Back

Sayan Ghosh

Hey I am on Medial • 1y

I am happy to unveil today that I have started a new position as Co-Founder at Ortella Global Capital - OG Capital, India's only fund that co-builds companies! In 2012, I failed to raise my first Venture Capital Fund. Back then, ‘startup’ was barely even a word, ‘venture capital’ was a foreign dialect and entrepreneurship was not even a career path worth considering. Over the last decade, after evaluating nearly 350+ funds in India and another 150 globally, I realized that it is not just capital that makes a successful high alpha-generating venture capital fund but the ability to build companies that creates sustainable value. Having managed nearly INR5,000 crores (US$600 million) across my career, delivered more than 40% IRR (returns y-o-y) consistently through cash exits, and backed a hundred founders, I am on a mission to create an institutional venture capital fund. I am building this alongside an army of founders, who have built and sold businesses, and operators, who have built multiple multi-billion dollar profitable companies. Today, we are excited to launch Ortella Global Capital - OG Capital, India's only fund that co-builds companies. It is a testament to the power of perseverance, the unwavering belief in the human spirit and the courage to defy the norms. OG Capital is not just about writing cheques; it is about working hand-in-hand with the founders, leveraging our deep operational expertise to accelerate growth and building iconic companies. We are here to roll up our sleeves and build dreams together. We are here to back the next generation of bold, visionary entrepreneurs who are shaping the world. Join us as we embark on this extraordinary journey, where dreams take flight, innovation thrives, and the future is shaped by the bold and the brave. I am deeply grateful to my mentors and ex-colleagues at the World Bank, IFC, Avendus and Kaizenvest, for making this journey enriching. I am thankful to all my founders, who thrived through the ups and downs and delivered. I am indebted to all the entrepreneurs, who helped me dream and to everyone who believed in us. Let us change the world.

Replies (30)

More like this

Recommendations from Medial

Rajvardhan Mohite

Investor | 2X Founde... • 1y

I am excited to announce that I have started a new position as Co-founder and Head of Enterprise Investments at Ortella Global Capital - OG Capital, India's only fund that co-builds companies. I am looking forward to investing in and co-building with

See More

Gaurav Verma

Head - Revenue Marke... • 1y

I am excited to announce that I have started a new position as Co-founder and Head of Consumer Investments at Ortella Global Capital - OG Capital, India's only fund that co-builds companies. I am looking forward to investing in India’s growing cons

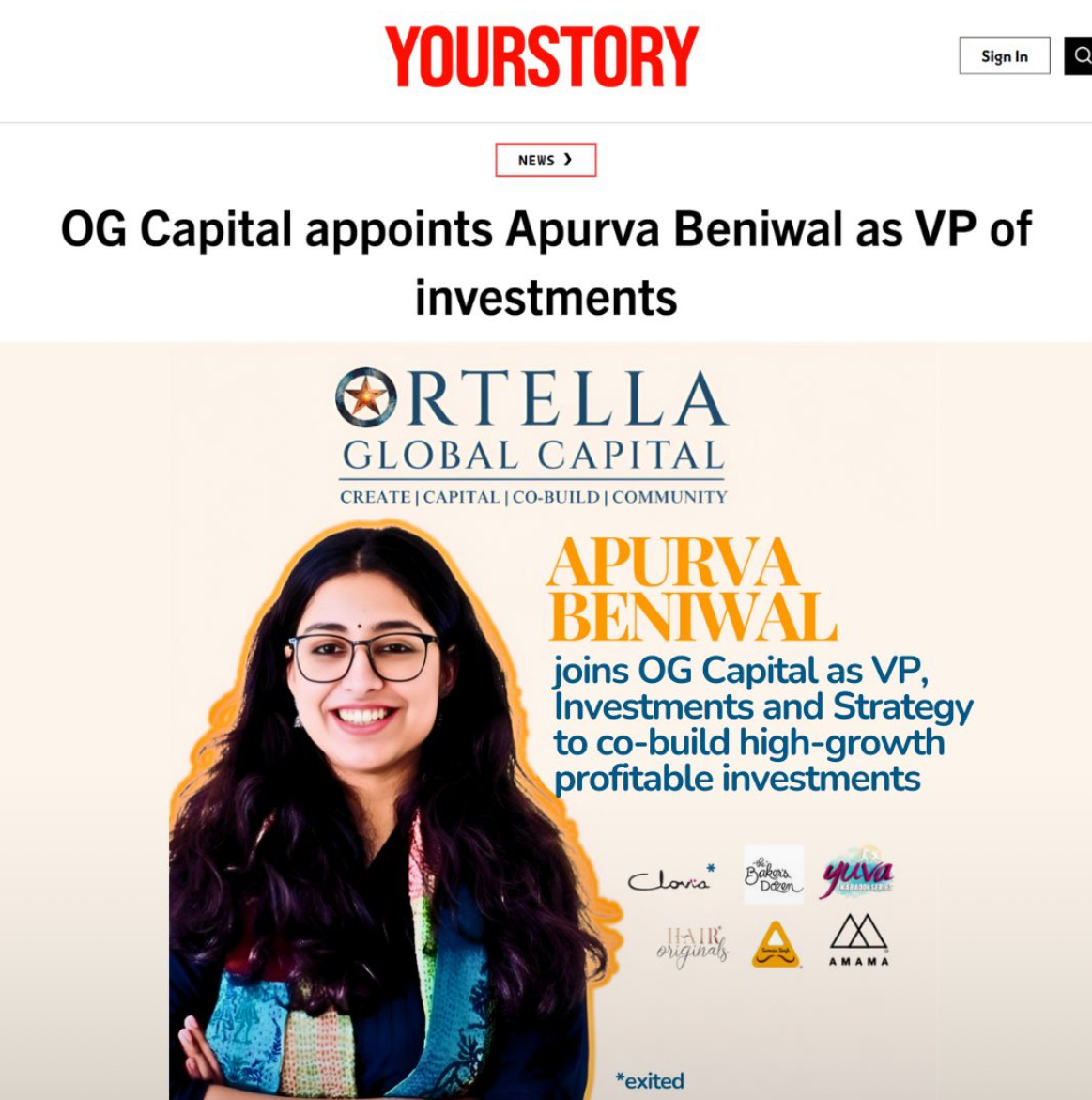

See MoreApurva Beniwal

Building the next bi... • 10m

Career Update: Some roles are taken, others are grown into quietly, over time. To me, this one feels like the latter. I have joined Ortella Global Capital - OG Capital, India's only fund that co-builds companies as VP – Investments & Strategy, Wit

See More

Gaurav Verma

Head - Revenue Marke... • 1y

Hiring Brand Warriors for a Venture Capital Fund 🔥🚀 Are you a marketing Avenger ready to Assemble? Do you have a passion for crafting impactful marketing strategies both for a Venture Capital firm and its diverse portfolio companies? 💼 In this r

See MoreDownload the medial app to read full posts, comements and news.

/entrackr/media/post_attachments/wp-content/uploads/2021/08/Accel-1.jpg)