Back

More like this

Recommendations from Medial

Asid

Brand | Marketing | ... • 1y

Gamification! From fintechs to edtechs and what all techs left, gamification has been around some time and it's reinventing itself through every businesses around you, playing with your psychology, seducing, motivating, and inspiring you(ethicaly or

See More

Praveen Kumar

Start now or Regret ... • 1y

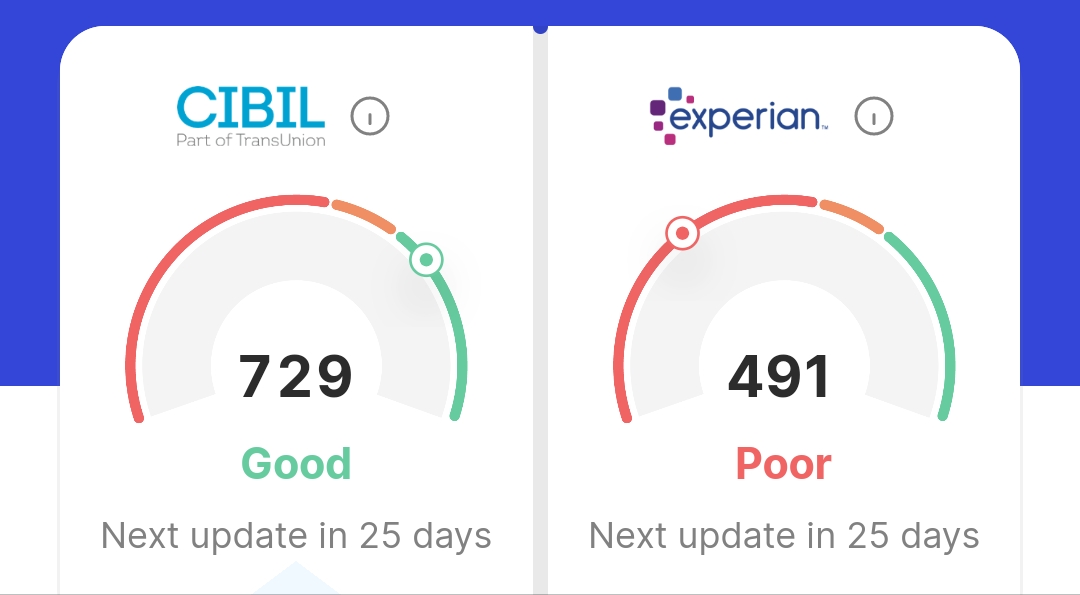

hii , At the age of 19 I have unfortunately taken a loan for my friend in mpocket and the loan was never paid.I have neglected that time because I don't have money .Now I am salaried with 5.2 lpa but I have less credit scores , so no credit card are

See More

Basavaraja V

Software Engineer • 1y

Many people want to make big purchases online but don't have a credit card. At the same time, some credit card holders have unused credit limits. ConnectCred solves this problem by allowing shoppers to make purchases through a service that connects t

See More

Pranjal Majumdar

Hey I am on Medial • 1y

"Big Changes in Credit Score Rules by RBI – Here’s How It Affects You!" Starting January 1, 2025, the RBI has introduced new rules that will make credit score updates faster and more accurate. Here’s what you need to know: ✅ Credit Score Updates Ev

See MoreGangesh Rameshkumar

Figure it out • 8m

Today's term of the day: Credit Credit is a kind of loan handed out by financial institutions to businesses and individuals. You can think of it as the ability you have to borrow resources from a lender to pay at a later date, with interest for usin

See MoreDownload the medial app to read full posts, comements and news.

/entrackr/media/post_attachments/wp-content/uploads/2021/08/Accel-1.jpg)