Back

Sairaj Kadam

Student & Financial ... • 1y

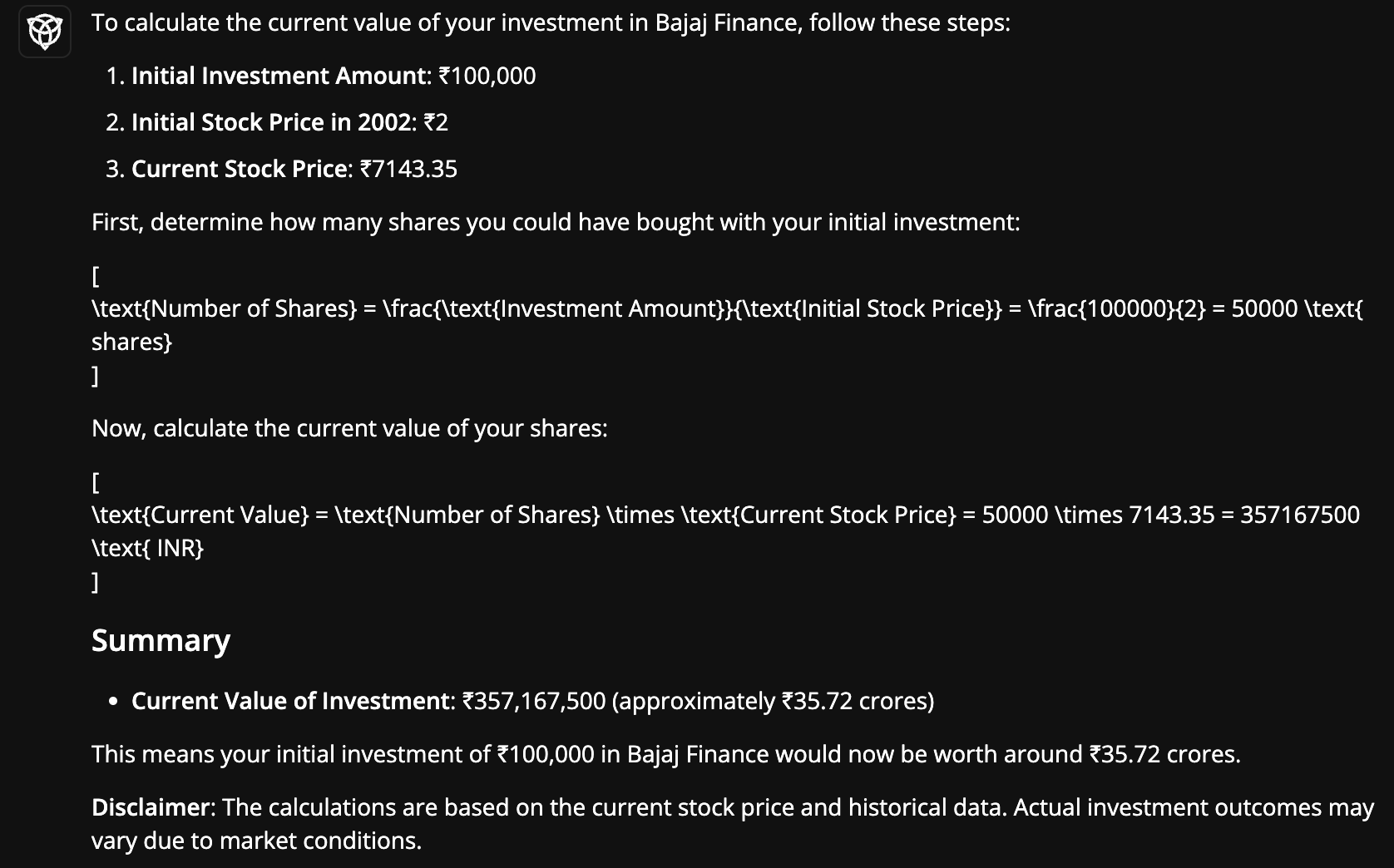

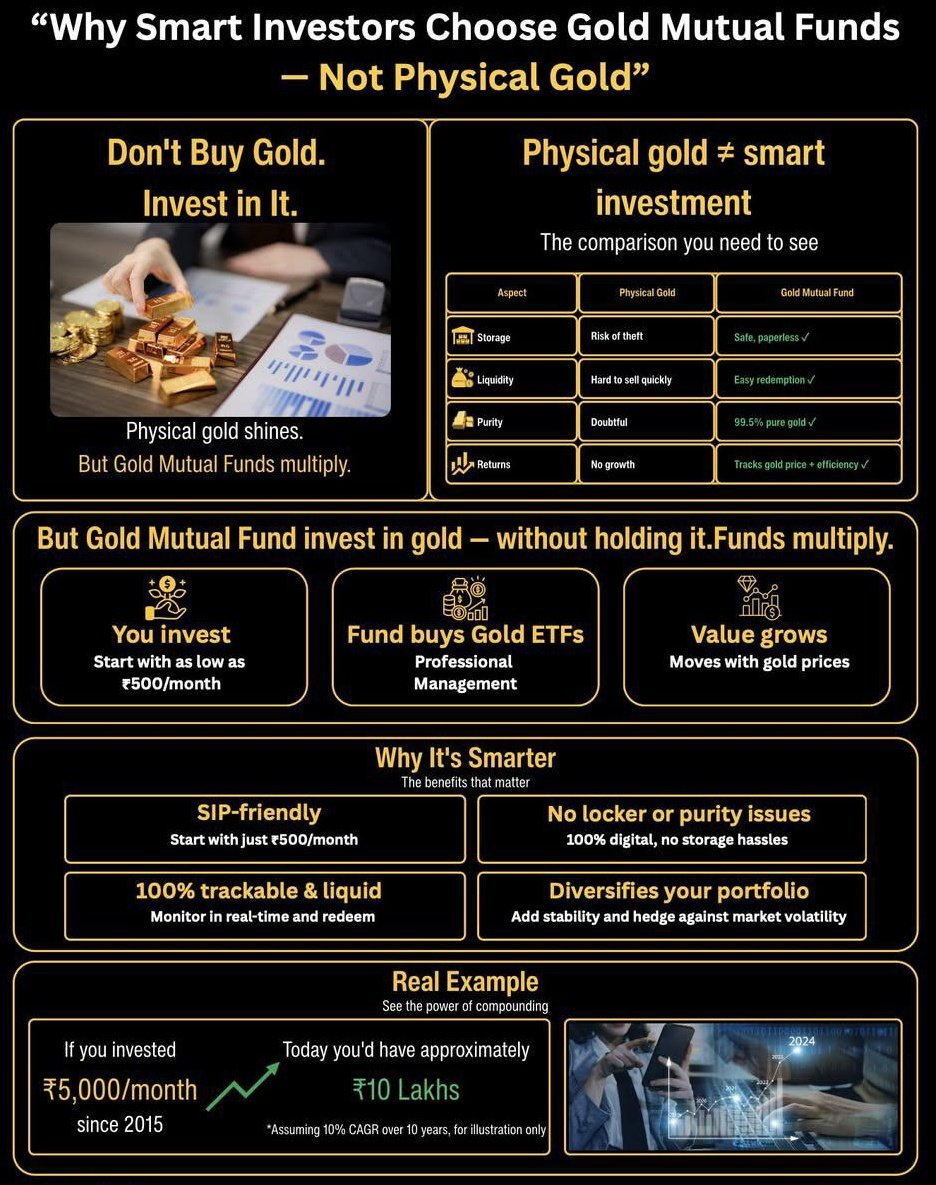

You’re right that FDs are a great option, especially with the current rates, and even small investments like ₹1,000 or ₹2,000 can generate a decent return over time. However, FDs might not always offer the highest returns in the long run. While FD interest rates are stable, exploring alternatives like stocks, mutual funds, or ETFs can provide better growth potential over time. That being said, I’m not suggesting you dive into picking individual stocks and putting all your money into them, nor am I recommending active trading. A more balanced approach, like investing in diversified ETFs or index funds, can still offer stability while giving you a better ROI over the long term.

