Back

Anonymous 3

Hey I am on Medial • 1y

Well of course chasing a high valuation without solving core issues just leads to a crash

Replies (1)

More like this

Recommendations from Medial

Poosarla Sai Karthik

Tech guy with a busi... • 10m

A startup’s valuation is the price investors believe it’s worth. But that belief is often based more on future potential than current reality. Factors like market size, growth projections, and hype around the sector often play a bigger role than actu

See More

Anonymous

Hey I am on Medial • 1y

I am a engineering graduate and employee working in an MNC. After working for years in engineering sector i need to change my domain to management as a consultant. So without any MBA or doing any crash course I can play a role in management. Please c

See MoreVatan Pandey

Founder & CEO @Zyber... • 11m

🚀 Business Growth or Just Valuation? Many startups chase high valuations but forget the core of business—profitability, sustainability, and real customer value. 🔴 Reality Check: ❌ Valuation without solid revenue ❌ Scaling too fast, weak foundatio

See More

Himanshu Dodani

Start now what you j... • 10m

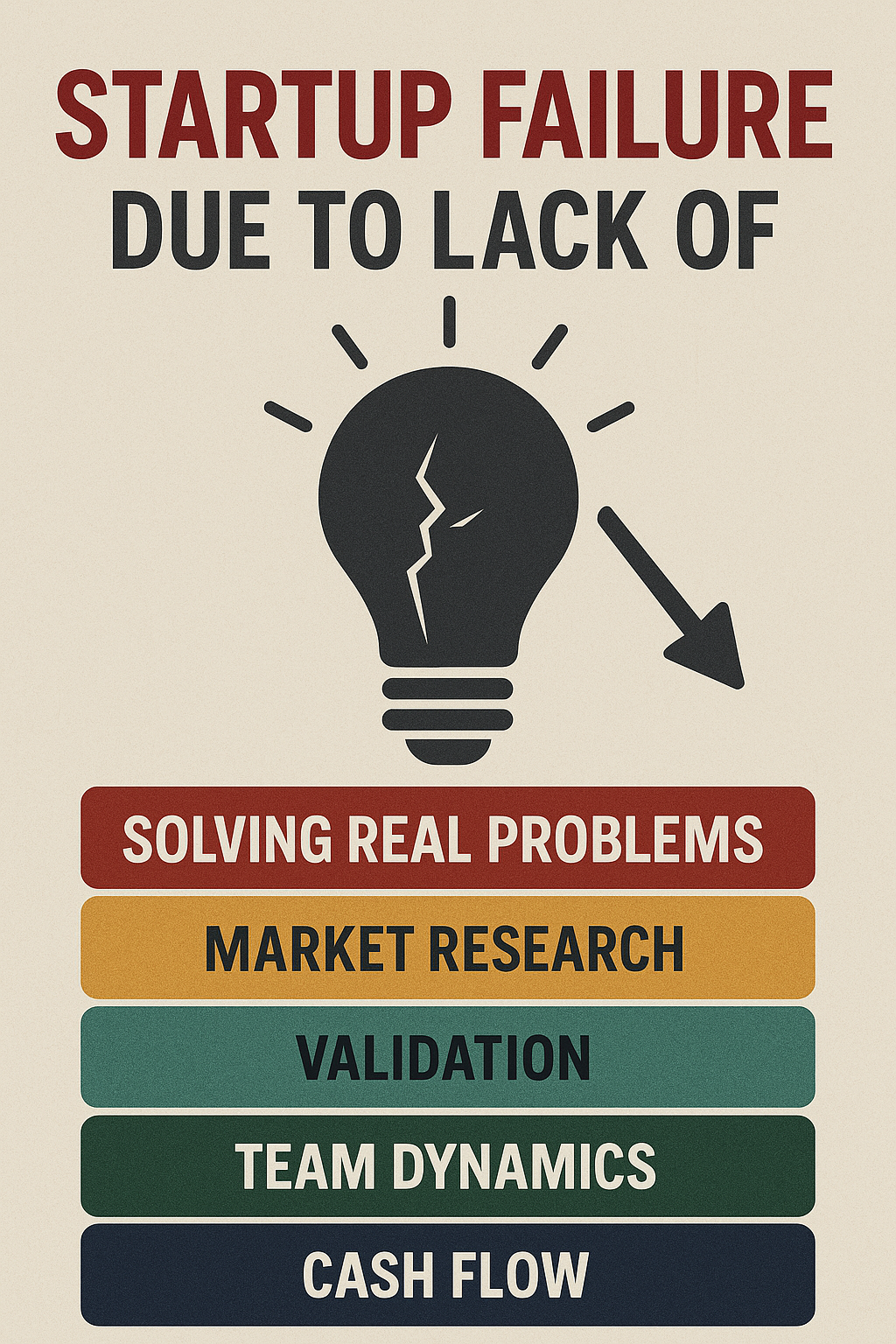

Startups are booming—but many crash before they even take off. 1. Chasing trends over solving real problems – Cool doesn’t always mean useful. 2. Skipping market research – Assumptions aren't data. 3. Building before validating – MVPs exist for

See More

Download the medial app to read full posts, comements and news.

/entrackr/media/post_attachments/wp-content/uploads/2021/08/Accel-1.jpg)