Back

More like this

Recommendations from Medial

Akash Bagrecha

Co-Founder at Jorden... • 1y

How much board seat right should you give to an investor in exchange for funding? Yesterday, met an founder who is running a biz with ₹10 Cr rev During our discussion, the founder mentioned an investor who was interested but only on the condition o

See MoreTarun Suthar

•

The Institute of Chartered Accountants of India • 7m

Zuckerberg just have15% Stake in meta, But Controls 100% - Here’s How 🤔 Yes, it’s true. Mark Zuckerberg holds less than 15% shares in Meta, but has full control over the company. How is that possible? 🧠 Because Meta has a dual share system: -

See More

Vishnu

Senior Software Engi... • 6m

Created a Board game with all rules and required card designs. Also played with friends and family for over 50+ iterations and improved the rules and introduced new cards. Now I think game looks perfect and enjoyable. It is mostly strategy than

See More

Anonymous

Hey I am on Medial • 1y

If you want to be rich in India or any country in the world you need 3 connections — 1=} Contral on berocracy - You can control indian berocracy by providing money and whenever you bribe them , take proofs of that meeting like video and other thing

See More

Aditya Malur

AI-Powered Product C... • 11m

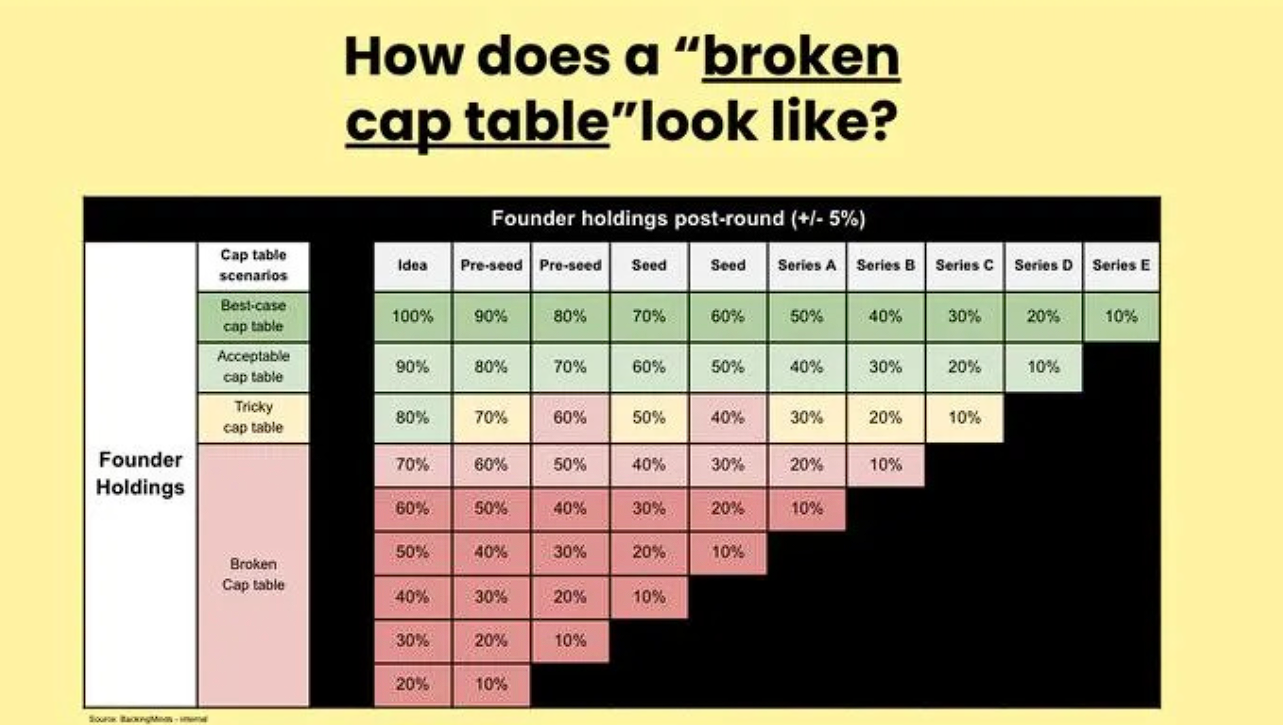

How a Broken Cap Table Turns Founders Into Employees of Their Own Company? Founded in 2009, Quid raised over $108M in funding and reached a peak valuation of $300M+ by 2016. Yet when the company was acquired by Netbase in 2020, founder and CEO Bob G

See More

Download the medial app to read full posts, comements and news.

/entrackr/media/post_attachments/wp-content/uploads/2021/08/Accel-1.jpg)