Back

Anonymous 7

Hey I am on Medial • 1y

Honestly, Indian founders need to treat term sheets like battle plans. If you’re building the castle, why let someone else control the bridge?

More like this

Recommendations from Medial

Sourav Mishra

•

Codestam Technologies • 10m

While you’re debating the perfect blog title… Your competitor just published their 27th post this month. While you’re tweaking colors on your CTA button… They’re stacking backlinks and grabbing traffic. While you’re overthinking tone, language, and

See MoreAanya Vashishtha

Drafting Airtight Ag... • 10m

"The Most Dangerous Clause in Term Sheets That Founders Ignore" Yes, it's the liquidation preference in your term sheet that can quietly screw you. It decides who gets paid first if your startup sells—or flops. Investors might snag 2x their money

See MoreKarnivesh

Simplifying finance.... • 1m

When I look at the EV industry today, the story feels less about sustainability hype and more about balance sheets. Demand is real, policies are supportive, and adoption is rising but profitability is still uneven. • EVs are capital-intensive with l

See MoreJay Bhatade

Web Developer | Entr... • 1y

Make Money by Renting Your Things! Got a guitar, camera, or anything else you’re not using? List it on our website and earn money! It’s that simple. Let your things help you make extra cash! comment your thoughts, is it useful and you are intereste

See MoreRavi Singh

Hey I am on Medial • 11m

I’m planning to building a tech-driven furniture rental platform that offers stylish, affordable, and flexible home and office furniture solutions. Our goal is to make furniture accessible without the hassle of ownership. If you’re passionate about s

See MoreMehul Fanawala

•

The Clueless Company • 1y

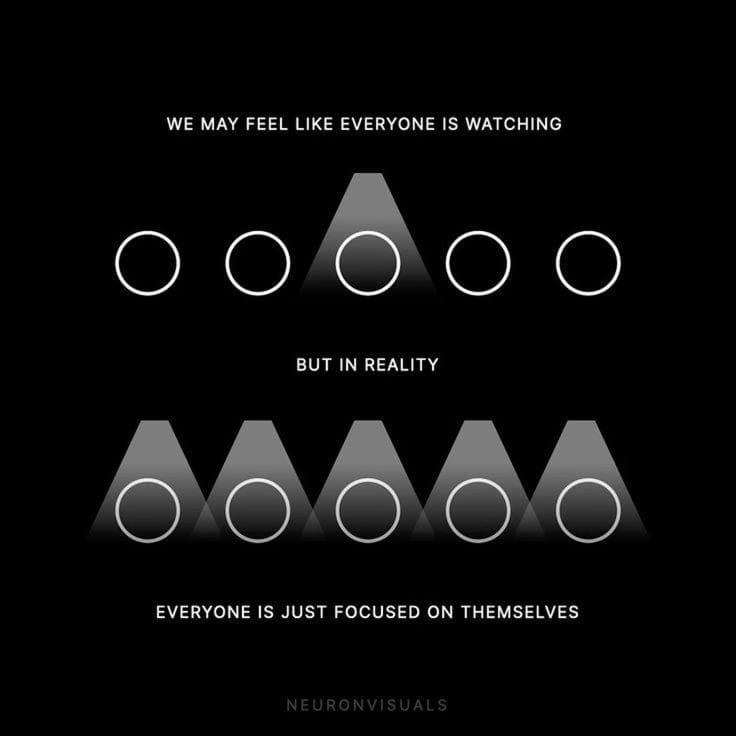

You think everyone's watching you, right? Newsflash: They’re not. Most people are too caught up in their own stories, their own challenges, and their own failures. If you’re worried about what others think, you’re wasting your time. Instead,

See More

Download the medial app to read full posts, comements and news.

/entrackr/media/post_attachments/wp-content/uploads/2021/08/Accel-1.jpg)