Back

Wild Kira

/Internet_ • 1y

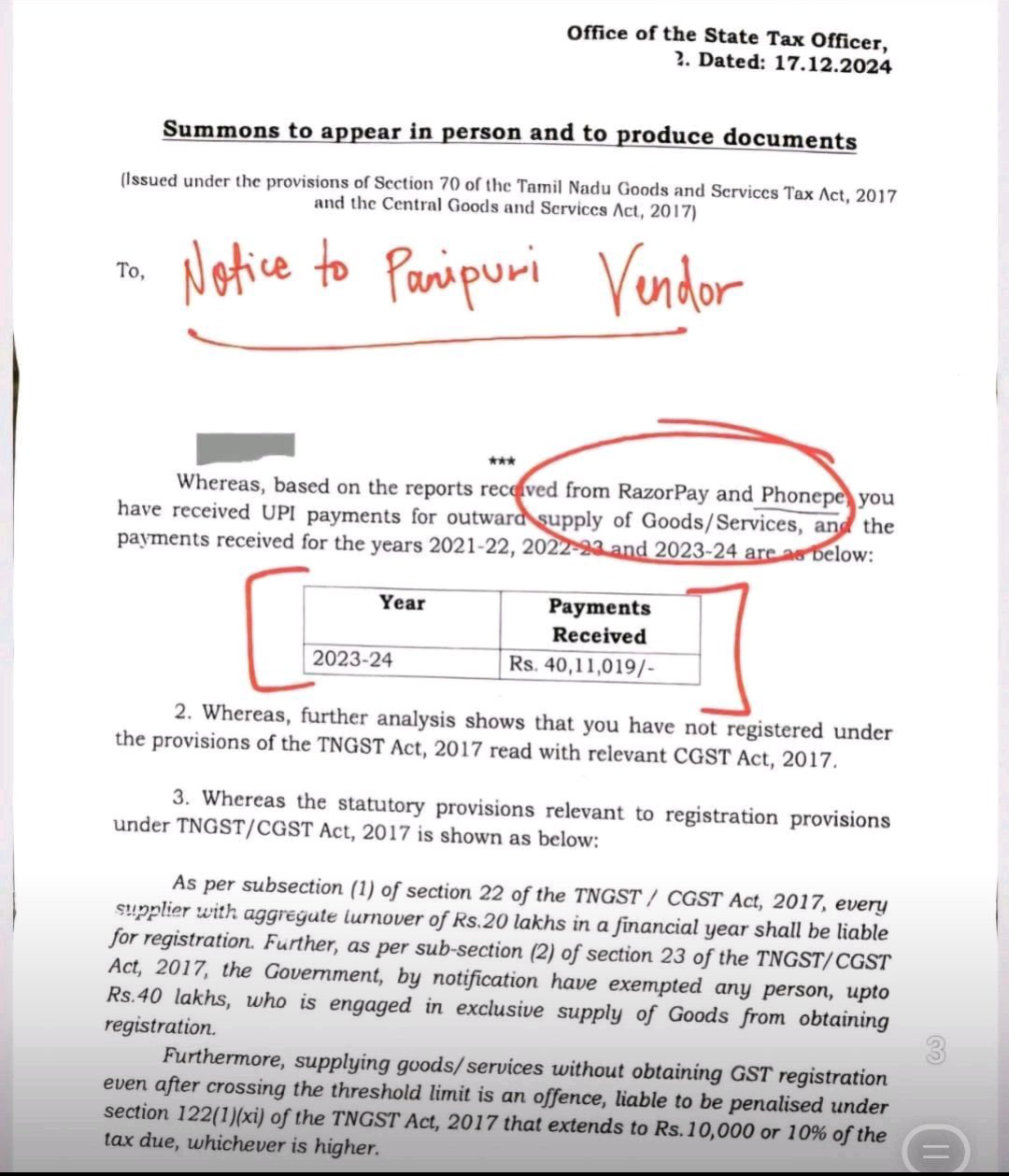

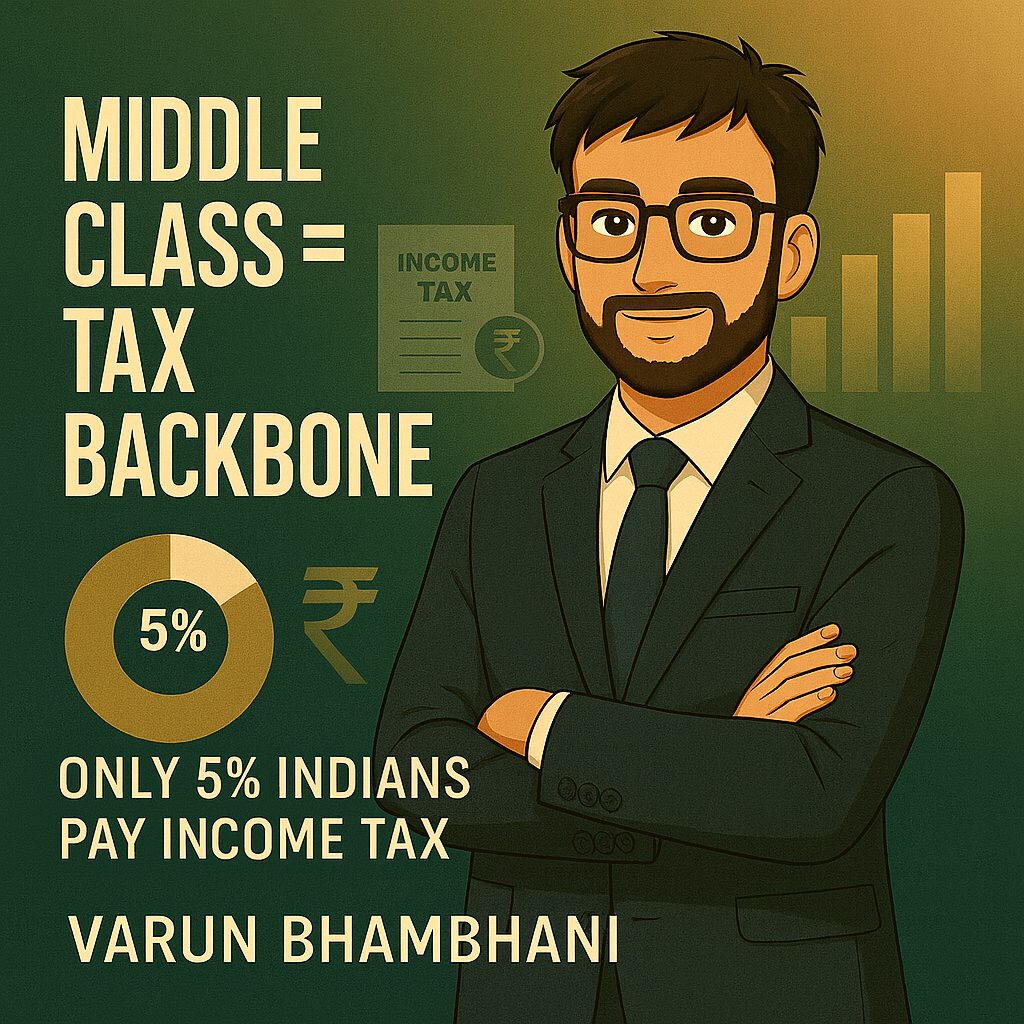

Digital India is a good initiative without it we can't develop, but the tax system isn't. The government should implement a system that ensures everyone, regardless of their profession, contributes their fair share through taxes.

More like this

Recommendations from Medial

Rahul Meena

Proficient in Java, ... • 1y

In India, a country with a population of over 1.5 billion, content creation has become a ubiquitous profession. Regardless of their occupation - be it software engineer, teacher, government officer, or BPO sector employee - the majority of individual

See MoreCA Dipika Pathak

Partner at D P S A &... • 1y

Here’s a real- lesson from July 2024: Many salaried employees, while filing their ITR, realized too late that they had missed out on crucial tax planning and investment opportunities because the financial year had already closed. Don’t let this hap

