Back

More like this

Recommendations from Medial

Account Deleted

Hey I am on Medial • 1y

SolarSquare’s Losses Surge Despite Revenue Growth in FY24 Rooftop solar provider SolarSquare saw a 63.5% YoY revenue growth in FY24, reaching ₹175 crore. However, its losses jumped 2.3X to ₹69 crore due to rising costs. Revenue from operations grew

See More

Khansaama Food

Authentic Mughlai • 1y

Khansaama Meals Pvt Ltd is an innovative food tech brand that specializes in authentic Mughlai cuisine, operating on a cutting-edge asset-light model. Our mission is to preserve the rich heritage of Mughlai culinary art while delivering it to modern

See MoreVivek Joshi

Director & CEO @ Exc... • 8m

Beyond the Buzzwords: India’s Revenue-Making Startups & the VC Lens India’s startup scene isn’t just about hype—it’s about real, revenue-generating ventures ready to scale. Founders who’ve proven product-market fit and built solid revenue engines no

See More

Vivek Joshi

Director & CEO @ Exc... • 7m

Beyond the Buzzwords: India’s Revenue-Making Startups & the VC Lens India’s startup scene isn’t just about hype—it’s about real, revenue-generating ventures ready to scale. Founders who’ve proven product-market fit and built solid revenue engines no

See More

Kimiko

Startups | AI | info... • 9m

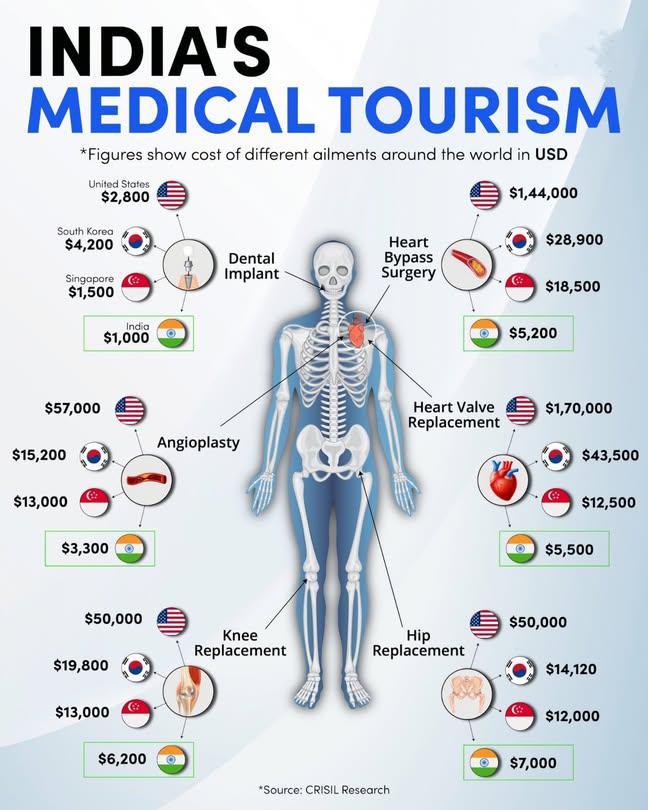

India offers significantly lower medical treatment costs compared to the US, UK, and even some other medical tourism destinations like Thailand and Singapore, often by a large margin. This is due to factors like lower operational costs, economies of

See More

Download the medial app to read full posts, comements and news.

/entrackr/media/post_attachments/wp-content/uploads/2021/08/Accel-1.jpg)