Back

Parkhi Bansal

See the angle which ... • 1y

Hey everyone If anyone wants there tax,gst,audit, accounting and finance related services on the lower rate connect me for the same. I want to help new business commers in the industry to help with the compliances. Connect for the process and prices Thanks

Replies (2)

More like this

Recommendations from Medial

Recouptax Consultancy Services

Onestop solution for... • 10m

Hi Guys, Does anyone need help with book keeping, accounting, Gst filing/TDS filing services. We are offering affordable and reliable services for Individual Tax Filings, Book keeping, Accounting, GST & TDS filings and all other registrations.

Sai Vishnu

Income Tax & GST Con... • 11m

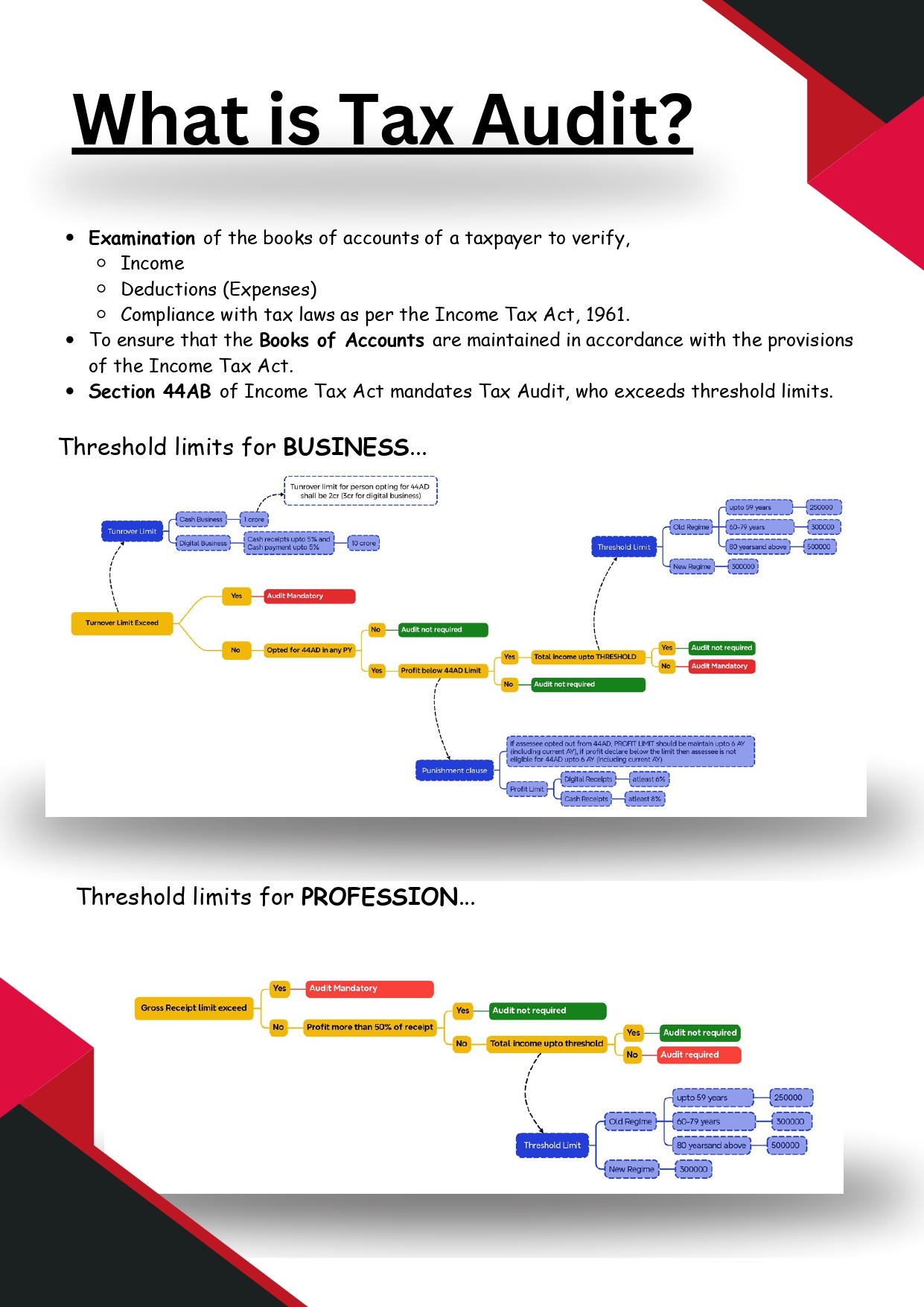

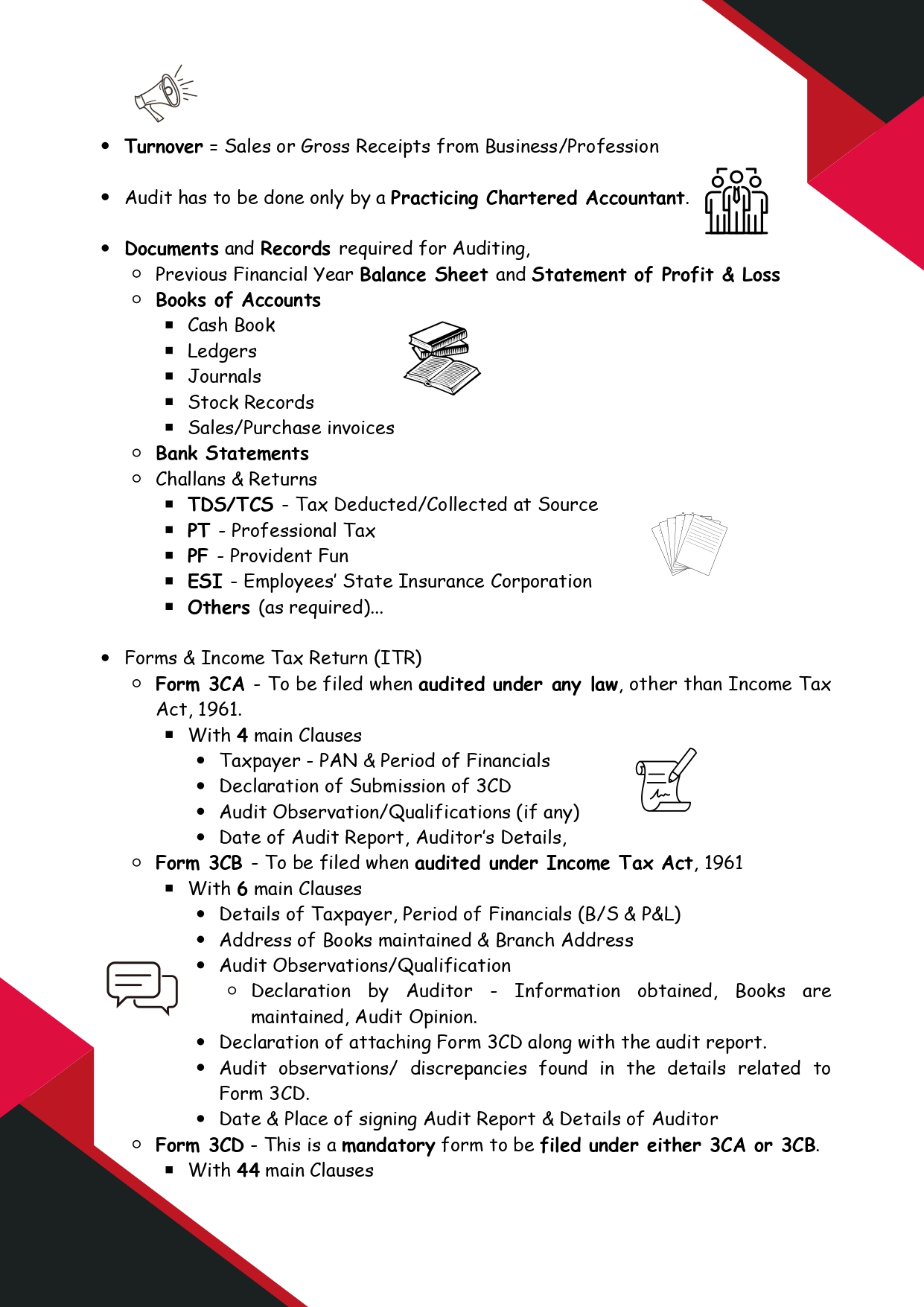

🚀 Everything You Need to Know About TAX AUDIT in Just 5 Minutes! 📊💡 🔎 What is a Tax Audit? A tax audit is a detailed examination of a taxpayer’s books of accounts to verify: ✅ Income & Deductions ✅ Compliance with the Income Tax Act, 1961 ✅ Prop

