Back

Sagar Anantwar

•

SimpliFin • 1y

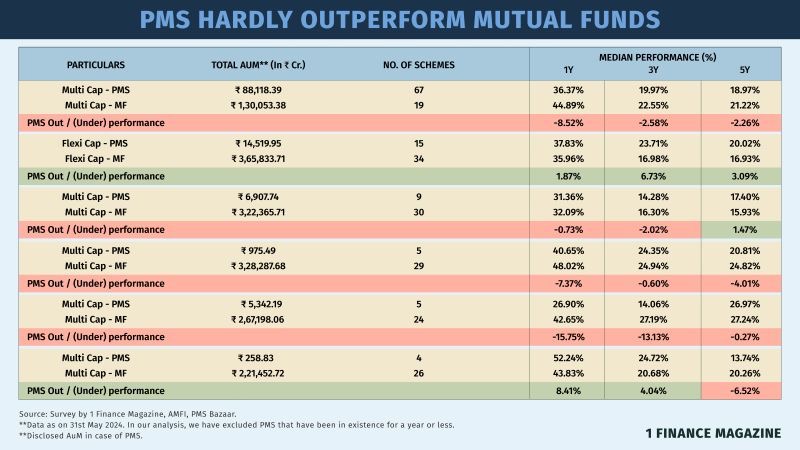

PMS (Portfolio Management Services) has always been the go-to for investors with a corpus of 50L+. But, in a recent study it was found that MFs are beating PMSs What do you think? Is PMS better or Mutual Funds?

Replies (1)

More like this

Recommendations from Medial

Krunali Jain

Actively looking for... • 1y

As a beginner with NO knowledge in stocks/mutual funds, what should my first step be to get into investing? How can I start? Should I - 1) Study Stocks (also, please suggestbest resources to get strted with) OR 2)Practically start with mutual funds

See Morefinancialnews

Founder And CEO Of F... • 1y

"Sebi Permits Mutual Funds to Invest in Overseas Funds Holding Indian Securities for Enhanced Transparency" Sebi Permits Mutual Funds to Invest in Overseas Funds with Limits on Indian Securities Exposure The Securities and Exchange Board of India (

See MoreHemanth Varma

''Money can't buy ha... • 1y

can mutual fund be a profitable investment? A mutual fund is a company that pools money from many investors and invests the money in securities such as stocks, bonds, and short-term debt. The combined holdings of the mutual fund are known as its po

See More

Rohan Saha

Founder - Burn Inves... • 10m

Many traders and investors often overlook fixed income instruments, but having a portion of the portfolio in debt is essential for stability. Buying bonds in India is very easy, yet people do not give much consideration to bonds or debt mutual funds.

Gyananjaya Behera

Helping an Idea to S... • 1y

Volt Money Partners PhonePe To Offer Loans Against MFs - Partnership Announcement: Volt Money has partnered with PhonePe to offer loans against mutual funds through the PhonePe app, with loan sizes ranging from INR 25,000 to INR 5 Cr. - Integration

See More

Download the medial app to read full posts, comements and news.

/entrackr/media/post_attachments/wp-content/uploads/2021/08/Accel-1.jpg)