Back

Anonymous 1

Hey I am on Medial • 1y

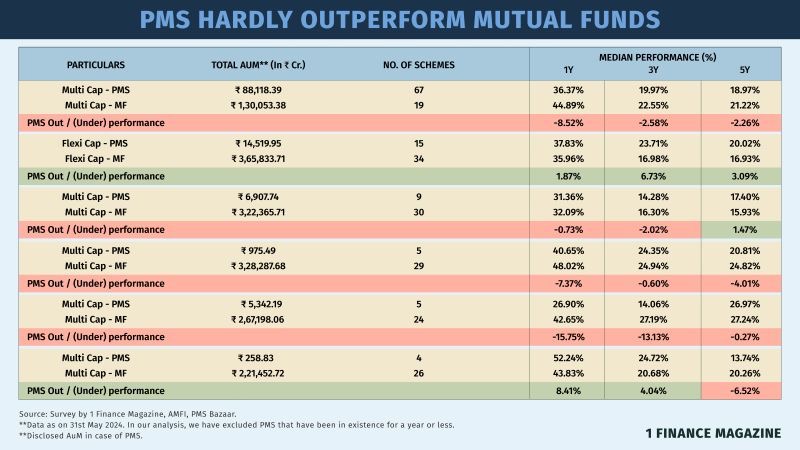

I think we miss the point with investing, it is not to get a multibagger return and become rich instantly, the whole point is to keep up with inflation and have enough corpus to survive a "covid" like thing again. So if we divide 50/50 between fund managers and MFs and then keep some in savings and keep some in gold, buy some fractional land/flats and slowly keep doing this then over time, whatever happens you will always have cash because the other loss making assets will offset profits and you will be left (hopefully) with something that keeps you up with inflation. This I think should be done when you start instead of IPOs or fund managers etc.

More like this

Recommendations from Medial

Manish M Tulasi

•

Mitra Robot • 1y

Mutual Funds: A Closer Look at the Real Returns Many people say that mutual funds are a great investment, but have we truly calculated the real returns, considering all factors like inflation and taxes? Let me break it down with a simple example.

See MoreJATINKUMAR PARMAR

30K+|🤖 Radically im... • 8m

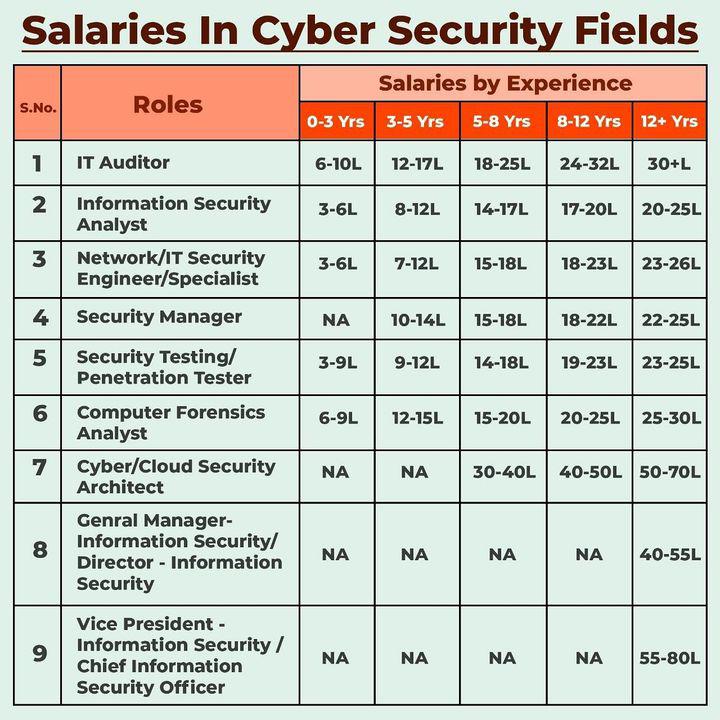

Mercor is now working with 6 out of the Magnificent 7 and all of the top 5 AI labs. Physicians, Pathologists, $140 - $160/hr Psychologists, $50 - $70/hr Medical and Health Services Managers, $65 - $85/hr Pharmacists, $65 - $85/hr Bioengineer

See MoreGargi Jain

Cloud | DevOps | Ill... • 1y

As a beginner, I started first with MFs tutorials [Zerodha Varsity], but then thought I won't much unless I try it out practically. So, what are your suggestions about these 3 for a beginner to start with SIP in MFs. for around 3 years maybe. Ofcou

See More

Joseph Matthew

Hey I am on Medial • 4m

How to Fix Sage 50 Error 3112 Without Losing Your Data? Worried about data loss while dealing with Sage 50 Error 3112? Don’t panic. This article walks you through safe and reliable methods to fix Sage 50 Error 3112 without losing any data. Learn how

See MoreDownload the medial app to read full posts, comements and news.

/entrackr/media/post_attachments/wp-content/uploads/2021/08/Accel-1.jpg)