Back

More like this

Recommendations from Medial

S A G N I K

Do. Fail. Learn. Mov... • 4m

I think SEBI should come and intervene rather stop Mutual Funds or atleast put a cap on them. Insurance Compamies and Pension Funds (MFICPF) need to stop investing in IPO companies. Here's why,, Merchant Bankers(MBs) who controls the game here. T

See MoreVikas Acharya

Building Reviv | Ent... • 1y

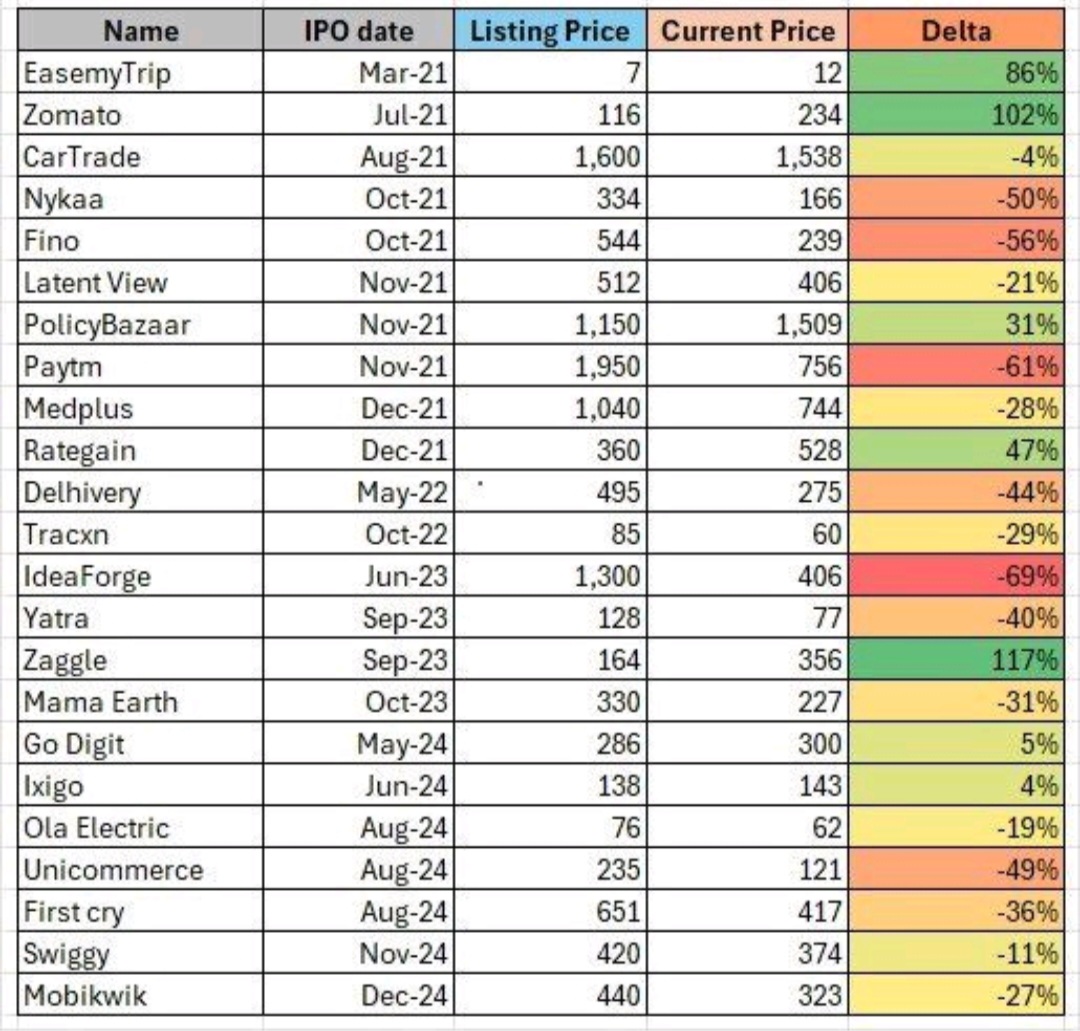

As per Inc42 data, 20 startups are in various stages of undertaking their IPO preparations at the outset of 2025 Key factors that are likely to contribute to the public listing mania in 2025 are India’s strong position in the equities market and rat

