Back

Anonymous 2

Hey I am on Medial • 1y

This is classic VC behavior—betting on the founders, not the product. If Mayank has a track record, they’re essentially funding his vision and network. Can’t say it’s entirely wrong.

Replies (1)

More like this

Recommendations from Medial

Account Deleted

Hey I am on Medial • 1y

92.5% c-stage startups fail But there's one VC firm that has an exceptional track record. 100% of their startups raise their next round, and they just leak their playbook and pitchdeck template. Thank me later😉 Head over to EmCap.com and then n

See More

Vivek Joshi

Director & CEO @ Exc... • 6m

Fundraising can be tough, and the last thing you need is to be scammed by a fake VC. To protect yourself and your business, always remember these key checks: * Due Diligence: A legitimate VC will have a verifiable track record of investments and a s

See More

Rohan Saha

Founder - Burn Inves... • 8m

We always say the mobile gaming industry can’t survive without India and honestly that’s not entirely wrong. But let’s be real apart from WCC, WCC2, WCC3, and the Real Cricket series, we have not really made any big titles that stand out. Sure there

See MoreBhavin Bhavsar

Entrepreneur and You... • 7m

Day 2 — Build in Public Challenge Today was kinda heavy. Onboarded devs, set up the full backend — engine bas ab start ho gaya, finally. But here’s what really hit: People laugh at your discipline… until that same discipline builds something they

See MoreAccount Deleted

Hey I am on Medial • 9m

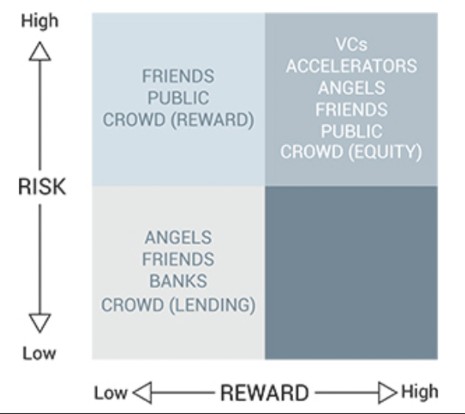

Before You Pitch Your Startup to Anyone, Ask These 2 Questions Most founders don’t raise money because their startup is bad. They fail because they’re pitching to the wrong kind of investor. Here’s what I mean. There are different kinds of investo

See More

Anonymous

Hey I am on Medial • 1y

Indian VC ecosystem is fundamentally against innovation. They’re private market, risk capital investors on paper, but essentially retail type stock pickers with a 7-10 year horizon.. In fact, if you think about true “innovation", things that India c

See MoreSameer ahmed

Founder & CEO of Hyg... • 11m

Most founders in EdTech focus on the wrong problem. They think tech will change education. It won’t. Students don’t need another app. Teachers don’t need another dashboard. They need a system that works the way learning actually happens. At HyggeX

See MoreAccount Deleted

Hey I am on Medial • 1y

Welcome to Dark Pool Venture Capital-where ultra-wealthy individuals, family offices, and private funds invest off the record. Not all VC funding makes headlines. Some of it stays in the shadows. Why stay hidden? 1) No public signals, no inflated

See MoreAccount Deleted

Hey I am on Medial • 11m

Raising VC Money? Tips No One Tells You : 1) Don’t Chase VCs, Attract Them - Build something so good they can’t ignore you. 2) Traction > Decks - Fancy pitch decks don’t matter if your numbers don’t add up. 3) Investors Follow Other Investors - G

See MoreDownload the medial app to read full posts, comements and news.

/entrackr/media/post_attachments/wp-content/uploads/2021/08/Accel-1.jpg)