More like this

Recommendations from Medial

Vikas Acharya

Building Reviv | Ent... • 11m

The 1% Club Eyes Expansion Into Fintech, Targets INR 30,000 Cr AUM In 2 Years The 1% Club is looking to expand its service portfolio to offer a wide range of fintech products The startup is mulling launching a suite of fintech products, including f

See More

Rohan Saha

Founder - Burn Inves... • 1y

I was reading the annual reports of some AMC companies, and I found an interesting and good statistic that many investors or traders in India are now preferring ETFs over mutual funds. This reminded me of the earlier days when ETFs were new in India,

See MoreMadhavsingh Rajput

Founder & CEO at Fin... • 1y

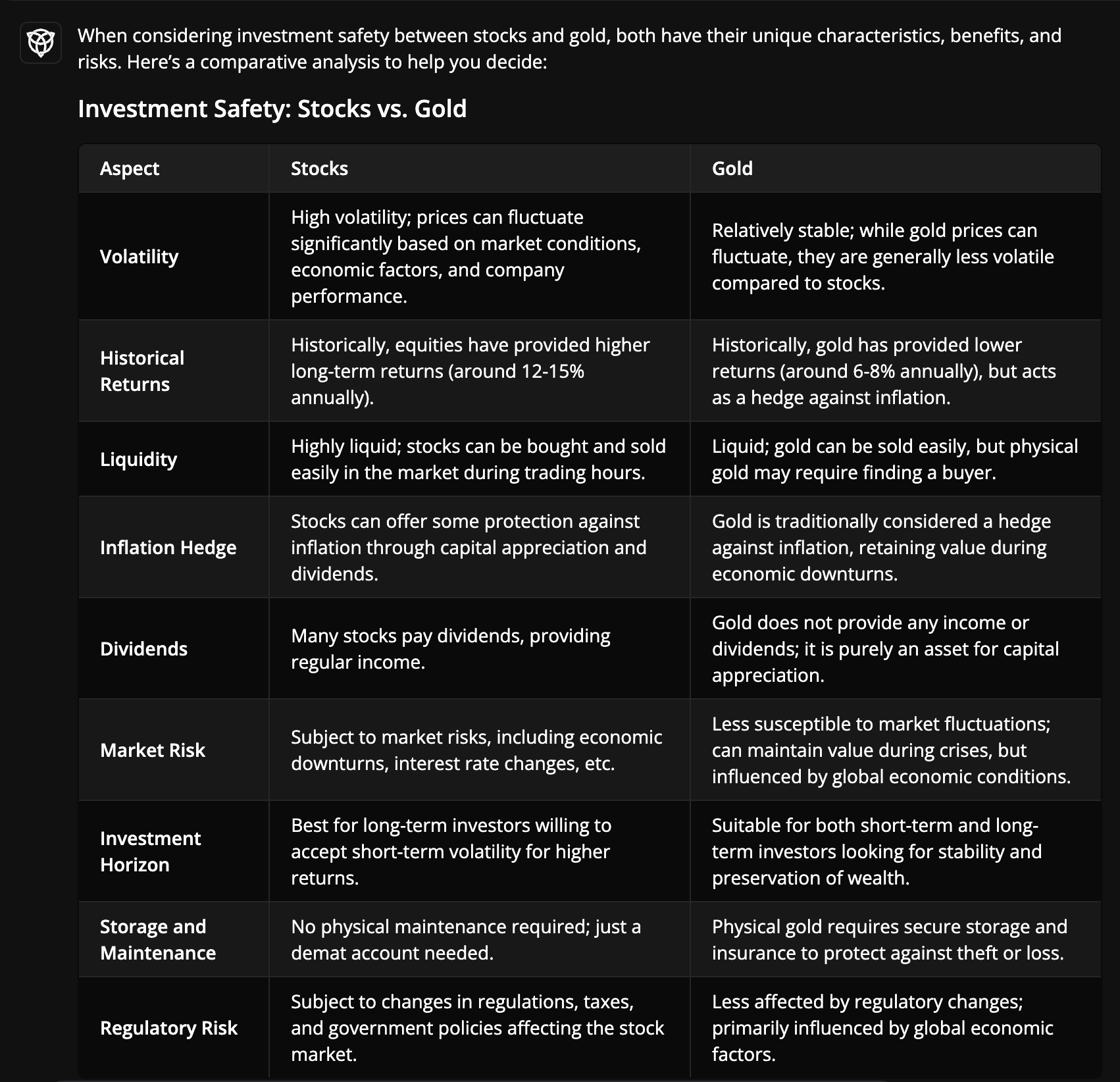

Gold or Stocks: Which is the better investment? 🤔 To make it simple, Finstreets' AI has prepared an easy to understand comparison table highlighting key aspects like: 1️⃣ Volatility: Stocks have high fluctuation, while gold is more stable. 2️⃣ Retur

