Back

More like this

Recommendations from Medial

Tanay Yadav

Things you own, End ... • 1y

News Update: The Top 10 Tech Startups in New Delhi Relying on innovation data from StartUs Insights’ Discovery Platform, which tracks 4.7 million startups, scaleups, and tech companies worldwide. Filtered by location, founding year, technology re

See More

Sunil Huvanna

Building AI Applicat... • 1y

Ilya's 3 months old SSI AI startup getting 1B$ Funding at 5B$ Valuation just simply shows the extreme strength of US VCs and their intense rational on investing on tech & talents. As SSI is just a concept with not even a single line of code in produc

See MoreMahendar Rajpurohit

SCALITYAI:-https://S... • 8m

Y Combinator in 30 Seconds: ✅ World’s top startup accelerator 💵 Offers $500K funding ($125K for 7%, $375K on SAFE) 🗓️ 4 batches/year (Winter, Spring, Summer, Fall) 👥 Backed Airbnb, Stripe, Dropbox, and 4,000+ startups 📈 Massive network + Dem

See More

Vivek Joshi

Director & CEO @ Exc... • 9m

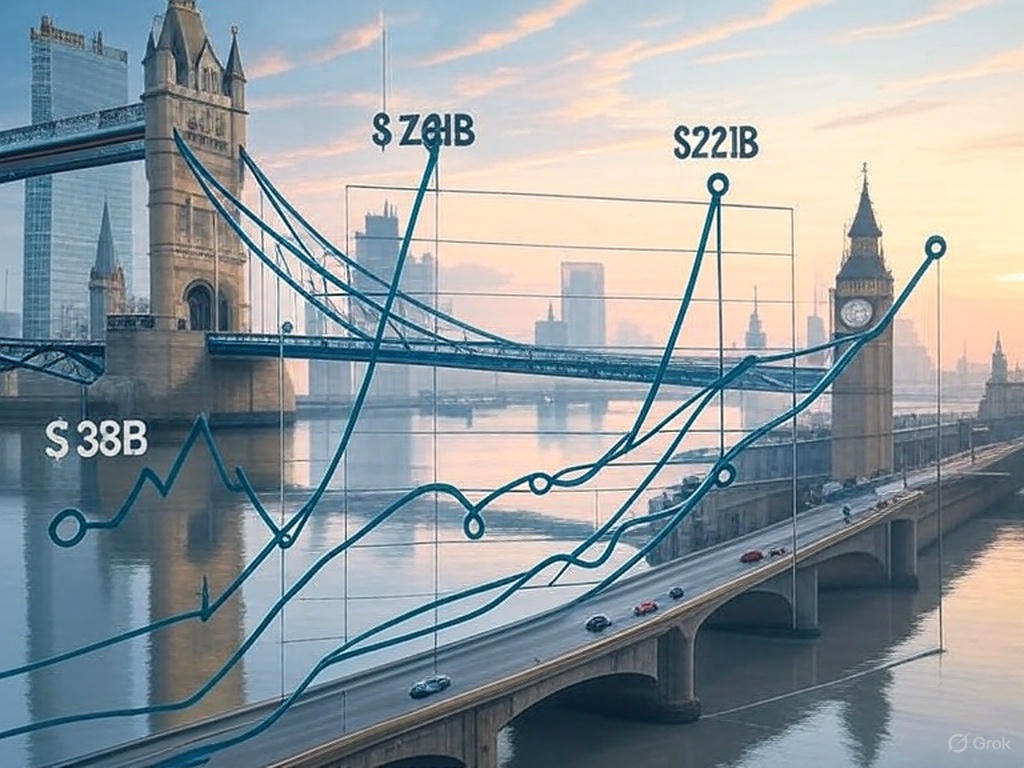

For early-stage startups, generating revenue and driving growth trump chasing venture capital (VC) funding. In 2023-2025, VC funding trends underscore this shift. Global VC investment plummeted from $381B in 2022 to $221B in 2023, with 2024 seeing on

See More

Parth Srivastava

A nerdy bug 🐛 • 1y

May sound noob but what exactly makes DEEPSEEK better than other ai as I don't believe benchmarks much, I only understand that till now DEEPSEEK didn't use supervised learning unlike other llms so it learns at each step on its own, other AIs couldn't

See More

Download the medial app to read full posts, comements and news.

/entrackr/media/post_attachments/wp-content/uploads/2021/08/Accel-1.jpg)