See More

CA Kakul Gupta

Chartered Accountant... • 5m

🏠 GST & Real Estate Update Realtors are waiting for govt clarity on how GST input tax credit benefits should be passed on to homebuyers. This decision will directly impact whether home prices go up or come down under the new GST regime. What do you

See MoreCA Dipika Pathak

Partner at D P S A &... • 1y

Dear business🔊 please note your tax audit applicability ➡️Every business, including private limited companies, individuals, and partnership firms (excluding those opting for the presumptive taxation scheme), is subject to a tax audit ifTotal sale

See More

Saurabh Mishra

Building a tech gian... • 8m

🚀 Now offering complete Tax, Compliance & Bookkeeping Services for Startups, Freelancers & Small Businesses! ✅ Income Tax Return (ITR) Filing ✅ GST Registration & Returns ✅ ROC/MCA Compliance ✅ Bookkeeping & Monthly Accounting ✅ MSME, Startup India

See MoreMehul Fanawala

•

The Clueless Company • 5m

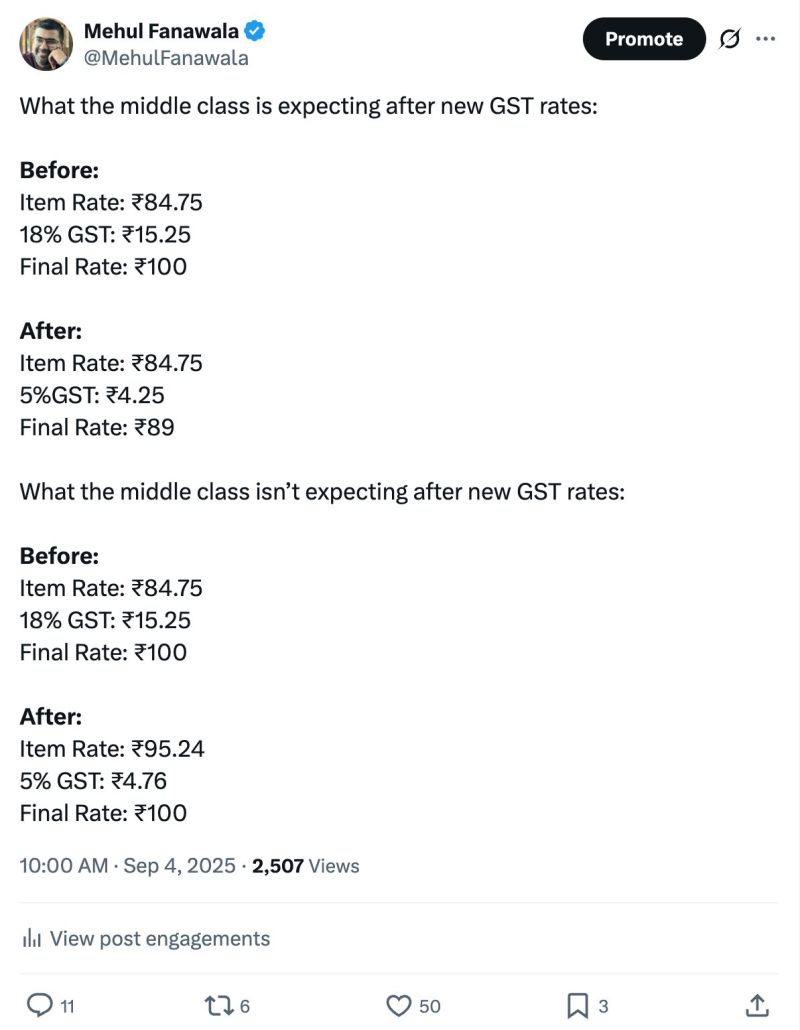

From 22nd September, the first day of Navratri, the new GST rates will be implemented. The government is calling it NextGen GST. Now, the middle class is looking at this change with a lot of hope. The expectation is simple, if GST rates are reduced,

See More

Rohan Saha

Founder - Burn Inves... • 5m

Will the GST Rate Cut Really Help People? The government recently announced a cut in GST rates and many are wondering if this will actually make life easier on paper lower taxes should mean lower prices but in reality it’s not always that simple. F

See More

Download the medial app to read full posts, comements and news.

/entrackr/media/post_attachments/wp-content/uploads/2021/08/Accel-1.jpg)