See More

VIJAY PANJWANI

Learning is a key to... • 22d

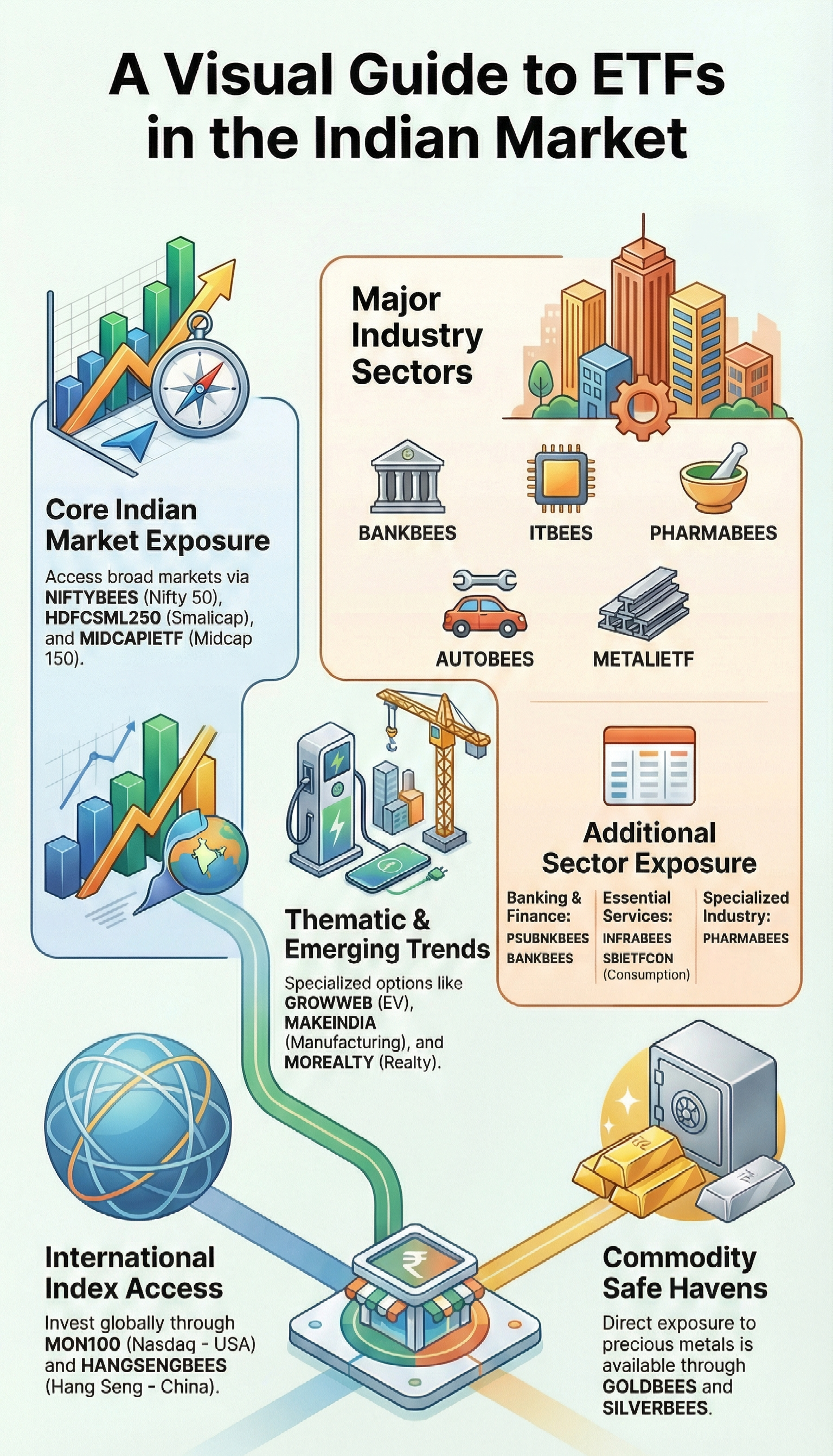

A Simple Guide to ETFs in the Indian Market 🇮🇳 Want to invest but confused about where to start? ETFs (Exchange Traded Funds) make it easy to diversify without picking individual stocks. Here’s how you can structure your portfolio smartly: 🔹 Core

See More

Download the medial app to read full posts, comements and news.

/entrackr/media/post_attachments/wp-content/uploads/2021/08/Accel-1.jpg)