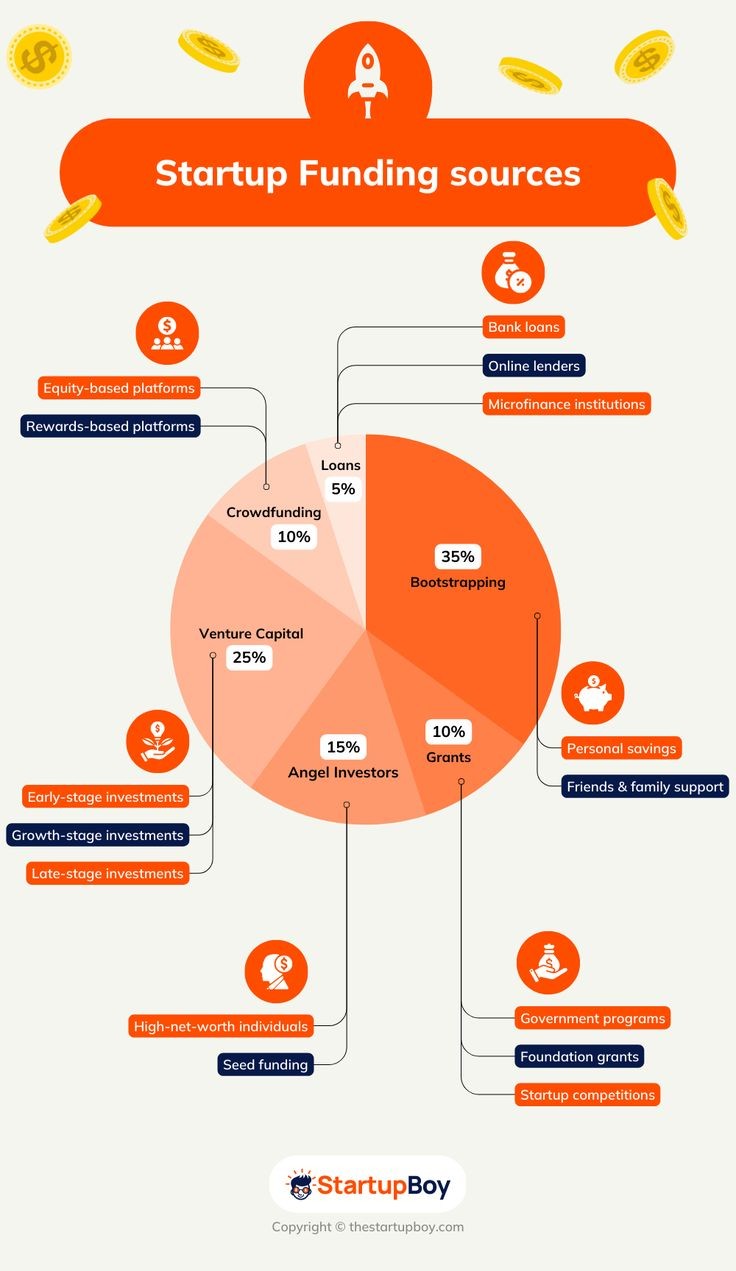

🚀 Ready to launch your startup? Here’s a quick guide to funding sources to fuel your journey! 💡💰 Whether you're bootstrapping, seeking venture capital, or exploring grants, there’s a path for every dream. 🌟 DM me 'Fund' and I’ll share a curated

See More

Account Deleted

Hey I am on Medial • 2y

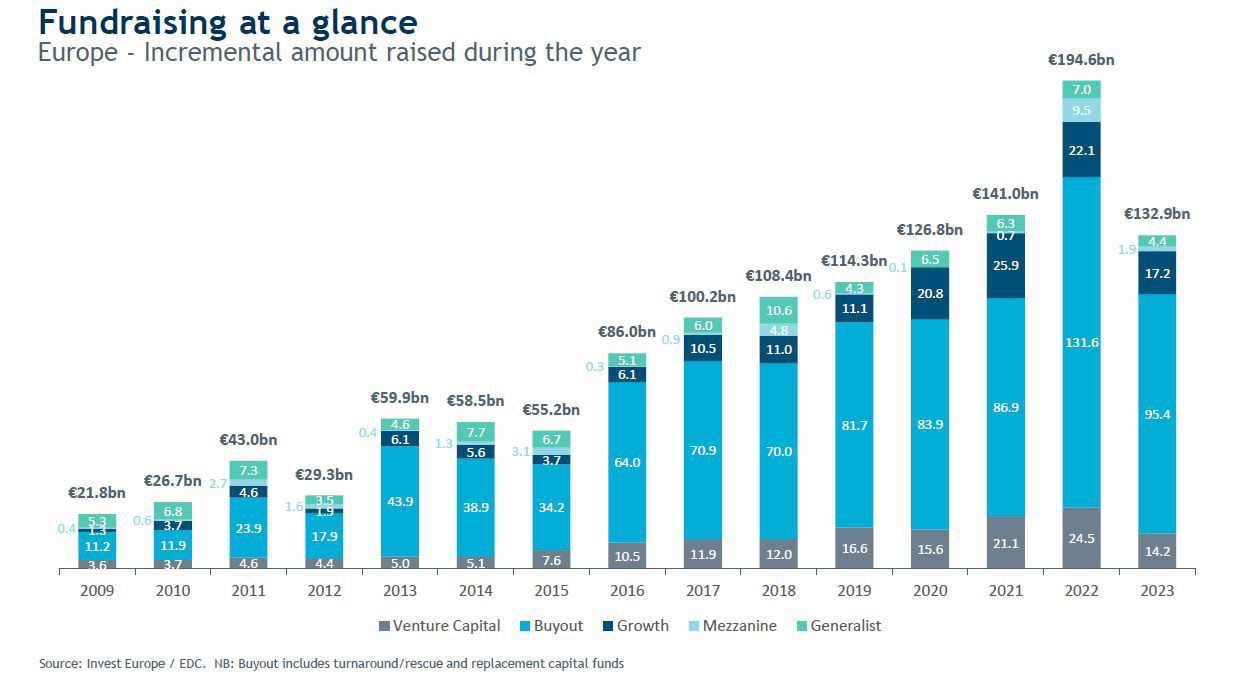

As we know, SoftBank, Sequoia Capital, and many venture capital firms are investing in AI startups like LLM companies and companies that use LLM model API to integrate in their backend. What do you think, where is technology going? 🤔 Let me know yo

See MoreRishabh Verma

The Only Way Out Is ... • 1y

Tumne inmein se kitne investors ka naam suna hai: 1. Sequoia Capital India 2. Accel Partners India 3. Tiger Global Management 4. SoftBank Vision Fund 5. Nexus Venture Partners 6. Lightspeed Venture Partners India 7. Kalaari Capital 8. Matrix Partner

See MoreAccount Deleted

Hey I am on Medial • 1y

Today's topic is : Sequoia Capital Venture Capital Firm🚀📈🤑 I. Introduction : • Sequoia Capital was founded by Donald Valentine in 1972 and current partner is My favourite Roelof Botha ♥️. • Sequoia Capital created new fund called 'Peak XV Pa

See More

Download the medial app to read full posts, comements and news.

/entrackr/media/post_attachments/wp-content/uploads/2021/08/Accel-1.jpg)