See More

Aakash kashyap

Building JalSeva and... • 1y

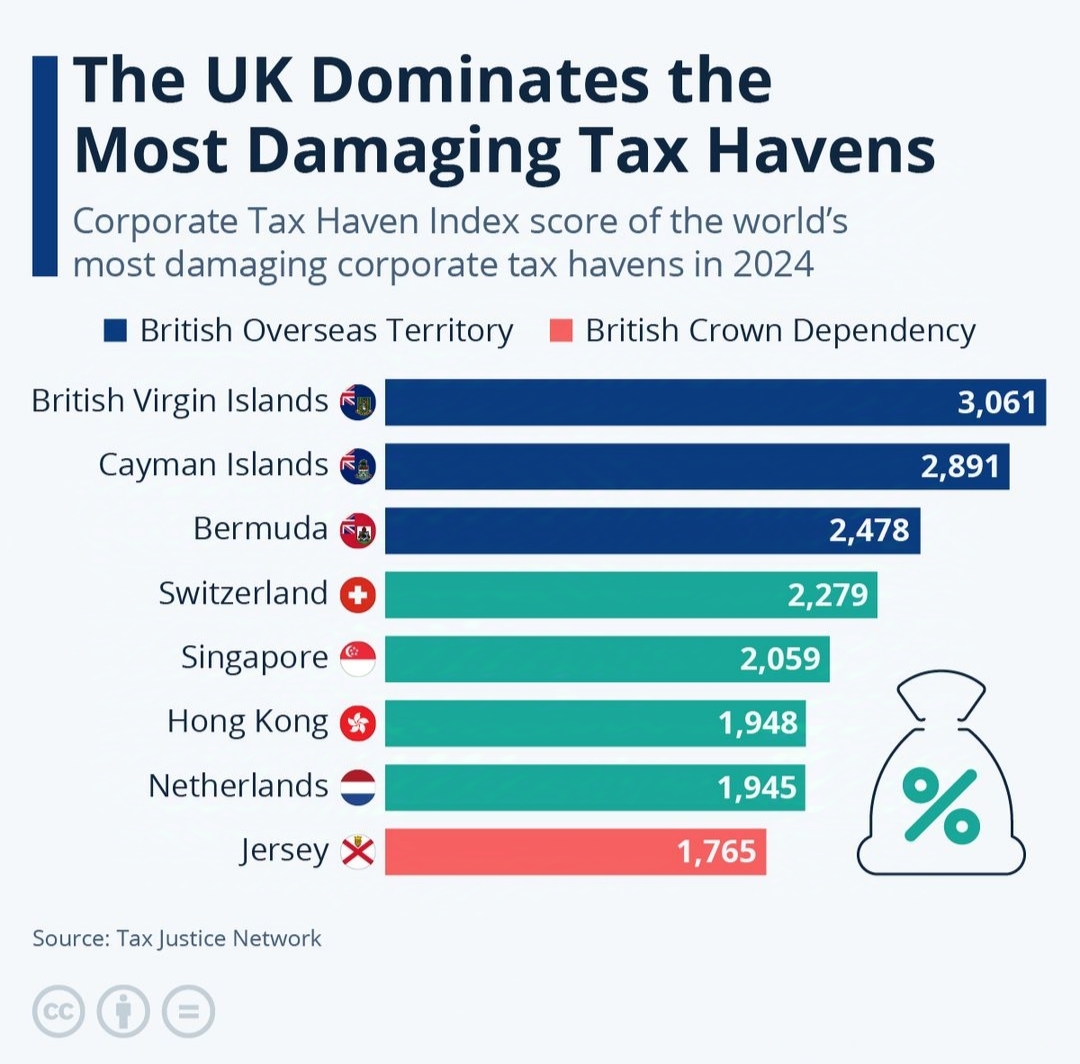

The UK's Overseas Territories Lead the Charge in Global Tax Havens – British Influence Dominates the Corporate Tax Haven Landscape in 2024 🤯 (A tax haven is a country or jurisdiction that offers low or no taxes, minimal financial transparency, an

See More

Download the medial app to read full posts, comements and news.

/entrackr/media/post_attachments/wp-content/uploads/2021/08/Accel-1.jpg)