Back

Nawal

Entrepreneur | Build... • 1y

thats be 990% tax

Reply

1

More like this

Recommendations from Medial

Nawal

Entrepreneur | Build... • 10m

Come on, just stop already - 🔥 Deeptech takes years to build, and here Indian VC give 10 mins to pitch. They don't understand the essence of R&D and want immediate results. No one wish to spend on R&D. So companies like Swiggy, Zomato fly but DeepT

See More

4 Replies

8

Sameer Patel

Work and keep learni... • 1y

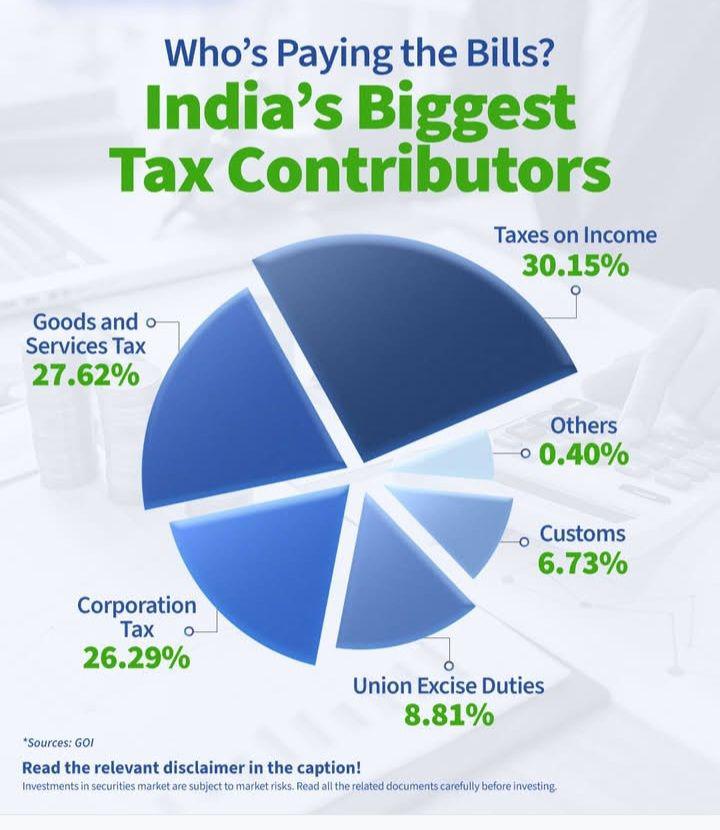

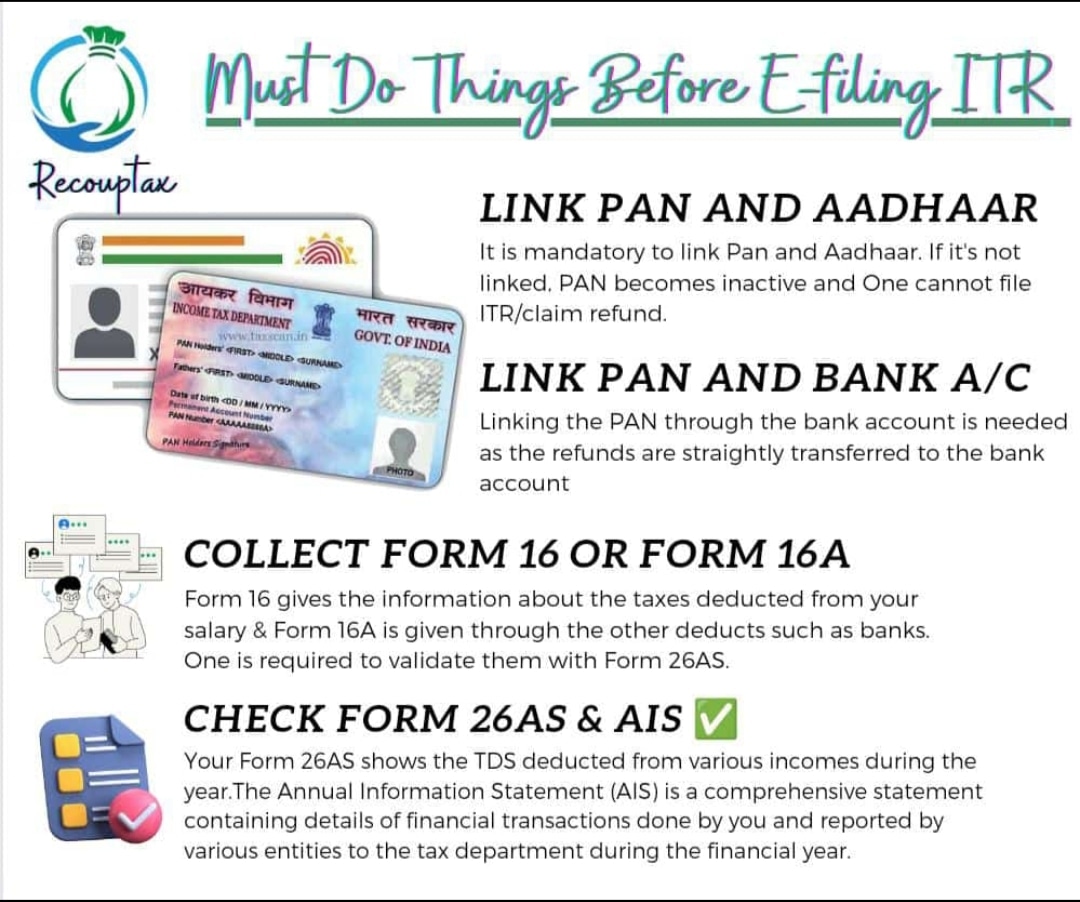

Financial knowledge Indian Tax slabs Income tax slabs categorize taxpayers based on their annual income, determining the applicable tax rates. Here's a breakdown: 1. Nil Tax: Annual income up to ₹2.5 lakh for individuals below 60 years. 2. 5% Tax: I

See More1 Reply

1

9

Download the medial app to read full posts, comements and news.

/entrackr/media/post_attachments/wp-content/uploads/2021/08/Accel-1.jpg)