See More

VCGuy

Believe me, it’s not... • 1y

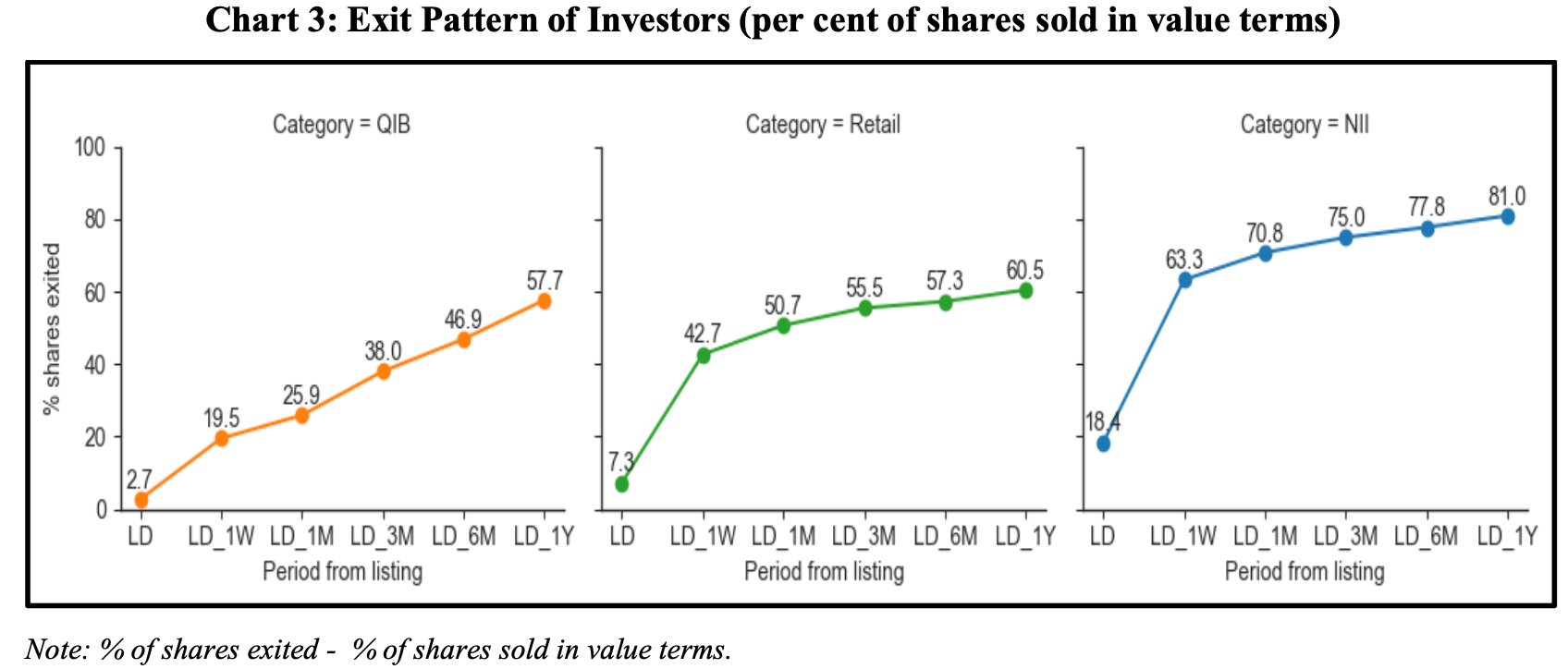

This year - IPO fundraise has picked up pace with 60 companies listing so far and raising ₹63,985 crore (+29% over 2023). 📄SEBI's report on Investor Behaviour in IPOs is an interesting reveal - - High Flipping Rate: Overall around 54% of IPO shares

See More

Download the medial app to read full posts, comements and news.

/entrackr/media/post_attachments/wp-content/uploads/2021/08/Accel-1.jpg)