Back

Vishu Bheda

•

Medial • 1y

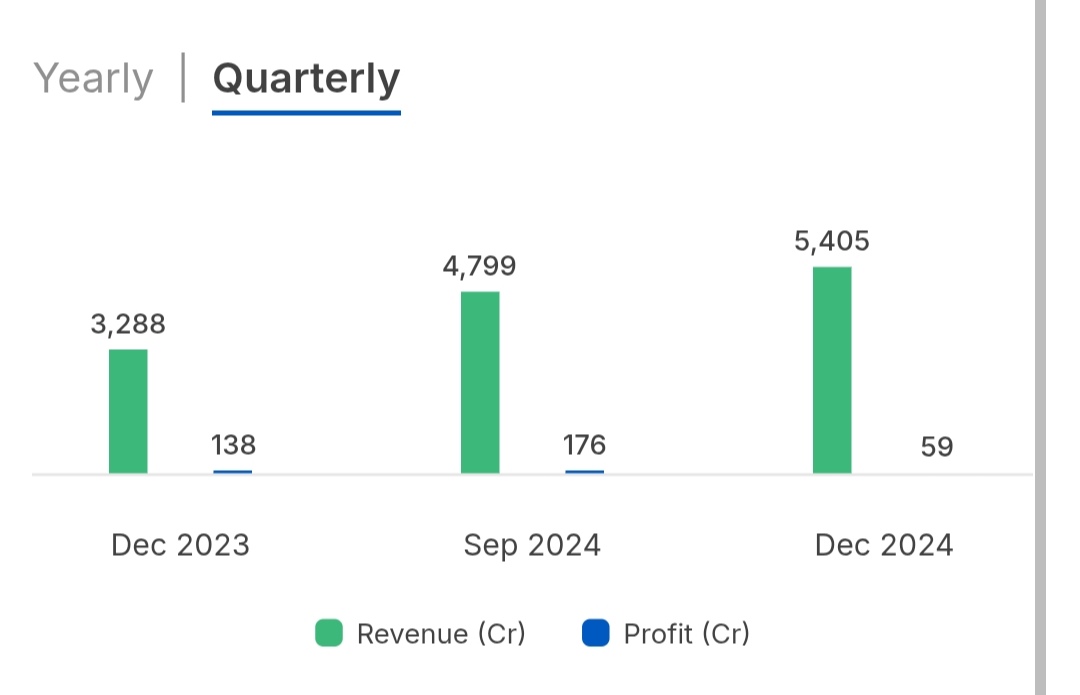

I miss the point that the profits of Zomato were made from investment returns and not from core business. Their core business is still operating at a loss!

More like this

Recommendations from Medial

Mohd Rihan

Student| Passionate ... • 11m

Zomato Finances of this year::: Revenue: 5405 cr Expenses: 5533 cr Loss:128 cr Non operating income (invested in FD, IPO and from other places): 252 cr Income- Loss=124 cr After tax: 59 cr Means, Zomato is earning from interest and FD's than actual

See More

Rohan Saha

Founder - Burn Inves... • 1y

We reached out to many P2P platforms from January to July this year regarding their incorrect business models where they were not following P2P lending rules. They kept telling us that they were not doing anything wrong and were operating according t

See MoreAnonymous

Hey I am on Medial • 1y

“ Never Use your business profits for fulfilling your personal needs because atleast for 5 years you need to re-invest that profit for expanding that business then after 5 years you will get huge returns and definitely you can use your profits for pe

See More

Download the medial app to read full posts, comements and news.

/entrackr/media/post_attachments/wp-content/uploads/2021/08/Accel-1.jpg)