Back

More like this

Recommendations from Medial

Thakur Ambuj Singh

Entrepreneur & Creat... • 10m

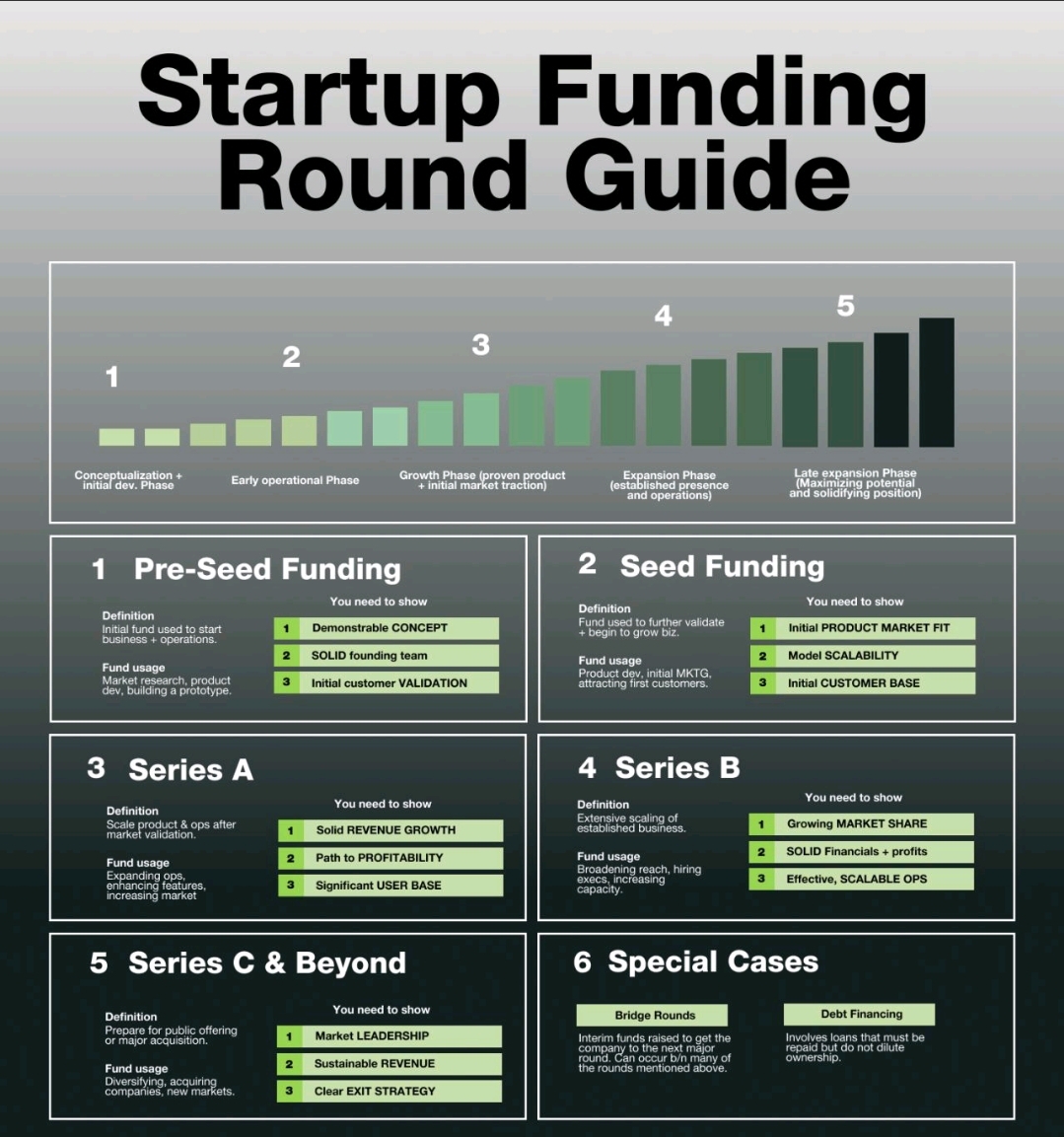

Startup Funding Guide: From Idea to Growth 🔹 Pre-Seed – Building a concept & team 🔹 Seed – Validating market fit 🔹 Series A – Scaling revenue & profitability 🔹 Series B – Expanding market share 🔹 Series C & Beyond – Preparing for IPO & market l

See More

9 Replies

116

88

derek almeida

Founder ,Ceo , Entre... • 1y

Headline: Calling All Startups: Venture Wolf Invests in YOU (Seed to Series C)! Dreaming of taking your innovative idea to the next level? At Venture Wolf, we're industry agnostic investors, believing in the power of disruptive ideas across the b

See More8 Replies

7

Download the medial app to read full posts, comements and news.

/entrackr/media/post_attachments/wp-content/uploads/2021/08/Accel-1.jpg)