Back

More like this

Recommendations from Medial

VIJAY PANJWANI

Learning is a key to... • 3m

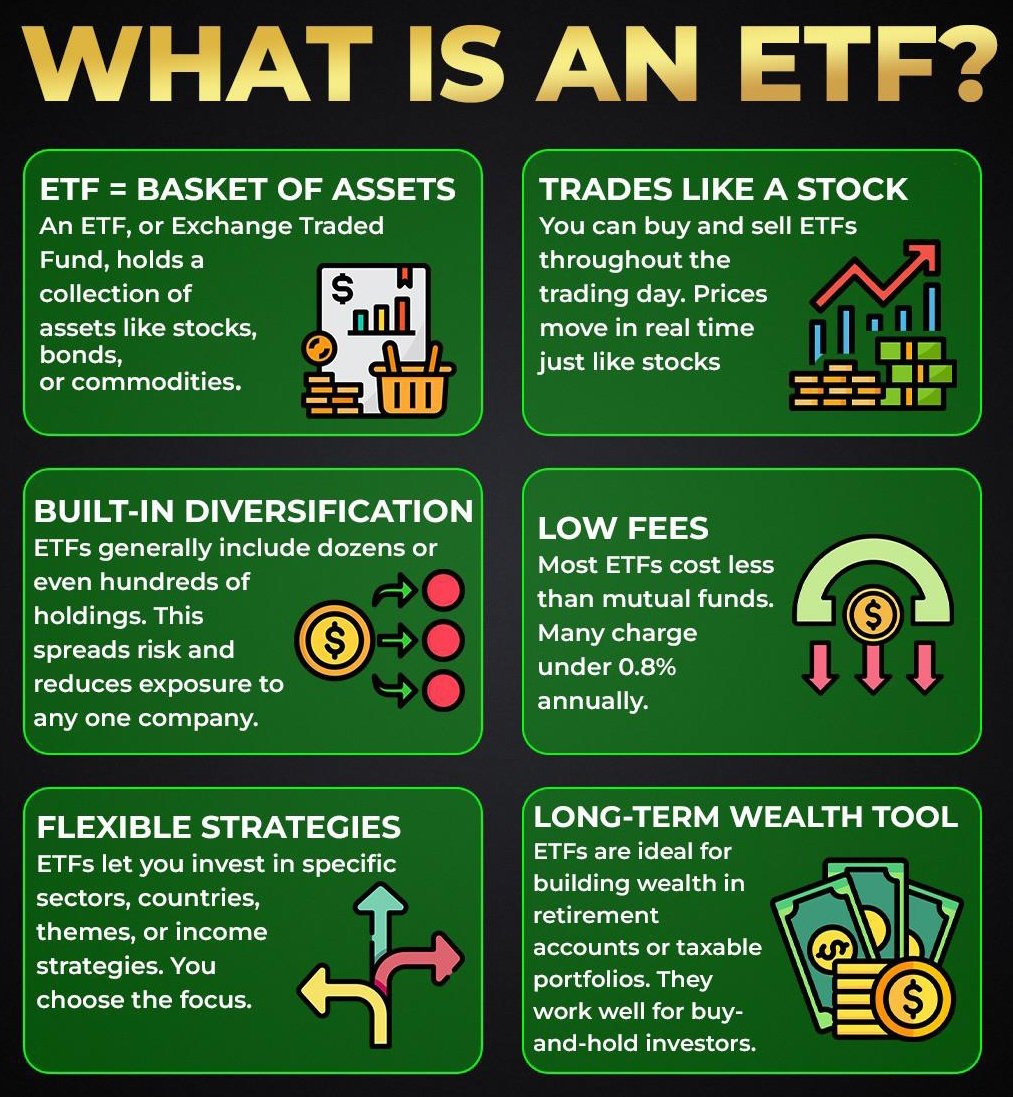

What is an ETF? If you want to start investing but don’t know where to begin, ETFs are one of the smartest and safest ways to grow your wealth 📈💰 Simple, low-cost, and perfect for beginners! Watch this reel to understand ETFs in 30 seconds 👇 S

