Back

More like this

Recommendations from Medial

Account Deleted

Hey I am on Medial • 11m

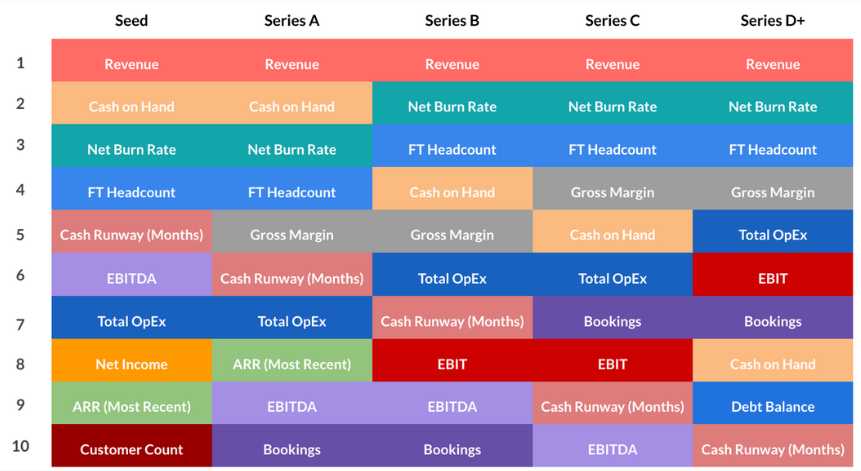

A lot of founders think funding = validation, but that’s just step one. If you can’t turn that capital into real, sustainable growth, it’s just a countdown to running out of cash. Just because a startup raises VC money doesn’t mean it’s successful. V

See MoreSanthosh Gandhi

Decoding Venture Cap... • 1y

Venture Studio vs Pre-Seed VCs Venture Studios and Pre-Seed VCs have different approaches. While Pre-Seed VCs invest in existing businesses with potential in a very early stage, Venture Studios creates new startups from scratch, providing operation

See More

Santhosh Gandhi

Decoding Venture Cap... • 11m

Startups don’t die because they have bad ideas. Most die because they run out of money. And that’s exactly why understanding Burn Rate and Runway is crucial. Burn Rate is the amount of money a startup spends every month to operate salaries, rent, ma

See MoreDownload the medial app to read full posts, comements and news.

/entrackr/media/post_attachments/wp-content/uploads/2021/08/Accel-1.jpg)