See More

Sahil Bagwan

•

MDFC Financiers Private Limited • 8m

Business Idea - Promptwood jese bollywood or hollywood hai Kyu na wese Promptwood bnaya jaye google veo 3 se jo videos bnate ja rhe h unka use krke proper movies and web series bnayi ja skti hai kyu na ek ott app ho Promptwood yha pr sirf ai se bn

See MoreThakur Ambuj Singh

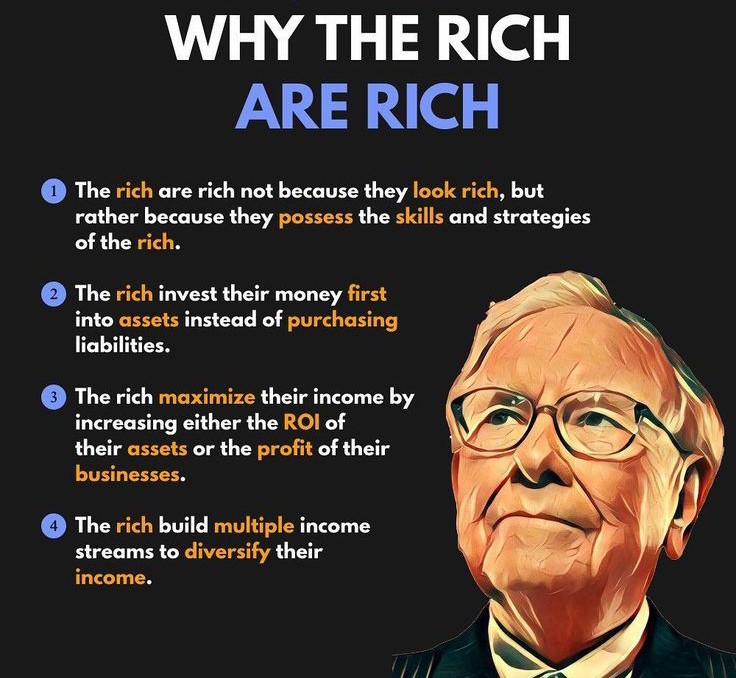

Entrepreneur & Creat... • 1y

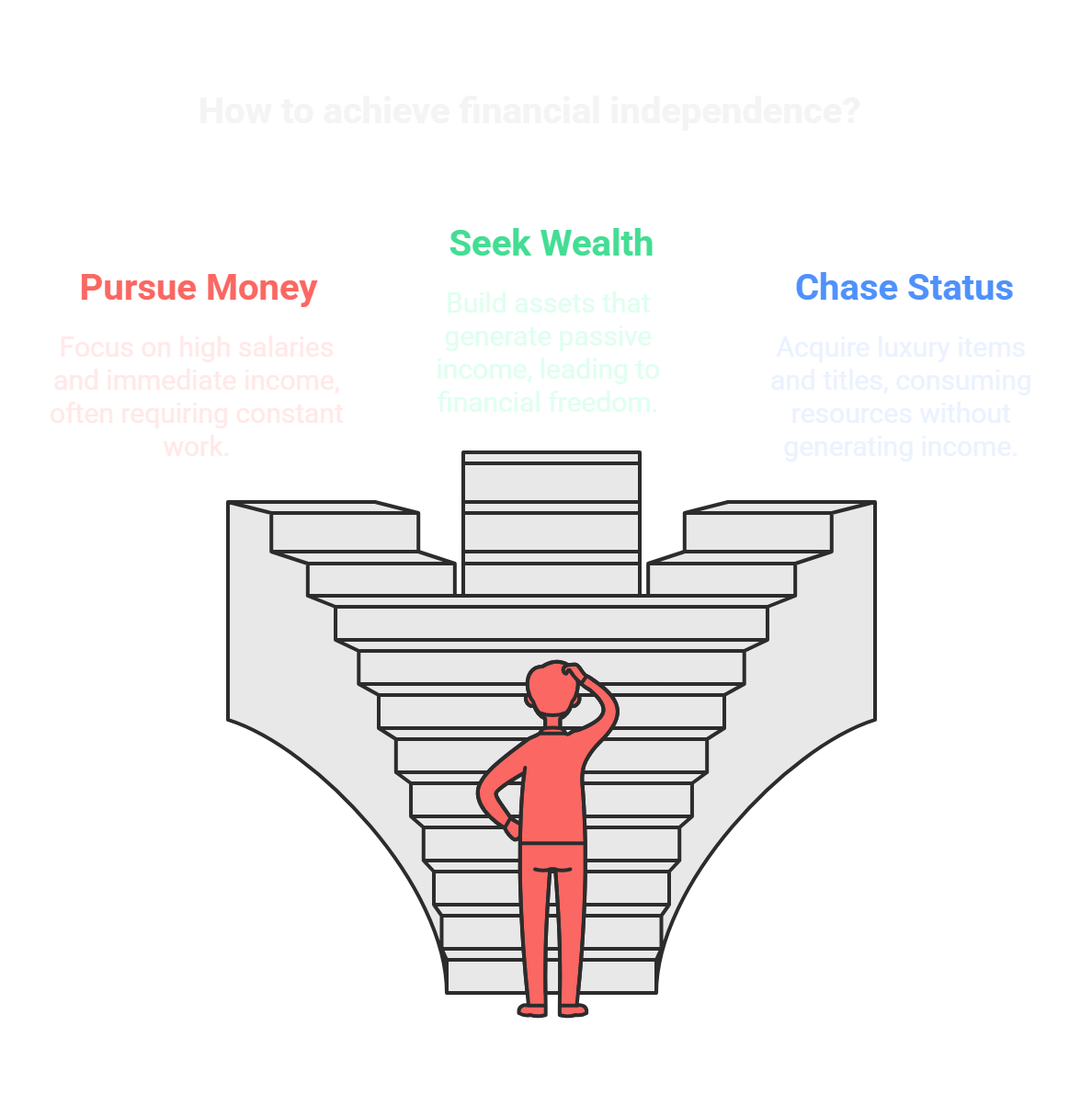

💼 Why the Rich are Rich 💼 It’s not just about looking wealthy it’s about the mindset and strategies that make a lasting difference. 💡 Here are some principles that set successful people apart 1️⃣ Skills & Strategies - True wealth comes from hav

See More

Krishnapal Singh Shekhawat

Founder of Pranvixca... • 1m

🚀 Day 1 Main do platforms build kar raha hoon — ek AI domain mein aur ek Healthcare domain mein। Soch AI Store ka focus hai AI solutions ko simple, useful aur accessible banana. ParanvixCare ka focus hai technology ke through doctor–patient connecti

See MoreSahil Bagwan

Learning New Things • 1y

New Business Idea💡 Content creation bahut bad rha h or bahut sare youtubers ab bade level par content bna rha h Aese me in creators ko ek achi team chahiye hoti h jo inke content creation me help kar ske jese script writers, thumbnail designer, e

See MoreVIJAY PANJWANI

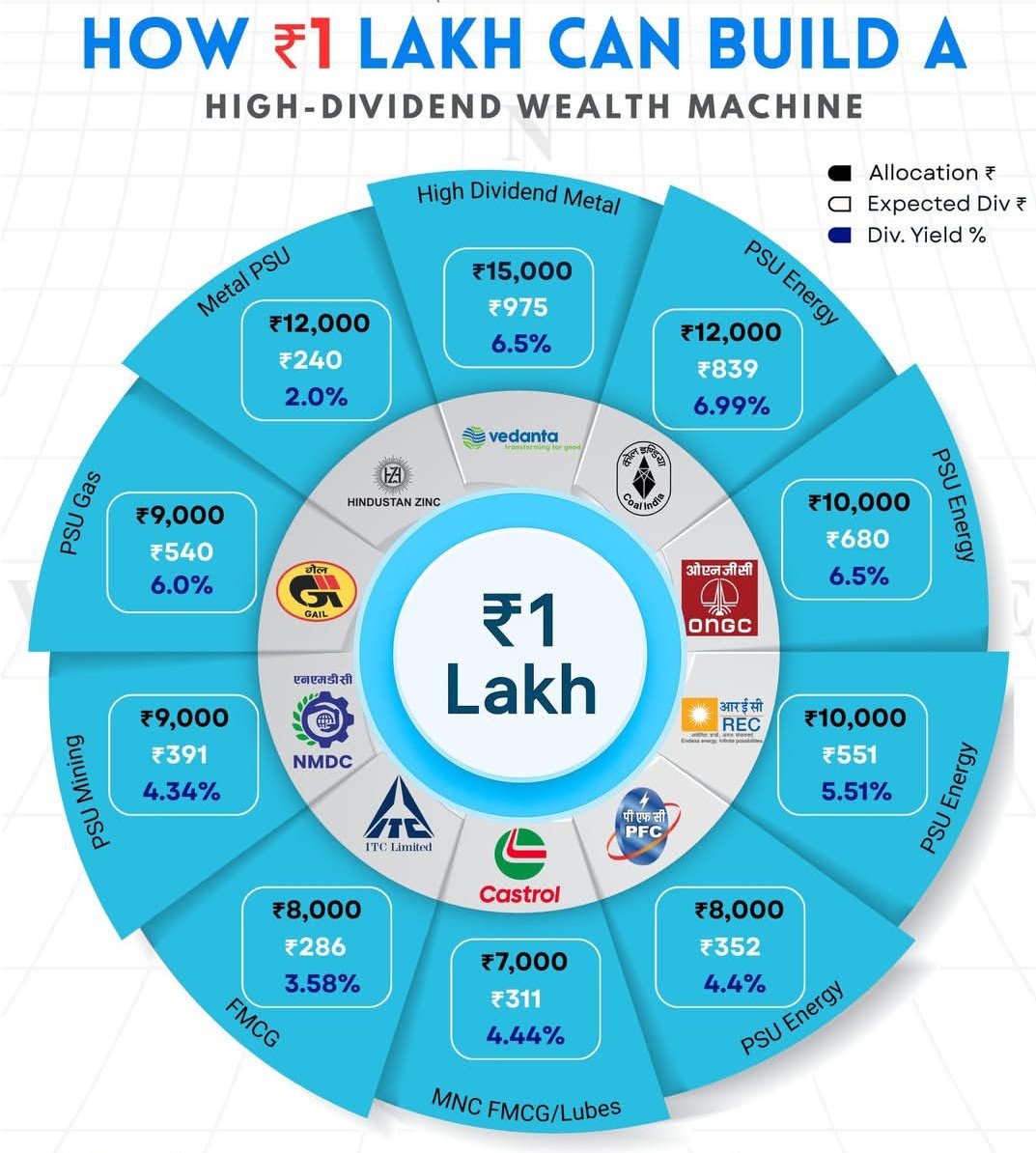

Learning is a key to... • 2m

💰 ₹1 Lakh → High-Dividend Wealth Machine! So many people think you need crores to earn passive income… ❌ Not true. 📊 With smart allocation in high-dividend stocks, even ₹1 Lakh can start generating regular cash flow. ⚙️ This portfolio focuses on

See More

Download the medial app to read full posts, comements and news.

/entrackr/media/post_attachments/wp-content/uploads/2021/08/Accel-1.jpg)